5 Ways to Keep Your Credit Utilization Low

Your credit utilization rate is an important metric that can help or hurt your credit score, and it's important to keep it as low as possible.

There are a few ways you can keep your credit utilization rate low, including paying off your purchases quickly, increasing your credit limits and spreading your balances across multiple cards. Here are some steps you can take to accomplish your goal.

What Is a Credit Utilization Ratio?

Your credit utilization rate is the percentage of your available credit that you're currently using across your credit cards and other revolving credit accounts. It's one of the most important factors in determining your credit score, typically accounting for about 30% of your FICO® ScoreΘ calculation.

Credit bureaus and lenders view this ratio as an indicator of how well you manage debt and your risk level as a borrower.

To calculate your utilization rate, simply divide your total outstanding credit card balances by your total available credit limits, then multiply by 100 to get a percentage. You can also do this for individual cards.

Example: Say you have one credit card with a $1,000 spending limit. If you carry a $250 balance, your credit utilization rate on that individual card would be 25%. If you also have a card with a $2,000 spending limit and a $750 balance, your overall credit utilization rate for the two cards is 33%.

5 Ways to Keep Your Credit Utilization Low

An ideal credit utilization rate is below 10%, and there are a handful of different ways you can keep yours as low as possible.

1. Pay Off Your Purchases Quickly

Paying off your credit card purchases as you make them can help keep your credit utilization low and prevent interest charges. By treating your credit card like a debit card, you get the benefits of rewards while avoiding high balances that could hurt your credit score.

Note, however, that you may need to wait until the transaction posts to your account before you can pay it off. It may take a few days for pending transactions to be finalized.

2. Make Multiple Payments in the Same Month

Making multiple payments throughout the month rather than a single payment at the due date can keep your outstanding balances lower when credit card companies report to the bureaus. Most issuers report account information at the end of each billing cycle, meaning the balance on your statement closing date is what appears on your credit report.

One way to do this is to make payments when you get paid. For example, if you're paid biweekly, set up automatic payments every two weeks to avoid accumulating a large balance over the course of the month.

Learn more: Statement Balance vs. Current Balance: What's the Difference?

3. Ask for a Credit Limit Increase

Requesting a credit limit increase is one of the most straightforward ways to improve your credit utilization rate without changing your spending habits. Since utilization is calculated by dividing your outstanding balance by your total available credit, increasing your credit limits automatically lowers your percentage, even if your balances remain the same.

Depending on your card issuer, you may be able to ask for a credit line increase by submitting a request through your online account or calling the number on the back of your card.

4. Use More Than One Credit Card

Using multiple credit cards strategically can help maintain a lower credit utilization rate by spreading your spending across different accounts.

When you concentrate all your purchases on a single card, you risk a high utilization on that individual account, which can negatively impact your credit score even if your total utilization across all cards remains low. Credit scoring models evaluate both your overall utilization and the utilization on each individual card.

Using more than one credit card maximizes your total available credit while preventing any single account from showing excessive utilization when reported to credit bureaus.

5. Keep Credit Accounts Open

Maintaining older credit card accounts, even those you rarely use, can significantly benefit your credit utilization rate because it preserves your total available credit. When you close a credit card, you immediately lose that credit limit from your utilization calculation, which can cause your percentage to spike if you carry balances on other cards.

If an old account you no longer use has an annual fee, ask your card issuer about downgrading the card to one with no fee. If it's a secured credit card that requires you to close your account to get your deposit back, ask about options for converting the card to an unsecured account instead.

Frequently Asked Questions

The Bottom Line

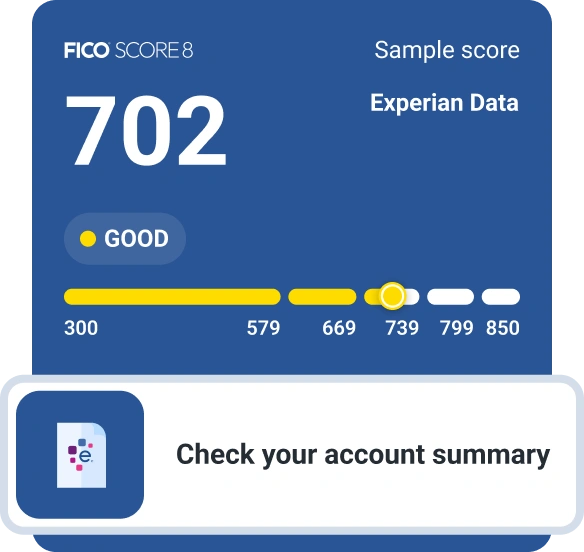

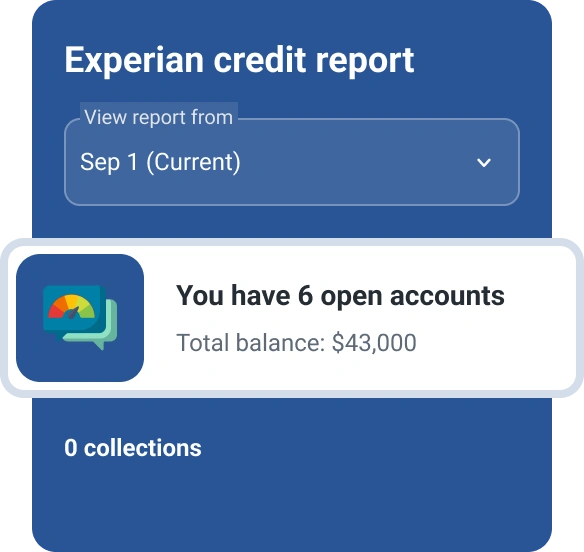

Maintaining a low credit utilization ratio is one of the most effective strategies for improving your credit score. Since your utilization percentage can change from month to month, regular credit monitoring enables you to actively manage your progress. With Experian's free credit monitoring service, you'll get access to your Experian credit report and FICO® Score, along with real-time alerts when changes are made to your report.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben