How to Avoid Foreign Transaction Fees

If you're traveling abroad and making purchases with your credit card, you may wind up paying an extra 1% to 3% in fees on every purchase—which can quickly add up if you're making large purchases or frequently spend time abroad. You could also be charged foreign currency conversion fees while traveling, which could cost you even more.

The simplest way to avoid foreign transaction fees is to use a card that doesn't charge the fee. Barring that, there are several steps you can take to avoid these costs.

Watch Out for Conversion and Transaction Fees

Fees for foreign transactions can come in several forms, and they can depend on what currency you're paying in and where you're making a purchase.

First, there are currency conversion fees that payment networks, banks, ATM operators and merchants may charge. These are markups on the conversion rate, and are generally unavoidable. There are, however, ways to minimize them.

Some debit and credit cards also charge foreign transaction fees. The fee can apply whenever you make a purchase in foreign currencies or if a foreign bank processes your transaction.

As a result, if you're traveling abroad, you could be charged a foreign transaction fee even if you're paying a merchant in U.S. dollars. You could also be charged the fee if you're in the U.S. and make a purchase online that's in a foreign currency.

However, the foreign transaction fees are easy to avoid if you use a card that doesn't have the fee.

Open a Credit Card That Doesn't Have a Foreign Transaction Fee

There are many credit cards that don't have foreign transaction fees. For example, none of the consumer cards from Capital One charge this fee, and many popular travel credit cards don't have the fee either. Some cards also offer extra benefits that can be helpful while you're traveling.

Exchange Currency Before You Travel

Another option to avoid fees is to visit your bank in the U.S. before you set off and exchange the dollars in your account for your destination's local currency. You may find that your bank or credit union charges a low (or no) foreign exchange fee, making it an ideal place to exchange money.

You likely don't want to be carrying too much cash when you travel, however. But having a little spending money when you arrive can be helpful, and you'll likely save a lot compared with exchanging your money at an airport or other port of entry.

Open a Bank Account That Doesn't Charge Foreign Fees

Using a credit card that doesn't charge foreign transaction fees can help decrease your costs. But some merchants may charge you extra if you want to use a credit card, or might not accept credit cards at all.

Before leaving the U.S., see if your bank charges any extra fees when you're outside the country. Sometimes there are debit card foreign transaction fees or higher ATM fees. You may be able to avoid these by opening the right account.

One popular option is the Charles Schwab Bank High Yield Investor Checking® account because it doesn't have any account minimums or foreign transaction fees. Charles Schwab also refunds all ATM fees worldwide.

If you don't want to open a new bank account for traveling, ask your bank if it has branch locations or partner banks abroad. You may be able to make withdrawals from ATMs at those locations for free.

Pay With the Local Currency

When merchants accept cards, they may ask whether you want to pay in the local currency or U.S. dollars. It may seem counterintuitive, but paying with the foreign currency is often the better option.

Merchants (and ATM operators) can do this using a dynamic currency conversion (DCC), which lets them show you the cost in the local currency or dollars in real time. However, there's a built-in conversion fee markup that's often much higher than what the payment networks charge. Plus, even if you choose dollars, you may have to pay a foreign exchange fee because a foreign bank will process the transaction.

You could check the Visa and Mastercard conversion rates and markups online, and compare the rate with what the merchant will charge you. But as a general rule of thumb, using a card that doesn't charge a foreign transaction fee and choosing the local currency is the best option.

Finding Cards With No Foreign Transaction Fees

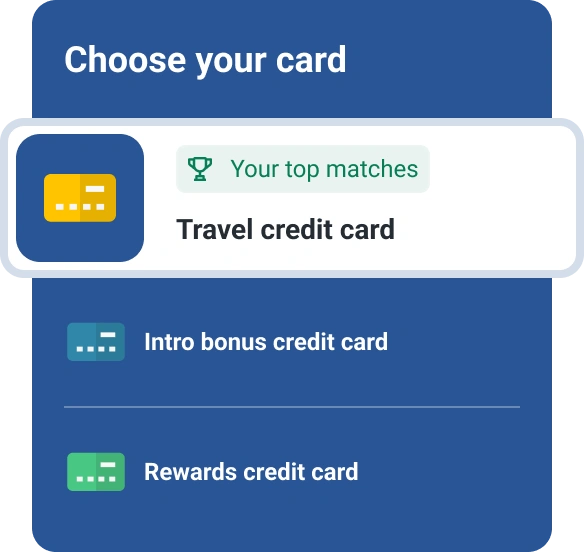

Choosing the right credit card depends on more than the foreign transaction fee. You'll want to consider the annual fees, rewards, cardholder benefits and required credit to get approved for the card. Experian's card comparison tool can help you sort through credit card offers based on the type of card, fees, credit card issuer and credit score ranges.

Get the travel rewards you deserve

Earn miles and find offers with bonuses and perks for your travel needs. Start with your FICO® Score and get matched with personalized rewards card offers.

See your offersAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis