Is 0% Credit Utilization Good For Credit Scores?

Quick Answer

A 0% credit utilization rate has no real benefit for your credit score. Instead of aiming for no utilization, keep your credit utilization rates below 30%, and preferably under 10%, to help your credit.

If keeping utilization low on your revolving credit accounts is good for your credit scores (and it is), you might think maintaining 0% utilization is ideal—but that's not the case. Zero percent utilization is no more beneficial to your credit scores than keeping utilization in the single digits, and refraining from any use of your credit cards can have unintended negative consequences. Here's how it all works.

What Is a Credit Utilization Rate?

Your credit utilization rate or ratio—the percentage of your total borrowing limit represented by the total of all outstanding balances on your credit cards and other revolving credit accounts—is a significant factor in determining credit scores. It shows how much of your available credit you're using at a given time, particularly on credit cards, and can help or hurt your scores.

Utilization rate, along with your total outstanding debt, are the main components of a credit scoring factor known as amounts owed, which is responsible for about 30% of your FICO® ScoreΘ.

Tip: Credit cards are the main type of revolving credit FICO considers in its credit utilization calculations. Personal lines of credit also count, but they are more rare. Home equity lines of credit (HELOCs) are another type of revolving credit, but because they are secured by your home, FICO generally excludes them from utilization calculations.

How to Calculate Your Credit Utilization Rate

To calculate your credit utilization rate, add up the outstanding balances on all your revolving credit accounts (credit cards and personal lines of credit), divide the result by the sum of the credit limits on those accounts, and multiply by 100 to express the answer as a percentage. Credit scoring systems factor this total utilization rate, as well as the rates for each individual account, into their score calculations.

Here's an example:

| Account | Credit Limit | Balance | Utilization (Balance/Limit) |

|---|---|---|---|

| Credit card 1 | $8,000 | $1,600 | 20% |

| Credit card 2 | $6,000 | $1,500 | 25% |

| Total: | $14,000 | $3,100 | 22% |

Reducing your credit card balances can bring relatively quick score improvement. In the example above, paying $1,000 toward the first credit card would bring your total utilization to 15% and potentially help your credit scores.

Is a 0% Credit Utilization Good?

Keeping your revolving credit utilization in the single digits is a proven practice for building a good credit score, but keeping utilization at 0% won't have much additional benefit and, paradoxically, it could end up backfiring. Here's how.

Credit scoring systems calculate utilization using balance information lenders report monthly to the national credit bureaus (Experian, TransUnion and Equifax). Each issuer reports on its own schedule, and each credit bureau updates your credit report with reported data on its own schedule. To maintain 0% utilization, you have a couple of choices:

- Ensure your account balances are zero on the days of the month your different lenders report your balances to the credit bureaus. This is typically on or near the date each month when your statement closes.

- Don't use your credit cards at all.

The first option is theoretically possible, by scheduling your monthly payments a day or two before your statement closing date, rather than the payment due date. But keeping ahead of the reporting dates for each account can be challenging, especially if you have multiple credit cards or other revolving accounts.Not using your cards at all comes with its own potential pitfalls:

- Risks credit limit decrease or account closure: If a credit card account is inactive for an extended period, the issuer may reduce its borrowing limit or even close the account altogether. Either lowers your total available credit, which can cause overall utilization to rise and negative consequences for your credit scores.

- Provides no payment history: Regular, timely debt payments are one of the most important contributors to credit score improvement, and revolving accounts that aren't used at all don't generate payments.

To avoid these issues, it's a good idea to use all of your credit cards at least a few times each year. If you use them for small purchases that you quickly pay off in full, you won't incur interest charges or spike your utilization, but you'll keep the accounts active and add to your credit reports' payment history.

Tip: Carrying a revolving balance forward month to month will not benefit your credit scores. Revolving a balance generally means incurring interest charges, and while that may sometimes be necessary, doing so does not help your credit scores.

What Is the Best Credit Utilization Rate?

The best credit utilization rate is in the single digits. Individuals with exceptional FICO® Scores typically maintain utilization rates lower than 10%.

Credit experts generally advise keeping utilization rates below about 30% to avoid significant credit score reductions. This is a broad guideline, however, and not a hard limit. Utilization rates above or below 30% could adversely affect your credit scores differently, depending on your payment history and how long you've been using credit. Generally, keeping your utilization rate in the low single digits while showing regular credit use could benefit your scores the most.

How to Lower Your Credit Utilization Rate

If you'd like to lower your credit utilization rate, there are two proven methods for doing so. Pursuing either one or both together can bring credit score improvement within just a few months.

Lower Your Outstanding Credit Balances

Paying down outstanding revolving credit balances can be doubly beneficial: It reduces your utilization rate and, often, the amount you pay in interest. For the biggest impact on utilization, start by paying down accounts whose balances are closest to their spending limits. Aim to get all accounts below 30% utilization and significantly lower if possible.

Increase Your Amount of Available Credit

If you've had a credit card account for a year or longer and have no missed or late payments, the lender may be willing to increase your available credit limit. If they approve your request, the utilization rate for any balance on that card will instantly decrease, and so will your overall utilization rate.

Opening a new credit card account also increases your overall borrowing limit and so reduces your overall utilization rate. Applying for multiple credit cards in a short period can cause your credit scores to dip, however, and it's not wise to open a new account just to reduce your utilization rate. However, if you're in the market for a new card—perhaps one with rewards that align with your interests—Experian's card comparison tool could help you choose a card you could qualify for, and the new account could lower your overall utilization rate.

Frequently Asked Questions

The Bottom Line

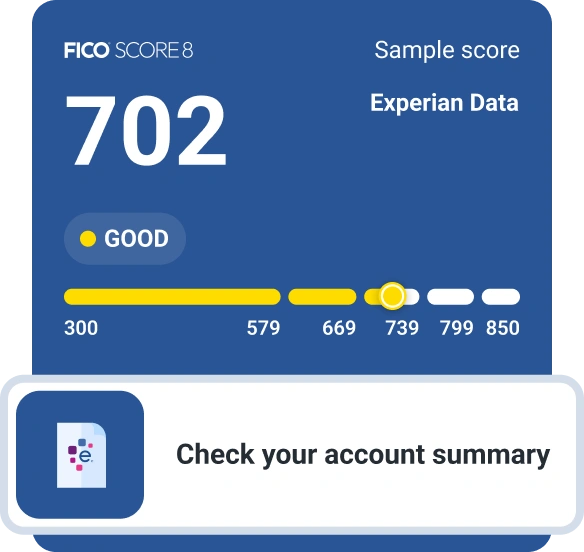

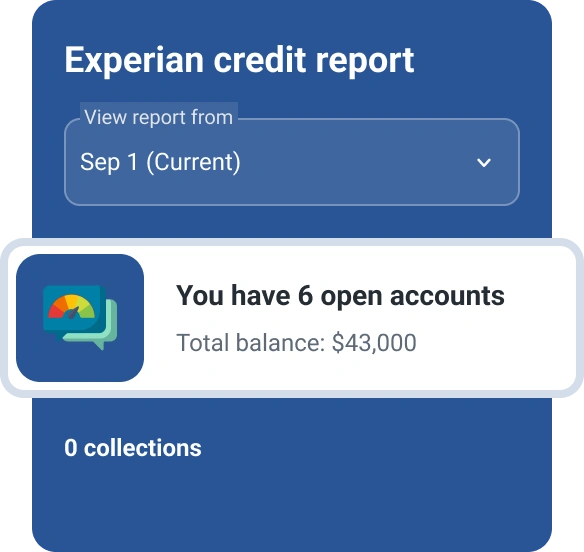

A low credit utilization rate—ideally under 10%—is great for healthy credit scores. Maintaining 0% utilization is no more beneficial, and the only practical way to achieve it consistently (abstaining from credit card use) could inadvertently undermine your efforts at credit score improvement. You can track your efforts to build your credit by regularly checking your FICO® Score for free from Experian.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim