How Long Does It Take to Repair Your Credit?

The length of time it takes to repair your credit depends on how serious your credit issues were and how your credit history was affected. If you're recovering from a bankruptcy, the process will take longer than if you're simply working to improve a low credit score caused by high credit card balances, for example.

The good news is that negative information doesn't stay on your credit report forever, and you can start taking action today to improve your credit standing. Here's what you need to know.

How Long Will Negative Information Appear on My Credit Report?

Negative information stays on your credit report for seven to 10 years, depending on the type of item. Most serious negative marks remain for seven years, though Chapter 7 bankruptcy lasts longer. Understanding these timelines can help you set realistic expectations for your credit recovery.

Here's a breakdown of common negative items and how long they remain on your credit report:

- Late payments: Seven years from the date of the first missed payment

- Collections accounts: Seven years from the original delinquency date

- Charge-offs: Seven years from the original delinquency date

- Foreclosure: Seven years from the date the foreclosure was initiated

- Chapter 13 bankruptcy: Seven years from the filing date

- Chapter 7 bankruptcy: 10 years from the filing date

- Hard inquiries: Two years from the date of the inquiry

It's important to note that the impact of negative information on your credit score decreases over time. While a recent late payment can significantly lower your score, the same late payment three years later will have much less impact.

Learn more: What Affects Your Credit Scores?

How Long Does It Take to Repair Your Credit?

Depending on the situation, it may take anywhere from a few months to a few years to rebuild your credit history.

If you have minor credit issues, such as high credit card balances, you may see your score improve within a few months if you start paying them down. More serious issues like collections, charge-offs or bankruptcy will require more time and consistent effort.

No matter the issue, it's important to remember that rebuilding credit isn't an overnight process. The most significant improvements often come from consistent, positive credit behavior over time rather than quick fixes.

Learn more: Which Debts Should I Pay Off First to Improve My Credit?

How to Repair Your Credit

Rebuilding your credit requires a strategic approach and patience. Here are some steps you can take to repair your credit:

- Check your credit reports for errors. Register with Experian to get your free Experian credit report, and review it carefully. You can also get free weekly credit reports from all three credit bureaus through AnnualCreditReport.com. If you find errors, you have the right to dispute them with the credit bureau reporting the information. Removing inaccurate negative items could improve your score immediately.

- Pay all bills on time. Set up automatic payments or payment reminders to ensure you never miss a due date. Payment history is the most influential factor in your FICO® ScoreΘ, so consistent on-time payments are essential for credit recovery.

- Pay down credit card debt. Focus on reducing your credit card balances to lower your credit utilization rate. A general rule is to keep your utilization below 30% of your total credit limit, but the lower it is, the better for your score.

- Keep old accounts open. The length of your credit history matters, so avoid closing old credit cards even if you're not using them regularly. Keeping these accounts open maintains your average account age and your total available credit.

- Become an authorized user. Ask a trusted friend or family member with good credit to add you as an authorized user on their credit card account. Their positive payment history can potentially benefit your credit profile.

- Consider a secured credit card. If you're unable to qualify for a traditional credit card, a secured credit card can help you establish a positive payment history. Use the card for small purchases, and pay the balance in full each month.

- Diversify your credit mix. Having different types of credit accounts, such as credit cards, an auto loan and a mortgage, can benefit your score. However, only open new accounts when it makes financial sense, not solely to improve your credit mix.

- Address collection accounts strategically. If you have accounts in collections, contact the collection agency to negotiate a payment plan or settlement. Get any agreement in writing before making a payment.

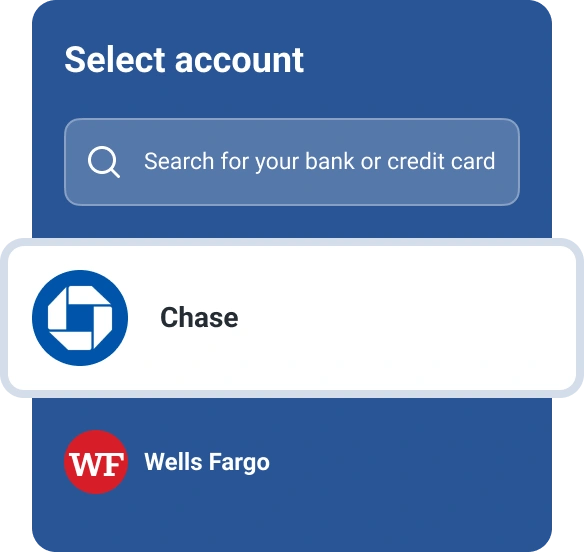

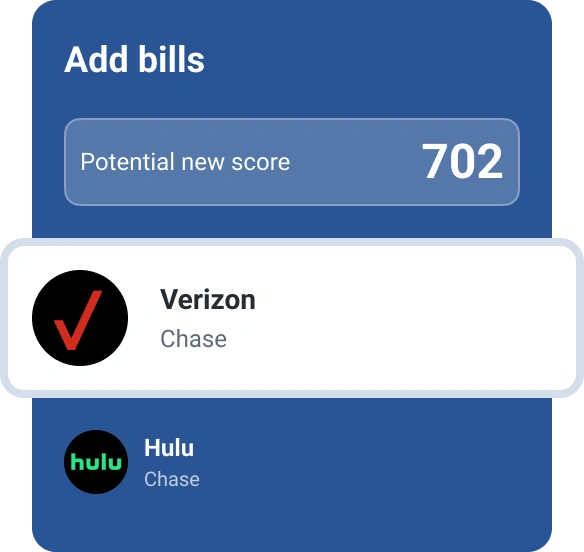

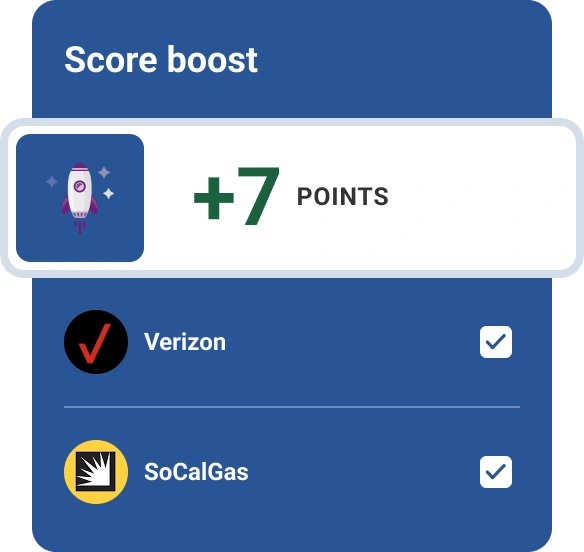

- Get credit for other types of on-time payments. Traditionally, on-time payments for rent, utilities, cellphones and streaming services aren't factored into your credit profile. But by signing up for Experian Boost®ø, you'll get credit for these types of payments and may see an immediate increase in your FICO® Score 8 powered by Experian data.

The Bottom Line

Rebuilding your credit takes time and dedication, but the effort is worthwhile. While negative information will eventually fall off your credit report, you don't have to wait for that to happen to see improvements. By consistently making on-time payments, keeping your credit utilization low and monitoring your credit reports for accuracy, you can begin to rebuild your credit.

Take advantage of free tools like Experian's free credit monitoring to track your progress and stay informed about changes to your credit profile. With patience and the right approach, you can achieve the credit score you need to reach your financial goals.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben