6 Personal Loan Requirements to Know Before You Apply

Quick Answer

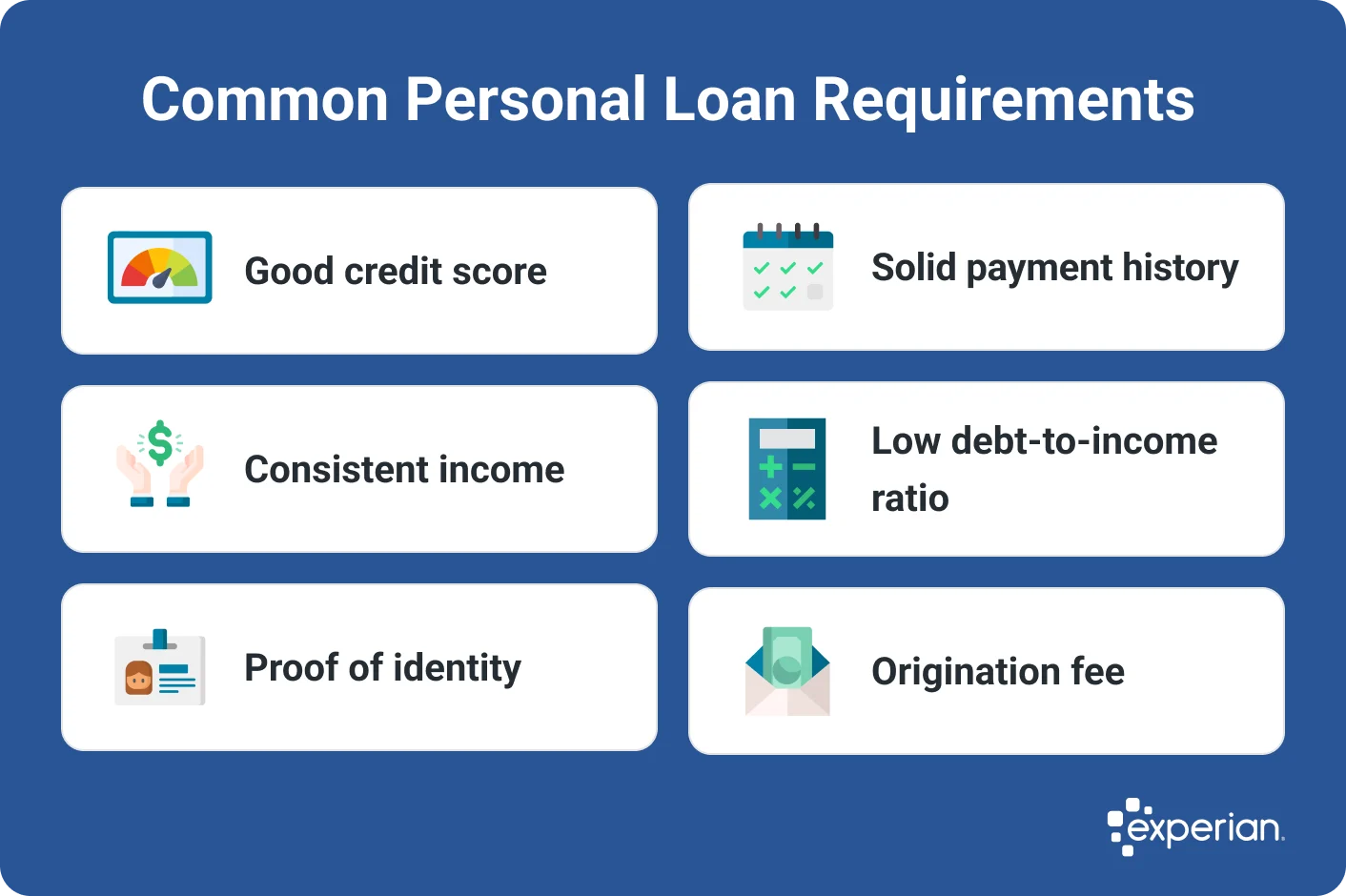

Personal loans typically require a minimum credit score and annual income, collateral if you’re choosing a secured loan and potentially an origination fee. Some lenders offer products for borrowers with poor or limited credit.

To qualify for a personal loan, you'll need to meet minimum credit and income requirements and potentially pay an origination fee. If you're choosing a secured loan, you'll also have to provide collateral.

Requirements can vary based on the lender and the particular loan you're interested in. For instance, lenders that offer personal loans to those with bad credit and limited credit history often have more lenient expectations. But in general, you'll get more affordable interest rates and pay lower fees the higher your credit score.

Here's what lenders look for on a personal loan application.

1. Good Credit Score

Your credit score is one of the most important factors to lenders, as it helps them assess how risky you are as a borrower. While many lenders work with borrowers with below-average credit scores, or those with thin credit files, you'll have a wider range of choices with a good credit score (from 670 to 739) or higher. That will also help you qualify for more favorable interest rates.

If your credit score is fair or poor, look into personal loans from credit unions, which may offer better rates and special programs to low-credit borrowers. Or enlist a cosigner to improve your approval odds. Pausing your loan efforts and instead focusing on improving your credit score is another option.

Tip: You can increase your credit score by paying bills on time, paying off your debts and limiting new credit applications. You can also look into products that specifically help strengthen your credit, such as a secured credit card or a credit-builder loan.

2. Payment History

Beyond your credit score, lenders evaluate how you've managed credit in the past. They look at your payment history, which includes how well you've handled other loans and credit cards, for reassurance you're a responsible borrower who makes consistent on-time payments.

If you don't have significant credit history, you can choose a lender that works specifically with borrowers who have thin credit. They may use alternative data—such as rent or utility payments, spending patterns and proof of income in your bank account—to approve you for a loan.

Tip: Check your credit report to make sure all your on-time loan and credit card payments are being reported to the credit bureaus, and that they're being reported accurately. That will help build a positive payment history.

Learn more: What's the Most Important Factor of Your Credit Score?

3. Consistent Income

When lenders evaluate your loan application, they want to see that you can afford to repay the loan. But the income you'll need for a personal loan varies by lender. Some have specific minimum requirements, such as an annual income of $25,000 per borrower or household. Others don't have a minimum requirement but still want to verify your income to ensure you'll have enough money to cover the loan payments.

Your income will contribute to the amount the lender approves you to borrow. Plus, lenders typically reserve their best interest rates for those with higher incomes, among other factors.

Tip: Don't forget to note every source of income on your personal loan application, including government benefits, child support or alimony you receive. That gives the lender a fuller picture of your ability to repay and could qualify you for a larger loan amount.

4. Low Debt-to-Income Ratio

Lenders use what's called a debt-to-income ratio (DTI) to help them measure your ability to repay a loan. Your DTI compares how much you pay toward debt each month with your gross monthly income. Typically, the lower your DTI, the better.

You can determine your DTI by adding up all of your monthly debts and dividing that number by your gross monthly income. For example, if you pay $2,000 per month in total mortgage, student loan and credit card payments and your gross monthly income is $6,000, your DTI is about 33%. Generally speaking, lenders prefer DTIs below 36%, but many lenders approve loans with higher ratios.

Tip: Reduce your DTI before applying for a personal loan by paying down debts if possible, increasing your income and pausing on applications for new credit.

5. Sufficient Collateral

If you choose an unsecured personal loan, you won't need to provide collateral. But for a secured loan, you will, typically in the form of cash savings, a car, a home or another asset holding monetary value.

Secured loans are less risky for the lender. They are generally easier to qualify for and come with lower interest rates. But there's a big pitfall: You could lose your collateral if you can't keep up with the payments on your secured loan.

Tip: Only opt for a secured loan if you can comfortably afford your loan payments and if your loan term isn't particularly long, which doesn't leave much time for unforeseen circumstances to affect your plans. Otherwise, the risk of losing your collateral may be too great.

Learn more: What Can Be Used as Collateral for a Personal Loan?

6. Potential Origination Fee

Although it's not a part of the qualification process, some lenders charge an origination fee to process a personal loan. Origination fees, which can range from 1% to 10% of the loan amount, pay for the lender's administrative expenses like verifying your application documents. But with good or excellent credit, you may be able to avoid an origination fee by qualifying for a loan that doesn't charge one.

Tip: Origination fees are subtracted from your loan proceeds, which means you'll get less than you were approved to borrow. That's another reason to aim to qualify for personal loans with no origination fee.

Document Requirements for a Personal Loan

Most lenders will require you to provide the following information, and documents to verify it if necessary, with your application:

- Personal information: Your name, contact information and Social Security number

- Income: Pretax monthly income from all sources; the lender may ask for W2s, pay stubs or tax returns to verify your income

- Housing expenses: Monthly housing costs, such as your mortgage or rent payment

- Proof of identity: A copy of your driver's license or Social Security card is typically enough

- Consent to verify income: Authorization for the lender to confirm with your employer the income and employment information you've provided

How to Get a Personal Loan

Applying for a personal loan is usually a straightforward process involving the following steps:

- Review your credit score and credit report. Check to see if your lender requires a minimum credit score. You can get your credit report and FICO® ScoreΘ for free through Experian to see where you stand. If you discover any discrepancies or inaccuracies in your credit report, dispute them with the credit bureaus.

- Compare multiple lenders. Investigate multiple lenders to find the loan offer with the best interest rate and repayment terms and lowest fees. Try to use a lender's prequalification process to check your potential loan rate and terms without impacting your credit score.

- Choose the best loan. After reviewing your loan offers, choose the one that best suits your needs.

- Complete a full application. Once you complete this step, the lender will likely perform a hard inquiry of your credit, which may cause a slight temporary dip in your credit score. Be prepared to submit any supporting documentation the lender requests, such as pay stubs or tax returns.

- Receive your funds. Upon approval, you'll need to sign for the loan. At that point, the lender will disburse your loan as one lump-sum payment. If you take out a loan through a bank or credit union, you can typically get the loan funds in one to five days. Online lenders are usually very fast; some lenders can provide loan funds the same day.

Tips to Qualify for a Personal Loan

Before you apply for a personal loan, review these tips that can improve your chances of qualifying.

- Improve your credit. While you can get a personal loan with a credit score of 580 or higher, having a score above 700 often qualifies you for the best terms.

- Lower your debt. A low DTI is looked at favorably by lenders. Consider paying off some of your credit cards or loans to reduce your DTI.

- Consider a cosigner. If your credit or debt aren't ideal, consider getting a cosigner who has good credit to help you qualify for better terms.

What to Do if You're Denied a Personal Loan

When you're not approved for a personal loan, the lender is required to send you an adverse action letter stating the reasons your application was denied. There will be up to five reasons stated in the letter, and you can use that information to make changes before you apply again. For example, you might learn you didn't meet the minimum credit, DTI or credit history requirements.

You could also pivot to applying for personal loans targeted at those with poor credit, or ask someone you trust to cosign the loan.

The Bottom Line

There are a range of personal loan types available, which all have varying requirements. But if you aim to build up a good credit score, keep as low a DTI as possible and establish a history of timely debt payments, you'll likely meet many lenders' basic requirements. That will set you up to have multiple loan options to choose from, leaving you with an interest rate that will make your monthly payments more affordable.

Need a personal loan?

Whether you're looking to eliminate debt or access cash fast, compare personal loan offers matched to your credit profile.

Start now for freeAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna