What Is a Fraud Alert?

Quick Answer

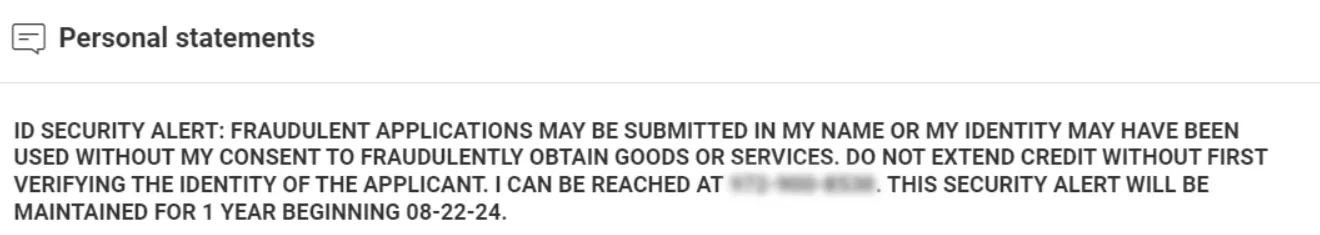

A fraud alert is a security message that appears under your personal statements in your credit report. It informs potential creditors that your sensitive information may be compromised, and instructs them to take additional steps to verify your identity before they extend credit in your name.

A fraud alert informs creditors that you might be the victim of identity theft and instructs them to verify your identity or contact you before extending credit in your name. You have the right to add a fraud alert to your credit reports for free. And once you add an alert to one of your credit reports with the three national credit bureaus (Experian, TransUnion or Equifax), that bureau must notify the other two bureaus, which will then add fraud alerts to their credit reports as well.

What Does a Fraud Alert Do?

A fraud alert can be added to your credit reports to help protect you from some types of credit fraud. The alert tells creditors that you have been or might be the victim of identity theft, or that you're an active-duty service member.

If you apply for a new credit account, request an additional or replacement card for an existing account or request a credit limit increase, the creditor is instructed to take reasonable steps to verify your identity or contact you and confirm that you're actually the person who made the request. For example, if the creditor has your phone number, a representative may call you to verify your identity.

The creditor may deny your application or request if it can't verify your identity or contact you, which can help protect you if someone else tries to get credit in your name.

Types of Fraud Alerts

There are three types of fraud alerts. Deciding which one to place on your credit report depends on your individual situation.

| Initial Fraud Alert | Extended Fraud Alert | Active-Duty Alert | |

|---|---|---|---|

| How long it lasts | 1 year | 7 years | 1 year |

| Who can use it | Anyone | Victims of fraud or identity theft | Active-duty service members |

| Instructs creditors to | Verify your identity | Contact you by phone or in person | Verify your identity |

| Other impacts | Removed from prescreened credit and insurance offers for six months | Removed from prescreened credit and insurance offers for five years | Removed from prescreened credit and insurance offers for two years |

The eligibility requirements, creditor obligations, expiration dates and protective measures differ with the three types of alerts:

- Initial fraud alert: Initial fraud alerts expire after a year. Everyone has the right to add these to their credit reports, and they ask creditors to have a reasonable belief that they know the identity of the person making a request.

- Extended fraud alert: These are available if you've been a victim of credit fraud or identity theft. You may need a police report or FTC identity theft report to add an extended fraud alert to your credit file, but it will last seven years. The extended fraud alert instructs creditors to contact you by phone or in person before issuing credit in your name.

- Active-duty alert: Only available to active-duty service members, these alerts expire after a year and ask creditors to have a reasonable belief that they know the identity of the person making a request.

You can also renew initial, active-duty and extended fraud alerts up to three months before they expire. But for active-duty and extended fraud alerts, you may need to resubmit verification documents proving that you qualify for the alert.

Even if you don't add a fraud alert to your credit report, you can opt out of receiving prescreened offers for credit and insurance on OptOutPrescreen.com. But some people prefer receiving these offers as they might get offers that aren't available to the general public.

Learn more: What You Can Do to Avoid Identity and Credit Fraud

Fraud Alert vs. Credit Freeze

You also have the right to place a security freeze, also called a credit freeze, to limit access to your credit report. It can help stop credit fraud because creditors that want to check your credit as part of an application review process won't be allowed access to your credit report.

Unlike the various types of fraud alerts, you'll need to unfreeze, or thaw, your credit reports if you want to apply for credit with a freeze in place. Additionally, you'll need to freeze and unfreeze each of your credit reports individually.

Fraud alerts and credit freezes can both be helpful, but compare and understand what they do—and what they don't do—before adding them to your credit reports.

| Fraud Alerts | Credit Freezes | |

|---|---|---|

| Cost | Free | Free |

| What it does | Asks creditors to verify your identity or contact you before issuing credit | Limits access to your credit report, which may prevent creditors from issuing credit |

| What it doesn't do | Restrict access to your credit report or prevent fraud that doesn't require a credit check | Require creditors to contact you or prevent fraud that doesn't require a credit check |

| Request passed to the other two bureaus | Yes | No |

| Expires | After 1 or 7 years | Never |

| You can apply for credit without removing it | Yes | No |

| Impact on your credit score | None | None |

When Does It Make Sense to Get a Fraud Alert?

In general, it makes sense to place a fraud alert if you believe you are or may become the victim of credit fraud or identity theft. More specifically, you might want to add a fraud alert to your credit after:

- Your information was compromised in a data breach

- Your wallet or documents with personal information were lost or stolen

- You suspect someone is using your identity

- You're an active-duty service member

- You reported identity theft or credit fraud to the police or FTC

Considering recent data breaches have exposed potentially billions of Social Security numbers, it may be safe to assume that fraudsters and scammers may have access to your personal information.

You can also place a fraud alert and freeze your credit if you want extra protection. And although managing freezes can be more work, they might provide more protection than a fraud alert.

Learn more: Here's What You Should Do After a Data Breach

How to Place a Fraud Alert

Requesting a fraud alert is always free. For all three types of alerts, you only need to submit the request to one of the three major credit bureaus—Experian, TransUnion or Equifax—and it will forward your request on to the other two.

You can use Experian's Fraud Alert Center to add an initial or active-duty alert to your credit report online (you may need to upload documents to verify your information). For extended fraud alerts, you'll need to mail a form and upload or include copies of the requested documents, including a copy of your identity theft report from a law enforcement agency.

Here's an example of what a fraud alert looks like:

How to Remove a Fraud Alert

Fraud alerts will automatically be removed from your credit reports after one year or seven years, depending on the type of alert, unless you renew them. You can also remove a fraud alert earlier by contacting the credit bureaus.

Unlike when you place the fraud alert, you'll need to contact each bureau separately to remove an alert before it expires. You can reach Experian using Experian's Fraud Alert Center or by mailing the request form and copies of the required documents to Experian.

Does a Fraud Alert Affect Your Credit?

Fraud alerts (and credit freezes) don't have any effect on your credit scores. However, adding fraud alerts to your credit reports could lead to a delay when you apply for a new credit card or loan because you'll need to wait for the creditor to verify your identity or contact you. While a fraud alert doesn't affect your credit, if you're a victim of identity theft there can be an impact to your credit.

Monitor Your Credit and Identity

Although fraud alerts can help protect you from credit fraud, you may still want to monitor your credit reports for unusual activity. With an Experian account, you can check your Experian credit report at any time, and you'll get free credit monitoring with real-time alerts.

Experian also offers paid premium memberships that monitor other databases for signs of identity theft or fraud that aren't related to your credit, such as when someone takes over one of your financial accounts. Paid members also get access to fraud resolution support and up to $1 million in identity theft insurance.

Have you been a victim of identity theft?

Add another layer of protection to your credit by notifying lenders to take extra steps to verify your identity before processing new credit.

Add a fraud alertAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis