What’s the Difference Between Secured and Unsecured Credit Cards?

Secured and unsecured credit cards are two common types of credit cards. The main difference between them is that secured credit cards require a security deposit, while unsecured cards do not. Let's dive into how each card works and how to choose the right one based on your credit history.

| Secured Credit Card | Unsecured Credit Card | |

|---|---|---|

| Security deposit | Refundable deposit required, usually $200 to $5,000 | Not required |

| Ideal for | Individuals with thin or poor credit | People with an established credit history and students |

| Initial credit limit | Lower; based your deposit | Higher; based on your credit score, income and credit history |

| Credit limit increase | Limited; may require additional security deposit | Based on income and account history |

| Interest rates | Usually higher than average | Varies |

| Fees | May include late fees, annual fees and balance transfer or cash advance fees | May include late fees, annual fees and balance transfer or cash advance fees |

| Rewards | Common | Common |

| Low intro APR offers | Rare | More common |

| Credit card options | Fewer options available | More options available |

What Is a Secured Credit Card?

A secured credit card is a card that requires you to make a refundable deposit when you open the account. This deposit, which might range from around $200 to $5,000, is collateral and usually determines your credit limit. The deposit is typically held in a linked savings account at the same bank until you either upgrade to an unsecured card or close your account.

If you default on the balance, your card issuer can use your security deposit to cover what you owe.

Because the deposit reduces the card issuer's risk, secured credit cards are easier to qualify for if you have limited credit or poor credit. Over time, using your account responsibly can help you build or rebuild your credit.

Learn more: Best Secured Credit Cards

What Is an Unsecured Credit Card?

An unsecured credit card is the traditional type of credit card. Approval is based on your income and overall creditworthiness, and no deposit is required. Periodically, card issuers review your account and may offer a credit limit increase if you qualify based on your income and account history. You can also request a credit limit increase after several months of responsible use.

If you fall behind on payments, the card issuer will first try to collect the balance from you directly before potentially sending the debt to a collection agency, which could hurt your credit score.

Learn more: Best Credit Cards for Building Credit

Is a Secured or Unsecured Card Better for Building Credit?

Both secured and unsecured credit cards can help you build credit depending on how responsibly you use them. The key differences are the approval requirements.

If you have no credit or bad credit, a secured credit card is often the better choice because you're more likely to be approved. Once the card is active, you can build credit as long as the issuer reports to the three major credit bureaus (Experian, Equifax and TransUnion) and you make payments on time. You may even eventually be able to transition your secured card into a traditional unsecured credit card.

If you already have good credit and a steady income, an unsecured credit card may be a better option, especially if you want more features and choices. You'll likely qualify for lower interest rates, higher limits and rewards, and you won't have to make a security deposit.

Tip: Being added as an authorized user on someone else's credit card can help you start building your credit history to qualify for an unsecured card. You'll benefit from that credit card's positive history without having to manage the account yourself or worry about qualifying on your own.

Should I Get a Secured or Unsecured Credit Card?

Whether or not you want to get a secured credit card or an unsecured credit card depends on your personal credit profile, how you plan to use the card and any features you'd find helpful to have. Here's how you can decide which credit card is better for you.

When to Consider Getting a Secured Credit Card

- You have little or no credit history. The security deposit serves as collateral, making approval easier without relying on your credit score.

- You're trying to repair your credit. If you've had late payments, collections or bankruptcy, a secured credit card helps you reestablish a positive payment history.

- You've been denied an unsecured credit card. If you've had a credit application turned down, using a secured card responsibly allows you to improve your credit profile and qualify for better credit cards later.

- You can afford a security deposit. Deposits typically start around $200, but can go higher depending on the card and your desired credit limit. If you can afford it, a higher credit limit gives you more spending flexibility.

Learn more: How Much Should You Deposit for a Secured Card?

When to Consider Getting an Unsecured Credit Card

- You have a well-established credit history. A solid payment history and decent credit score make it easier to qualify for unsecured cards with better terms.

- You want higher credit limits and more flexibility. Unsecured cards often offer higher credit limits, making it easier to make larger purchases and keep a low credit utilization ratio.

- You want premium benefits. While some secured cards offer minimal benefits, an unsecured card is the better option for higher rewards, purchase protection, travel insurance and extended warranties.

- You want a 0% intro annual percentage rate (APR). With established credit, you may qualify for an intro 0% APR promotion, which can allow you to pay off a balance transfer or large purchase interest-free.

- You want to keep your money accessible. Since there's no deposit, your money stays available for savings or emergencies.

- You've managed a secured credit card responsibly. After several months of on-time payments, you may qualify for an unsecured credit card.

Tip: If you're in the market for a new credit card, Experian can help you get matched with credit cards that fit your unique credit profile. You'll be able to compare interest rates, features and more before deciding.

How to Upgrade From a Secured to an Unsecured Credit Card

Many card issuers review secured accounts after six to 12 months to determine whether you qualify for an upgrade to an unsecured credit card. There are several ways to improve your chances of an automatic upgrade.

- Make your payments on time. Payment history is the most important factor in your credit score. Paying on time shows your card issuer you can manage credit responsibly.

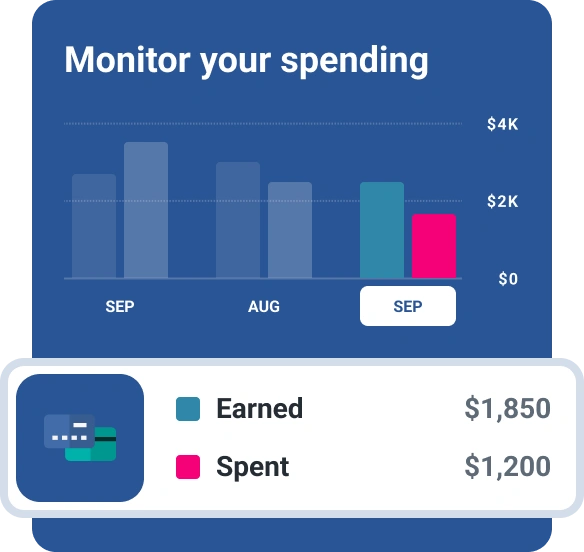

- Keep your balance low. Using your card for small purchases and paying them off helps maintain a low credit utilization, which helps your credit. Maxing out your card or going over the credit limit can make it harder to get upgraded.

- Minimize new credit applications. Opening new credit cards and loans impacts your credit score and potentially increases your debt. Each time you open a new credit account, the hard inquiry that appears on your credit report as part of the application process can temporarily decrease your credit scores a few points; repeat inquiries for credit cards compound the impact on your scores.

If your card issuer doesn't automatically upgrade your card, you can request an upgrade after you've managed your account responsibly for several months. If upgrading isn't available, consider applying for a new unsecured card once you've built several months of positive payment history.

The Bottom Line

Both secured and unsecured credit cards can help you build your credit, but the best choice depends on your current credit standing. If you have a low credit score or no credit score at all, a secured card is usually the better option to help you build or rebuild your credit. With an established credit history, you're more likely to be approved for an unsecured card.

Before applying, check your FICO® ScoreΘ for free from Experian to see where you stand and decide which type of card is most likely to work for you. No matter which card you choose, using your account responsibly is key to building your credit and qualifying for better credit offers.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya