How to Qualify for New Credit With No Credit Score

Quick Answer

There are certain credit products available to applicants with no credit score. You might be able to qualify for a secured credit card, credit-builder loan and retail credit card, which often don’t require a prior credit history.

If you have no credit score, there are options available specifically to help you start a credit file so you can get new credit in the future. You can get a secured credit card, a credit-builder loan, join another person's credit card account as an authorized user and more.

When choosing the best way to build a credit score from scratch, consider your budget and your comfort level with using credit for the first time. Some products, like credit-builder loans, come with little risk for building up debt, while others—like retail credit cards—require more careful management.

Here's how to get started with credit when you don't yet have a credit score.

What Is a Credit Score?

A credit score is a three-digit number that's calculated using information in one of your three credit reports from the national consumer credit bureaus: Experian, TransUnion and Equifax. Your credit report includes credit accounts you've opened, plus your payment history on those accounts. Lenders use your credit score to decide, based on your past experience with credit, whether to work with you and what interest rates and terms to offer. Without a credit score, you'll likely have difficulty getting certain types of credit because lenders have no way to evaluate your creditworthiness.

Credit scores fall into a range. The higher the score, the less of a lending risk you present. FICO® ScoresΘ and VantageScore® credit scores are two of the main types of credit scores, and in the newest models of both, scores range from 300 to 850. A score of 700 or above is generally regarded as good. The average FICO® Score in Q2 2023 was 716, according to Experian data.

Why Don't I Have a Credit Score?

You may not have a credit score if you don't have much activity with credit, either recently or at all. Here are the circumstances when you likely won't have a credit score:

- You have a thin credit file. If you have fewer than five credit accounts listed on your credit report, the credit bureaus may not be able to calculate a score because there's not enough information available. You might have a thin credit file if you are young and haven't established any credit, or if you recently moved to the U.S.

- There's little recent activity on your credit reports. If you haven't applied for new credit in a long time, or you haven't used credit in more than six months, credit scoring models may not be able to calculate a score. If you choose not to use credit regularly, consider making a charge with a credit card at least every few months, even if it's a small purchase you pay off right away, to keep your credit file current.

What Are My Credit Options With No Credit Score?

To get new credit, you'll first need to establish credit. With no credit score, you can choose one of the following routes:

Secured Credit Card

Secured credit cards are cards that require you to provide a deposit as collateral for the card. That deposit usually serves as your credit limit. So if you deposit $300, you can spend up to that amount on the card. The deposit reduces the risk for the card issuer, making secured cards easier to qualify for than many other credit cards. A secured credit card is a low-risk way to build your credit that can set you up to use a traditional card down the line.

Store Credit Card

Store cards are credit cards offered by a specific retailer. Some can only be used to buy items at that store. Retail credit cards typically come with a lower credit limit and a higher annual percentage rate APR than other credit cards, though they can be easier to qualify for with no or poor credit. Since store credit cards often come with perks and discounts that can lead to higher spending, they're likely a riskier bet for those new to credit than secured cards.

Getting a Loan Cosigner

If you're applying for a private student loan or car loan, for example, you can ask a loved one to cosign. The cosigner must have strong credit, which will likely make it possible for you to qualify for the loan, and at better interest rates and terms than you would get otherwise. Once the loan is on your credit report and you make regular payments toward it, your credit file will grow. Cosigning does have risks, since failing to make payments on the loan means your cosigner becomes responsible for it.

Becoming an Authorized User

As an authorized user on a relative's or friend's credit card account, you can use the credit card without taking responsibility for making payments on the account. The card's account history and activity will be added to your credit file, which will help you get a credit score. But it may not give you strong enough credit to get credit in your own name. For that, additional credit history, such as through a secured credit card or credit-builder loan that only you are responsible for, will help.

How to Build Credit for the First Time

Once you've decided on the path you'll use to build credit, it's important to follow certain best practices to strengthen your score as much as possible. Try these strategies for building credit with no credit history:

- Consider a credit-builder loan. Unlike a traditional loan you can use to make a purchase, such as a car loan or mortgage, a credit-builder loan is specifically for establishing credit. The lender will hold the total loan amount in a savings account while you make payments on it. Once you've paid off the credit-builder loan, you receive access to the funds. Used in tandem with other credit-building products mentioned above, it can help you build a more substantial credit file. Just make sure the lender you're considering reports payments to all three credit bureaus.

- Make all payments on time. Payment history is the most significant factor that goes into calculating your credit scores, so no matter which route you choose for building credit, take all precautions to ensure you pay your bill on time each month.

- Try Experian Go™. Experian Go creates an Experian credit report for you for free, even if you don't have any credit accounts. You'll also get suggestions on how to jump start your credit history and add more accounts to build your credit profile.

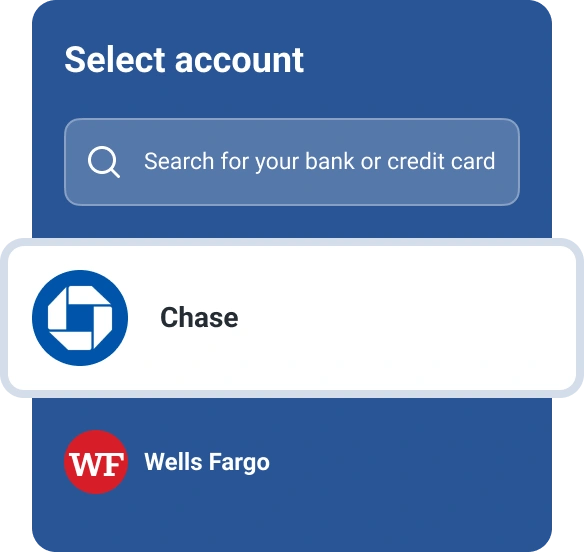

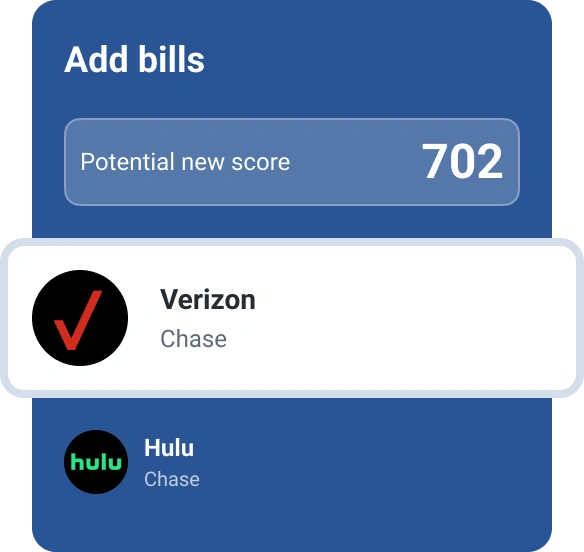

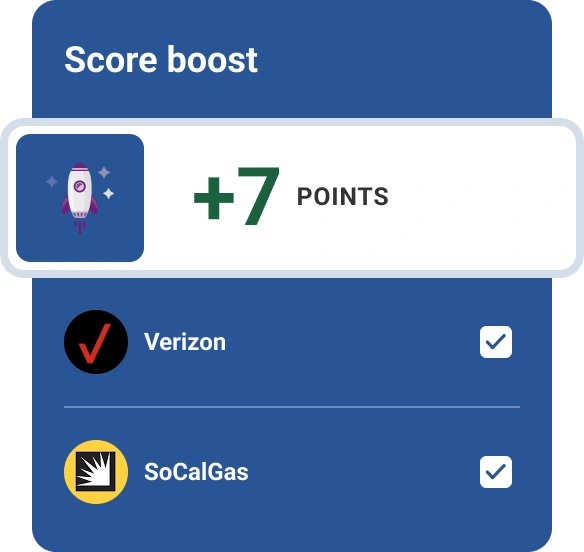

- Add more payment history to your credit report. Some services allow additional payments not typically included in your credit report to contribute to your score. Rent reporting services, for example, may add on-time rent payments to certain credit reports—for a fee, which makes it crucial to understand all terms beforehand. Experian Boost®ø can also add eligible rent, utility, insurance and other monthly payments to your Experian credit report for free, which could improve your FICO® Score.

- Track your progress. Check your score and credit report regularly to make sure all information is accurate and you're making the best use of any accounts or services you're using to build credit. You can access your credit reports from each of the three credit bureaus for free through AnnualCreditReport.com. Check your credit scores for free through the credit bureaus, card issuers and lenders where you have accounts or a free credit score website.

Starting Your Credit Journey

With no credit score, you have a unique opportunity to start fresh with credit. By choosing the best credit-building products for your circumstances and managing them well, you'll build a credit score that will reliably get you new credit when you need it. A good or excellent credit score will also allow you to take advantage of low rates and beneficial terms, saving you money in the long run.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna