How to “Fix” Your Credit Yourself

Quick Answer

You can work to repair your credit yourself for free by taking these 11 steps. Start by checking your credit report, bringing late accounts current, making all payments on time, reducing credit utilization and debt, and more.

When your credit history stands in the way of your financial goals, paying a company to "repair" your credit can be tempting—but the DIY approach can save you a lot of money. You can repair your credit for free over time by checking your credit report, bringing past-due accounts current and more. Here are 11 steps you can take to fix your credit yourself.

- Check your credit report

- Dispute inaccurate information

- Bring past-due accounts current

- Set up autopay

- Maintain a low credit utilization rate

- Pay off debt

- Avoid applying for new credit

- Keep unused credit active

- Apply for a secured credit card

- Consider a credit-builder loan

- Get credit counseling

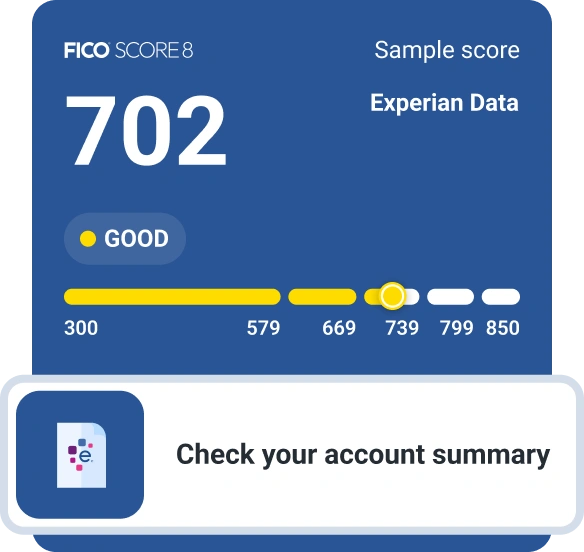

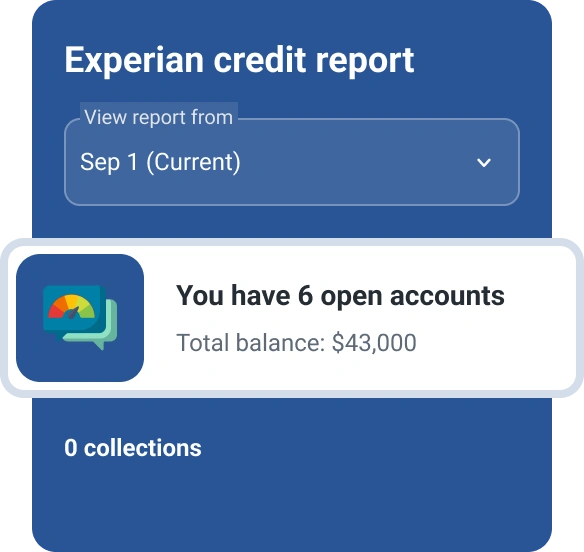

1. Check Your Credit Report

Inaccuracies in credit reports are rare but can occur occasionally, and could negatively affect your credit score. Reviewing your credit report from each of the three major credit bureaus (Experian, TransUnion and Equifax) at least once a year helps you spot any potential problems. You can check your free credit report from Experian anytime and get copies of all your credit reports for free once a week from AnnualCreditReport.com. Review the following information:

- Accounts: Your credit report should show your open credit accounts, as well as closed accounts for up to 10 years after they've been closed. Check for accounts you don't recognize, payments inaccurately reported as late and other potential errors.

- Personal information: Make sure your name and any variations, birth date, current and past addresses and employers are correct. While these don't directly impact your credit score, information you don't recognize could be a sign of fraud.

- Credit inquiries: Hard inquiries occur when a company or individual views your credit report as part of a credit application.

Tip: A name, address, account or hard inquiry that you don't recognize could be a sign of identity theft or fraud.

2. Dispute Inaccurate Information

If your credit report contains information you believe is inaccurate, you have the right to file a dispute with the credit bureau(s) on whose report the information appears. Inaccurately reported negative information, such as a reported late payment that was actually paid on time, could hurt your credit scores.

You can dispute errors in your Experian credit report online, by mail or by phone; each credit bureau has its own dispute process. When you file a dispute, Experian asks the company that provided the disputed information to check their records. Incorrect information will be corrected by the lender; information that can't be verified will be deleted or updated.

Tip: Errors in your personal information, such as a creditor reporting your name or address incorrectly, won't impact your credit score but should still be corrected.

3. Bring Past-Due Accounts Current

Once your payment is 30 days past due, your creditor can report it to the credit bureaus as late. Payment history is the single biggest factor in your credit score, so just one late payment can damage your credit. A late payment stays on your credit report for up to seven years, although its negative impact diminishes over time.

If you've missed a payment but aren't yet 30 days late, pay the bill immediately. If your payment is 30 or more days overdue, bring the account current as soon as possible. A payment that's 60, 90 or 120 days late will hurt your credit score more than one that's 30 days overdue.

Tip: If you're experiencing financial hardship and can't afford to make a payment, ask your lender about hardship options such as pausing or reducing payments, waiving fees, reducing interest or forgiving past-due payments.

4. Set Up Autopay

Once your accounts are current, aim to keep them that way by setting up autopay. Setting autopay to make the minimum payment on your credit cards each month can help prevent late payments and fees. However, it's best to pay your credit card balance in full each month.

You can typically set up autopay with your lender or service provider, or through the bank account you use to pay bills. Be sure there's enough money in your account to cover all your autopays. Otherwise, your bill might not get paid, and you could face overdraft charges, nonsufficient funds fees or returned payment fees.

Tip: Set up recurring calendar reminders a few days before an automatic payment is scheduled so you can check your balance and add funds if necessary.

Learn more: Can Automatic Bill Payments Help My Credit Score?

5. Maintain a Low Credit Utilization Rate

Your credit utilization rate, an important factor in credit scores, reflects how much of your available credit you're using on revolving credit accounts such as credit cards. Credit scoring models may consider both overall credit utilization and per-account utilization.

To calculate your overall credit utilization rate:

- Use the balances and credit limits of your revolving credit accounts as they appear on your credit report (not your statements).

- Divide your total balances by your total credit limits and multiply by 100 to get a percentage. This reflects your overall credit utilization ratio.

- Calculate the credit utilization ratio for each credit card by dividing the card's balance by its credit limit and multiplying by 100.

Credit Utilization Rate Calculation Example

- Credit Card A: $10,000 credit limit, $2,000 balance

- Credit Card B: $5,000 credit limit, $3,000 balance

- Total balance = $5,000

- Total credit limit = $15,000

- $5,000 / $15,000 = 0.33

- 0.33 x 100 = 33% credit utilization ratio

Although there's no set point where credit utilization starts to negatively impact your credit scores, it's generally recommended to keep credit utilization rate below 30%. People with the highest credit scores tend to have rates below 10%. If your utilization rate is 30% or more, either overall or on a single account, paying down your credit card balances could improve your credit scores.

Tip: Keeping credit utilization at 0% won't help your scores and could actually hurt them. If you don't use your credit cards, credit scoring models won't have enough information about your credit habits. Even putting one small monthly bill on each card and autopaying it can help you strike the right utilization balance.

Learn more: What Is the Best Credit Utilization Ratio?

6. Pay Off Debt

How much debt you owe, including loans and credit utilization, accounts for 30% of your FICO® ScoreΘ. If you're carrying high debt balances, especially on high-interest credit cards, make a plan to pay them down by:

- Making a debt payoff budget to free up more funds

- Using the debt snowball or debt avalanche payoff method

- Starting a side hustle for extra money to put toward your debt

Another option: Use a debt consolidation loan to pay off your credit cards, then repay the loan over time in fixed monthly installments. Although debt consolidation loans charge interest, rates are typically lower than credit card interest rates, ultimately saving you money. Plus, one fixed monthly payment can be easier to budget for and pay on time than multiple credit card bills.

Tip: Seeing zero balances on your credit cards could tempt you to run them up again. Before applying for debt consolidation loans, have a plan to avoid racking up new credit card debt.

Learn more: How to Get Out of Debt

7. Avoid Applying for New Credit

Whenever you apply for new credit, the lender checks your credit report. This is called a hard inquiry and can temporarily ding your credit score by a few points. If you truly need new credit—a debt consolidation loan, for example—search for loans you're likely to qualify for before you apply. You'll get an idea of what rates and terms you may be approved for, without harming your credit.

8. Keep Unused Credit Accounts Open

After paying off a credit card, closing it might seem like a smart way to avoid running up a balance again. But closing a credit card can negatively impact your credit score by reducing your available revolving credit, which could increase your credit utilization rate. It also can eventually decrease the average age of your credit accounts and can impact your credit mix, all of which can hurt your credit scores.

Keeping credit card accounts open even if you don't plan to use them can benefit your credit. To avoid temptation to use the card again, remove saved card details from websites, apps and shopping accounts and leave the cards at home.

Tip: If a card you no longer use charges a hefty annual fee, ask the card issuer to downgrade your card to one without a fee so you can keep the available credit without paying a fee.

9. Apply for a Secured Credit Card

A secured credit card works like a regular credit card, but opening the account requires a security deposit. The deposit is refundable, can be as little as a few hundred dollars and typically determines your credit limit.

If you don't pay your bill on a secured credit card and the account goes into default, the credit card issuer can use your deposit to pay it. This reduces the card issuer's risk, which can help you get a secured credit card even with poor credit. For the biggest benefit from a secured credit card, use it for small purchases and pay the balance in full and on time each month.

Tip: After demonstrating six to 12 months of responsible use, you may be upgraded to an unsecured credit card. If the card issuer doesn't upgrade you automatically, contact them after 12 months to request an upgrade.

Learn more: How to Get a Secured Credit Card

10. Consider a Credit-Builder Loan

Small banks, credit unions and online lenders may offer credit-builder loans, usually for amounts of $1,000 or less with repayment terms of six to 24 months. Credit-builder loans are designed to help borrowers build or rebuild their credit scores by demonstrating financial responsibility.

When you get a credit-builder loan, the money you borrow is placed in a savings account or certificate of deposit. You make fixed monthly payments of principal and interest until the loan is paid off. Then you receive the money in the savings account, sometimes with interest.

Tip: Before applying for a credit-builder loan, make sure the lender reports to the three consumer credit reporting agencies (not all of them do). This will maximize the impact on your credit.

11. Get Credit Counseling

Fixing your credit yourself doesn't have to mean going it alone. A reputable nonprofit credit counseling agency can offer the support you need to get your credit back on track. Nonprofit credit counselors often provide free or low-cost services, and are required to put your interests first. Credit counselors can review your finances with you and help you make a plan to tackle financial issues such as budgeting, paying off debt and managing your money.

Tip: The National Foundation for Credit Counseling and the Financial Counseling Association of America are good places to start looking for a certified credit counselor.

Frequently Asked Questions

The Bottom Line

Focusing on good credit management and being patient is the best way to repair your credit yourself. You can sign up for free credit monitoring through Experian to track your progress and get alerts of important changes to your credit.

In addition to the steps above, consider using Experian Boost®ø. This free feature adds your on-time payment of eligible rent, utility, insurance, cellphone and certain streaming service bills to your credit report. These payments aren't normally reported to credit bureaus, so adding them to your credit history could give your credit scores based on Experian data an immediate boost.

Instantly raise your FICO® Score for free

Use Experian Boost® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

No credit card required

About the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen