What Is a Budget?

Quick Answer

A budget is a spending plan that allocates your money to different spending and savings categories to help you achieve your financial goals. Budgeting can help ensure you can pay your bills, manage your debts and save for the future.

A budget is a plan for how you'll allocate your money for essential expenses, discretionary spending and short- and long-term savings goals. Creating a budget can help you break the cycle of overspending and improve your financial health. There are many budget methods, from simple to complex, but the key to success is designing a budget you can stick with.

What Is a Budget?

A budget is a tool that helps you manage your spending and achieve your financial goals. Without a budget, it can be challenging to know where your money goes. This can lead to overspending, being unable to pay your bills or getting deep into credit card debt.

You may think of budgets as restrictive, but in reality, a budget can help you balance your needs with your wants. Staying within budget can ensure you have enough money for what's most important to you, whether that's traveling, putting your kids through college or buying a home.

Learn more: When Should You Start a Budget?

Types of Budgets

The best type of budget depends on your finances, goals and personality. Here are some popular budgeting methods to consider.

| Type of Budget | Definition |

|---|---|

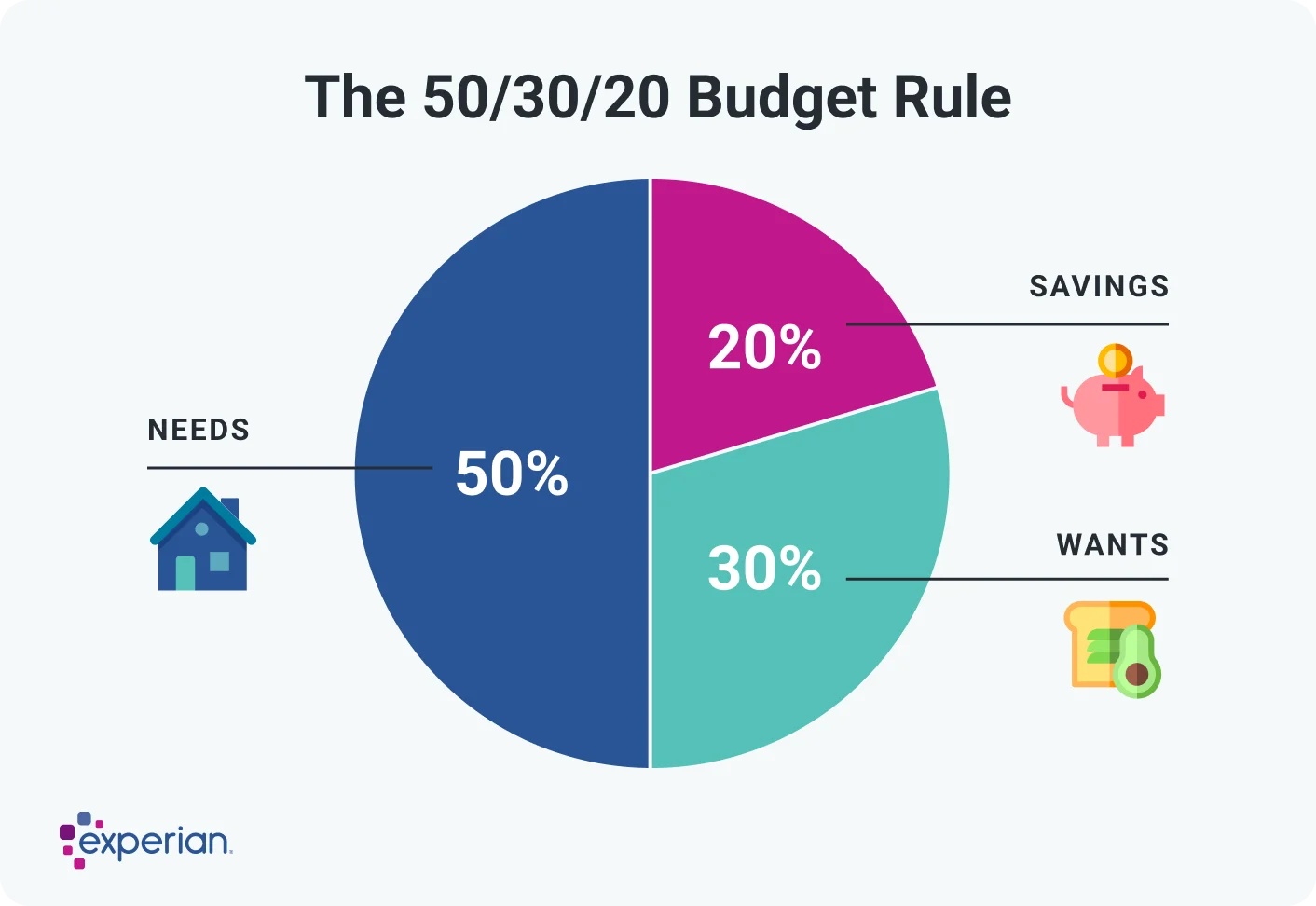

| 50/30/20 budget | Allocates 50% of income to needs, 30% to wants and 20% to savings and debt repayment |

| Zero-based budget | Every dollar of income is assigned a specific purpose so at the end of the month you have zero dollars left |

| Envelope budget | Cash is divided into envelopes for each spending category; when an envelope is empty, spending stops |

| Pay-yourself-first budget | Prioritizes saving by allocating a portion of income to savings or debt before any other expenses |

| "No-budget" budget | A relaxed approach where you only track "must pay" necessary expenses and are free to spend the rest of your income as you wish |

50/30/20 Budget

The 50/30/20 budget allocates your money into three main categories:

- Basic needs: 50%. This includes essential expenses, such as housing, groceries, child care and utilities.

- Wants: 30%. These nonessential expenses, or discretionary spending, include going out to eat, entertainment, traveling or any spending that goes beyond your basic needs.

- Savings and debt payoff: 20%. This goes toward paying off debt and building savings.

You can easily adjust the 50/30/20 percentages to fit your goals and finances. For instance, if you're trying to pay down your credit cards, you could cut discretionary spending to 20% and put an extra 10% toward debt payoff.

Example: You bring in a total of $6,000 per month. Using a 50/30/20 budget, you allocate $3,000 for your essential expenses, $1,800 for discretionary expenses and $1,200 to savings and debt payoff.

Learn more: What Is the 50/30/20 Budget Rule?

Zero-Based Budget

A zero-based budget assigns every dollar of your income to a spending category. The goal is to zero out your spending, with every dollar accounted for at the end of the month. Basic categories include essential and nonessential expenses, savings and debt payoff. However, you'll probably want to break these categories down in more detail. For example, you might budget $1,000 for rent, $120 for utilities, $323 for your car payment and so on.

If you spend more than you've budgeted in one category, you'll need to stop spending or take money from another category to avoid going into the red. For instance, if you run out of grocery money, you could move funds from your entertainment budget to buy food.

Zero-based budgeting can help you gain control of your money and stop overspending. However, it may be overwhelming if you're new to budgeting, and the rigid approach can be hard to stick with.

Learn more: What Is a Zero-Based Budget?

Envelope Budget

An envelope budget works like a zero-based budget, except that you budget using physical cash. This method is also called cash stuffing because you sort cash into envelopes dedicated to different budget categories and spend only what's in the envelope for each category. When an envelope is empty, you can't spend any more in that category until your next pay period, unless you move cash from another envelope.

Handling physical cash can make you more aware of your spending. However, budgeting in cash can be time-consuming, and carrying cash can be risky. Since many bills can't be paid with cash, you'll probably have to use cashless methods at least some of the time.

Learn more: What Is Cash Stuffing?

Pay-Yourself-First Budget

A pay-yourself-first budget or reverse budget puts the focus on your savings and debt repayment goals. Whenever you get paid, your first priority is transferring money into savings or putting it toward your debt.

After paying yourself, you can use the rest of your money as one big pool of funds. Just make sure you have all your necessary expenses covered before spending on nonessentials.

The pay-yourself-first method can work well if you have a firm handle on your financial obligations and feel comfortable taking a flexible approach to managing your money.

If you aren't careful, though, this approach could lead to overspending or accidentally overdrawing your checking account. Protect yourself with guardrails such as setting up spending alerts on your checking account or setting all your bills to autopay when you get paid.

Learn more: What Does It Mean to Pay Yourself First?

"No-Budget" Budget

A "no-budget" budget is a flexible spending plan that takes two things into account:

- Your net pay for the month

- Your "must pays" for the month

Must-pays include things like rent, gas, groceries, utilities, debt payments and savings. Make sure you earmark enough money for these essentials, and you can treat everything else as disposable income, with no need to track nonessential spending.

The no-budget budget is similar to the pay-yourself-first budget. Set up automatic transfers into your savings account as soon as you get paid so you know how much you have left to work with. You can also set up autopay for essential bills and set spending alerts to ensure you don't overdraw your checking account.

Tip: The no-budget budget generally works best if you have a steady income and don't tend to overspend. It's less effective if you're an impulse buyer or have an irregular income.

Why Is Budgeting Important?

Budgeting is important because it helps you make the most of your money and reach your financial goals. Sticking to your budget ensures you can cover your bills and pay your debts. Budgeting can also help you reach short- and long-term financial goals like taking a vacation or buying a home.

Without a budget, you're more likely to overdraw your bank account or overspend on your credit cards. You might get hit with late payment or overdraft fees or accumulate interest on your credit card balance, which can lead to a cycle of debt. Budgeting eases financial stress because you know your critical expenses are handled.

If you're struggling with high-interest debt, budgeting can help you pay it off. For example, you could use the snowball method or avalanche method to budget for paying down credit cards.

Tip: Make room in your budget to build an emergency fund you can tap for financial crises or unexpected expenses, like layoffs or a big medical bill.

How to Make a Budget

To make a budget, follow these steps.

1. Add Up Your Expenses

Review your spending over the past three to six months by looking at your bank account and credit card statements. Many bank or credit card apps can automatically sort your spending into categories; you can also use spreadsheet software to categorize spending. Depending on the budgeting method you plan to use, you can use broad categories, such as utilities, or more detailed categories, such as breaking utilities into gas, water, electricity, internet service and so on.

Learn more: How to Budget for Fixed and Variable Expenses

2. Calculate Your Income

Add up all your sources of income, including paychecks and money from tips, side gigs, unemployment compensation, Social Security or other sources. This is generally straightforward if you receive a regular income. If your income fluctuates, review the past year's net income and divide it by 12 to get an average monthly income.

3. Set Financial Goals

Think of realistic ideas for improving your financial life. Your goals should be achievable given your current financial situation but also help you get where you want to go. For example, if you're living paycheck-to-paycheck, you could set a financial goal to break the cycle by reducing spending and putting a set amount into an emergency fund each week. Once you escape the paycheck-to-paycheck cycle, you can set new goals like paying down debt faster or saving for a down payment on a new car.

Learn more: How to Set SMART Financial Goals

4. Choose a Budgeting Method

Decide how you want to structure your budget using the different methods described above. If this is your first time making a budget, a flexible option like the 50/30/20 plan can be a good place to start.

5. Track Your Spending

Track your spending to see whether your budget is working. You can track spending on paper or with a spreadsheet, but the easiest option is to download a budgeting app that automatically syncs to your bank account. That way, you can import and categorize transactions and chart your progress over time.

Learn more: How to Track Your Expenses

6. Adjust Your Budget as Needed

Regularly review your spending and compare it to your budget. You can do this each month, each pay period or each week, whichever works best for you. If you miss the marks you set for yourself, don't beat yourself up. Instead, look for ways to adjust your spending to fit your budget.

For instance, maybe you can eat out less and cook at home more often, or cancel some streaming services. If you're going over budget month after month, though, you may need to set more realistic savings goals or bring in more income.

Learn more: Ways to Stop Going Over Budget

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

How to Stick to a Budget

If you're having trouble sticking to a budget, try these tips.

- Refocus on your goals. Why did you create a budget in the first place? Maybe you want to pay off debt, buy a home or hold your dream wedding. Picturing yourself achieving these goals can reignite your motivation.

- Build in some wiggle room. If you're consistently struggling to stick to your budget, your spending plan may be unrealistically strict. An overly restrictive budget can backfire, causing burnout. A budget that allows flexibility is more likely to keep you on track.

- Celebrate small wins. Meaningful change isn't always easy. Stay inspired by setting small goals (such as sticking to your entertainment budget for the week) and celebrating progress with no-splurge treats.

- Automate savings and bill payments. Automation helps remove temptation. If you never see this money, you're less likely to spend it on non-necessities.

- Prepare for recurring expenses. It's easy for recurring occasional expenses, such as tuition or property taxes, to slip your mind when making a budget. Build them into your spending plan and set up sinking funds to save for them.

- Buddy up. An accountability partner can help keep you on track. If you don't have a friend or partner to keep you accountable, join a financial accountability group or try an accountability app.

Learn more: How to Stop Impulse Spending

Frequently Asked Questions

The Bottom Line

There's a bit of a learning curve when you first make a budget, but eventually, living within your means should become second nature. Budgeting gives you control of your financial future, and you'll gain a sense of accomplishment as you watch your savings grow and your debt shrink.

Just like monitoring your spending, monitoring your credit score is essential to your financial health. Consider signing up for free credit monitoring from Experian to track your FICO® ScoreΘ and see how paying bills on time and reducing debt impacts your credit.

Want to lower your monthly bills?

We’ll negotiate bills for you and cancel unwanted subscriptions.

Get startedAbout the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen