What Is a CVV Number on a Credit Card?

Quick Answer

A card verification value (CVV) is a three- or four-digit number printed on your credit card that adds an extra level of security. You generally need to enter your CVV when making purchases online or over the phone.

When you make a purchase online or by phone, you're often asked to provide a credit card's CVV number. A CVV, or card verification value, may be a number you've typed out hundreds of times, but have you ever wondered what it is and why retailers ask for it?

Learn how a CVV adds an extra layer of security when making purchases online or over the phone.

What Is a CVV on a Credit Card?

A CVV is a three- or four-digit number that's printed on your credit card in addition to your credit card number and expiration date. The purpose of a CVV is to add a layer of protection to ward off potential fraud.

Where to Find Your CVV

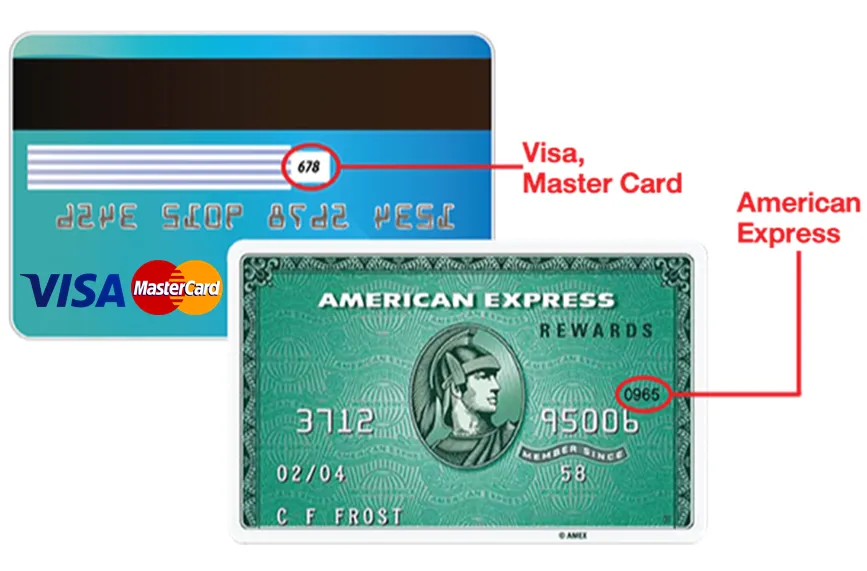

Different issuers have slightly different names and locations for CVVs. The CVV for Visa, Mastercard and Discover credit cards is a three-digit number on the back of your card, to the right of the signature box.

American Express uses a four-digit code, which they call the card identification number (CID). The American Express CID is on the front of the card above the account number.

What's the Purpose of a CVV?

In transactions where your card isn't present, meaning online or on the phone, merchants often ask for this number in addition to your credit card number and expiration date. It's not always required, but it helps ensure they're (most likely) getting payment from the legitimate cardholder.

If a thief is able to steal your credit card number and expiration date but doesn't have your CVV, they can't buy anything from merchants that require purchasers to provide a CVV.

How Your CVV Protects You From Identity Theft

CVVs add another layer of identity theft protection and can help prevent unauthorized transactions. While many major retailers store your credit card account number in their databases, your CVV or CID is not allowed to be stored after the card is authorized due to credit card compliance standards.

This means even if identity thieves hack into a merchant's system and steal your credit card number, or somehow otherwise access your credit card number, they may not be able to use your card information if they don't have the code when attempting an online or phone purchase.

Keep in mind that businesses are not currently required to request a CVV or CID code, and not all do. Moreover, some retailers will ask for it the first time you make a purchase to verify your identity, but then do not require it on subsequent purchases if you are logged in on their website as a customer.

It is also possible for identity thieves to use malicious software known as malware to steal your CVV or CID codes from retailers, or thieves could potentially obtain one from you in a phishing attempt if you're not careful. Plus, if someone steals your physical card, they will have access to it. Some financial institutions are experimenting with dynamic CVVs, or CVVs that change periodically, to make it even harder for thieves to make fraudulent purchases.

The Bottom Line

All credit cards have CVVs on them as a measure to help ward off fraudulent purchases made online or by phone. And while a CVV or CID code is harder to access than your card number, it doesn't guarantee protection. They certainly help, but they aren't foolproof, so it's still important to take steps to protect yourself. It's wise to use identity theft monitoring so you'll know right away if there's any unauthorized access to your accounts.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Emily Starbuck Gerson is a freelance writer who specializes in personal finance, small business, LGBTQ and travel topics. She’s been a journalist for over a decade and has worked as a staff writer at CreditCards.com and NerdWallet. Emily’s work has appeared in CNBC, MarketWatch, Business Insider, USA Today, The Christian Science Monitor and the Chicago Tribute, among other websites and publications.

Read more from Emily Starbuck