How Old Do You Have to Be to Get a Credit Card?

Quick Answer

In most states, you can get a credit card at 18. If you’re under age 21, however, you’ll have to show proof of income to help card issuers set an affordable credit limit.

Getting a credit card early can help you get a jumpstart on building your credit. You have to be 18 to get your own credit card, but there are some additional eligibility rules if you're younger than 21.

How Old Do You Have to Be to Get a Credit Card?

You have to be at least 18 years old to get a credit card in most states. You have to be 19 if you live in Alabama or Nebraska and 21 if you live in Puerto Rico. This is the age that you're legally considered an adult and can accept the terms of a credit card agreement.

Though you are legally allowed to get a credit card at 18 or 19, there is an extra eligibility step required. The Credit CARD Act of 2009 requires applicants between 18 and 21 to provide proof of their income before being approved for a credit card. This prevents card issuers from approving young adults with no source of income for credit cards they can't afford.

You can access a credit card under age 18 by becoming an authorized user on someone else's credit card. As an authorized user, you can make purchases using the credit card, but you're not responsible for paying the bill. You must be at least 13 to be an authorized user on many credit cards but some card issuers don't set a minimum age limit.

Why It's a Good Idea to Get a Credit Card at 18

Getting a credit card at 18 is a big responsibility, but there are several advantages to starting early.

- Begin building a credit history. Getting a credit card early gives you more time to gain experience using credit. As long as you practice good credit habits, that experience can make it easier to borrow money for your first car or house in the future.

- Access better fraud protection. Most credit cards offer zero fraud protection, a feature that keeps you from being responsible for unauthorized purchases. Other payment methods could cause you to lose some of all of your money in the event of fraud or unauthorized use.

- Earn rewards on your spending. If you have a rewards credit card, your purchases will earn rewards like cash back or travel miles. Once you accumulate enough rewards, you can redeem them for flights, hotel stays and more.

- Learn financial responsibility early. Managing a credit card can help you master money skills earlier in life. Mastering your spending and payment habits prepares you for credit cards with higher credit limits and larger loan amounts.

What to Look For in a Starter Credit Card

Choosing the right credit card is an important decision, but choosing among dozens of credit card options can be overwhelming. Here are some things you should look for in a starter card.

- New credit or no credit accepted: Since you're just starting out, don't expect to be approved for the best credit card offers. These are reserved for people with excellent credit. Instead, consider a credit card that caters to people just starting out with credit. For instance, try a secured credit card, which requires a security deposit as collateral and can be easier to qualify for.

- No annual fee: When you're learning the ropes of using a credit card, you want to avoid unnecessary fees, like an annual fee. This allows you to start building credit without paying additional fees.

- Low interest rate: The interest rate affects the amount you pay on any balance you carry from month to month. Ideally, you should pay your full balance each month to avoid interest. However, having a low interest rate minimizes the interest you'll pay if you need to carry a balance.

- Offers rewards: Earning rewards allows you to get more benefit from using your credit card. Rewards are a nice perk, but they aren't essential. If you find a credit card that checks all the other boxes, but doesn't offer rewards, it's not a dealbreaker.

- Credit bureau reporting: Make sure the card you choose reports to at least one of the major credit bureaus (Experian, TransUnion and Equifax). Credit bureau reporting is how your account history is added to your credit report to help you build credit.

What Happens if You Get Denied for a Credit Card?

Being denied when you're looking for a credit card can be disappointing. Know that it's a possibility when you're new to credit since you don't have a credit history yet. If you're denied, it's important to understand why so you know what to do next.

The card issuer will send a letter explaining why you were denied. When your credit was a factor in the decision, the letter—known as an adverse action notice—will list the reasons why you were denied and tell you how to get a free copy of the credit report that was used in the decision.

There are some options for building your credit score so you can qualify for a credit card in the future.

- Become an authorized user. Ask a trusted family member to add you as an authorized user on a credit card account they manage responsibly (meaning they keep balances low and never miss payments). As an authorized user, the credit card's history is added to your credit report and can help you qualify the next time you apply for a credit card.

- Use other bills to boost your credit. You can use regular bills like utilities and streaming services to help build a positive credit history with Experian Boost®ø. Adding these payments to your credit report may increase your credit score instantly.

- Apply for a secured card or student credit card. These options can be great starter credit cards because they're aimed at people who are just starting out with credit.

The Bottom Line

Getting a credit card at 18 can be challenging, especially if it's your first credit card. Becoming an authorized user or getting a secured credit card are two options for credit cards when you're just starting out.

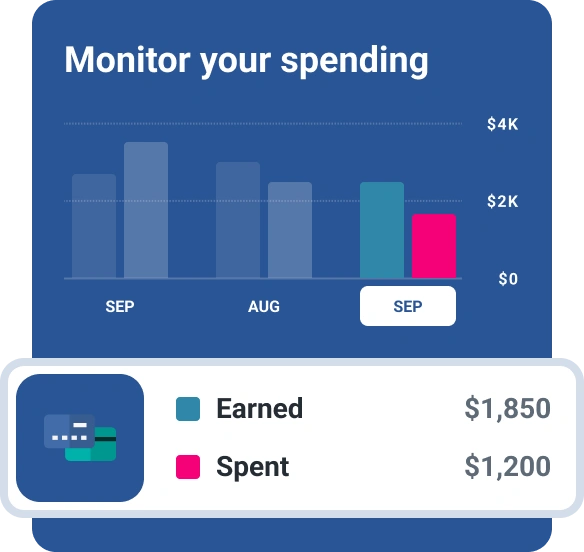

Your first credit card may not have all the bells and whistles, but as you build a positive credit history, you'll qualify for better offers. You can check your credit score periodically to see how your good credit habits are paying off.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya