What Is a Line of Credit?

Quick Answer

A personal line of credit lets you borrow against a set credit limit much like a credit card. But unlike a credit card, it has a finite lifespan consisting of two phases: a draw period and a repayment period.

A personal line of credit (LOC) lets you borrow money as you need it, up to a preset borrowing limit. It has a fixed lifespan that's divided into two phases: the draw period and the repayment period. During the draw period, a LOC functions much like a credit card; in the repayment period, it acts more like an installment loan.

Here's what to know about the different types of credit lines, how they compare to other financing options and how to decide if they're a good choice for you.

What Is a Line of Credit?

A LOC is a form of revolving credit, with a set credit limit that you may borrow against. It's called "revolving" because, during the draw period, you can borrow any amount up to the account's limit, repay what you owe and borrow again as many times as you wish.

Some lines of credit are secured—guaranteed by collateral such as your home, car or, commonly among personal LOCs, a certificate of deposit (CD) you open at the financial institution issuing the loan. If you fail to repay what you borrow through the LOC, the lender can seize the collateral to cover your debt.

Many lines of credit are unsecured, with no collateral requirement. Because they are riskier for lenders than secured accounts, they may come with higher interest rates than secured accounts and may have steeper credit score requirements than secured accounts.

Learn more: Secured vs. Unsecured Loans: What You Need to Know

How Does a Line of Credit Work?

During the account's draw period, you can borrow any amount up to the account's credit limit and pay it back in payments of any size, as long as you meet a monthly minimum payment. Once your line of credit closes, you enter the repayment period. At this point, you will be required to pay the entire balance of your line of credit, plus interest.

The timelines on LOCs can differ by lender and type, but a typical draw period lasts about five years, while the repayment period can last seven years or more.

Interest rates on LOCs may be fixed or variable and apply to outstanding balances only, so you only pay interest on what you borrow. LOCs may also entail fees, including:

- Origination fees, which are typically added to your balance when you open the account

- Maintenance fees, often charged annually while the account is open

- Transaction fees, applicable each time you use the account

- Penalty charges, typically imposed if you make a late payment or exceed your borrowing limit

Example: Let's say you qualify for a personal line of credit with a borrowing limit of $12,000, a draw period of five years and a repayment period that's also five years. During the draw period, you borrow and repay funds as needed, and when the repayment period begins, your outstanding balance is $3,000. You must pay that balance in full, along with any interest that accrues in the meantime, before your five-year repayment period ends.

You'll still have monthly minimum payments to make, but you can pay off the balance as quickly or as slowly as you like as long as the loan is paid in full by the end of the repayment period. The sooner you pay it all off, of course, the less you'll pay in interest.

Line of Credit vs. Credit Card

A line of credit operates similarly to how a credit card works, but they have some key differences:

- No card for purchases: LOCs typically do not include a card you can use to make purchases. Instead, you access the line of credit by requesting a funds transfer into a designated bank account, or by using a dedicated checkbook that draws from the LOC's available credit.

- Finite account timeline: A credit card account can stay open indefinitely as long as you keep it in good standing. However, a line of credit's draw period is finite. When the draw period ends and the repayment period starts, you can no longer borrow against the account, and any remaining balance must be repaid in equal monthly installments.

Types of Lines of Credit

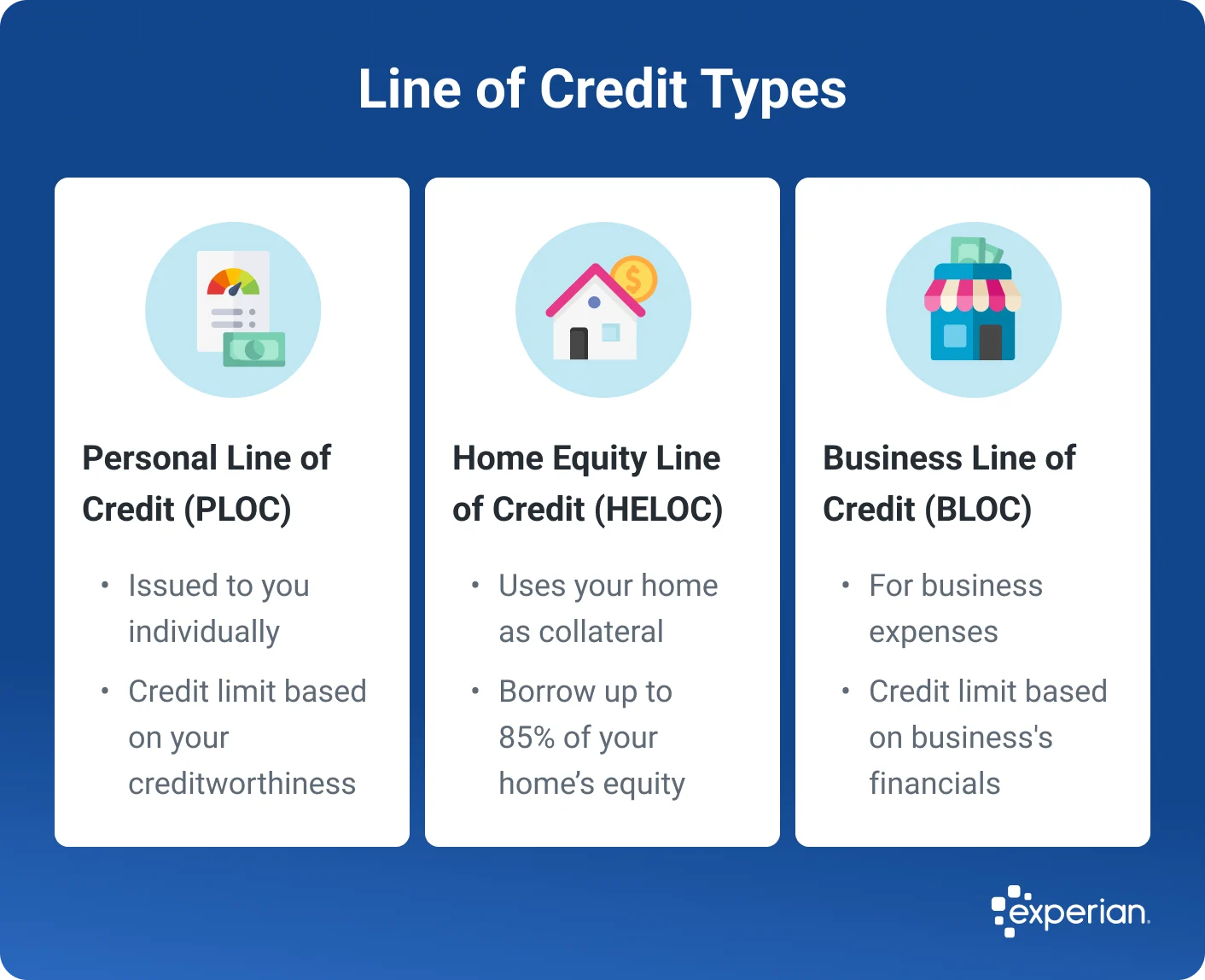

There are three main types of lines of credit:

1. Personal Line of Credit (PLOC)

A personal line of credit is issued to you individually, based on your credit scores and, potentially, on your willingness to invest in a CD or use an existing one as collateral.

2. Home Equity Line of Credit (HELOC)

A home equity line of credit is a secured LOC that uses your home as collateral. More specifically, it uses equity in your home—the portion of the property you own outright—to secure the loan.

You can typically borrow up to 80% of your home equity with a HELOC, but if you fail to repay the loan, the lender can seize your house or attach a lien to it that must be paid upon sale of the property.

3. Business Line of Credit

Business lines of credit are issued to commercial entities for use in managing business expenses. They are commonly available to businesses from the financial institutions where they keep their payrolls, accounts receivable or business checking accounts.

The credit limit, interest rate and fees on the account may depend in part on company financials or the amounts deposited in other company-held accounts.

What Can a Personal Line of Credit Be Used For?

A PLOC can be used for just about any purpose you choose, but common practical applications include:

- Emergency expenses: If you need an infusion of more cash than you typically have on hand in your emergency fund—the car needs major repairs or your furnace needs replacement, for example—a PLOC could fill the gap.

- Debt consolidation: If you qualify for a PLOC with a comparatively low interest rate, you could use it to pay down credit card balances or other debts with higher interest charges, ultimately saving money on interest charges in the long run.

- Home improvements: If your home needs urgent repairs, or you need cash for a remodel or refurbishment, a PLOC could furnish funds to make it happen.

Learn more: Good Debt vs. Bad Debt: What's the Difference?

Pros and Cons of a Personal Line of Credit

Before you consider applying for a personal line of credit, take a look at some of its potential benefits and drawbacks.

Pros

-

Immediate access to funds: If you have a PLOC at your disposal, you can borrow cash when you need it, virtually instantly by transferring funds through a web portal or phone app.

-

Pay interest only on funds you use: You're only charged interest on money you borrow, so your interest charges could be minimal depending on how you use the line of credit.

Cons

-

Steep credit requirements: Many lenders require good to exceptional credit for unsecured LOCs, and they may also limit eligibility if your debt-to-income (DTI) ratio—the percentage of your gross income that goes toward monthly debt payments—exceeds a limit they set.

-

Variable interest: Most PLOCs have variable interest rates, which rise and fall based on market conditions. This can mean dramatic swings in the interest you owe, making it difficult to budget.

-

Potential fees: Some PLOCs charge regular maintenance fees or transaction fees each time you borrow against your account.

Line of Credit vs. Personal Loan vs. Credit Card

The most popular forms of unsecured loans are lines of credit, personal loans and credit cards. Here's a look at their similarities and differences.

| Line of Credit | Credit Card | Personal Loan | |

|---|---|---|---|

| Funds distribution | Revolving line | Revolving line | Lump sum |

| Payment type | Variable, monthly | Variable, monthly | Fixed, monthly |

| Account duration | Depends on type of credit line | Open-ended | Two to five years |

| Secured or unsecured | Both options available | Both options available | Unsecured |

| Interest charges | Interest is charged only on outstanding balance | Interest is charged only on outstanding balance | Interest charges are spread out across all payments |

| Loan amount | $500 to $50,000 (unsecured); up to 85% of home equity (HELOC) | Up to $500,000, but $10,000 or less is more typical | Up to $100,000 |

| APR range | 11% to 22% | 14% to 30% | 7% to 35.99% |

Here are the main ways these forms of credit differ from one another:

- Lump sum versus credit line: When you take out a personal loan, you receive the full amount you borrow as a lump sum. With a credit card or LOC, you can borrow as much as your credit line or borrowing limit.

- Payment amounts: A personal loan requires you to make a payment in the same amount every month. With a credit line or credit card, you can pay what you owe in sums of any amount, as long as you meet a minimum payment on any month when you're carrying an account balance.

- Cost: It typically costs less to use a line of credit than it does a credit card. Unsecured personal loans, on the other hand, may offer even lower rates.

- Getting cash: It's much easier (and less expensive) to get cash from a personal LOC or personal loan than from a credit card. With a personal loan, you receive a lump-sum cash payment, and with a personal credit line, you typically get a checkbook and the ability to transfer borrowed funds into your checking account. In contrast, a cash advance from a credit card is much more expensive. Interest rates on cash advances are typically higher than those on regular purchases, and additional fees often apply to cash advances.

- Length of term: A credit card account is open-ended, and you typically can keep one open indefinitely by using the card regularly and keeping up with your payments. Personal loans and LOCs, by contrast, have limited lifespans.

How to Get a Line of Credit

If you decide a line of credit is right for you, here are steps you can follow to go about getting one.

1. Check Your Credit

Lenders usually require good credit to qualify for a line of credit. You can check your credit report for free from Experian to see where you stand and if you need to take action to improve your credit. You should also review your credit reports to check for inaccuracies.

AnnualCreditReport.com offers free credit reports from all three credit bureaus. If you find any inaccuracies, you have the right to dispute them to correct the record. Doing so could improve your credit scores if inaccurate information that's decreasing your credit score is removed.

2. Compare Lenders

Consider banks, credit unions and online lenders and look for opportunities to prequalify, which provides an estimate of credit terms based on a soft inquiry that doesn't impact your credit scores. Compare offers based on:

- Credit limit

- Length of draw and repayment periods

- Interest rate

- Fees, including origination or application fees, transaction fees and annual maintenance fees

Learn more: What Is Prequalification?

3. Gather Required Documents

You may need to provide copies of:

- A government-issued photo ID

- Proof of income

- Proof of address

- Employer contact information

- Bank account information

4. Apply

Depending on the lender, you may be able to submit an application online, in person or over the phone. Your application will typically trigger a hard credit check, which can cause a small, temporary dip in your credit score.

If your application is declined because of your credit score, the lender must provide you with a letter explaining the decision.

5. Review the Offer Carefully

If your application is accepted, review the credit offer carefully. Note that the terms may differ from those provided when you prequalified; if they are not to your liking, you can decline the offer.

6. Accept the Offer

If the credit terms are agreeable to you, sign the credit agreement to activate the line of credit. Once you receive confirmation that the account is active, you can borrow against your credit limit right away.

How a Personal Line of Credit Can Impact Your Credit Score

Good management of a LOC can help your credit scores, but missteps can do them harm, for the following reasons.

- Payments and their consequences: Making on-time payments when you have a balance on the account will tend to benefit your credit scores, but failure to make a minimum payment could hurt your scores significantly. That's because payment history is the most important factor contributing to your credit scores.

- Utilization impact: If you use more than about 30% of the borrowing limit on a LOC, your credit scores can be expected to drop, and greater score declines can be expected as your balance approaches your borrowing limit. How much you owe on your accounts is responsible for about 30% of your FICO® ScoreΘ—and credit utilization factors heavily in that calculation.

- Hard inquiry: As mentioned above, when you apply for a LOC, the lender typically performs a credit check that results in a hard inquiry on your credit report. A hard inquiry can cause a short-term drop in your credit score, which typically recovers in a few months as long as you keep up with your bills.

- Add variety to your accounts: Opening a LOC could help your credit scores if it increases the credit mix, or variety of types of accounts that appear on your credit report. A good blend of installment debt and revolving credit benefits your scores by demonstrating the ability to manage multiple accounts responsibly.

The Bottom Line

Before you seek a line of credit or any other form of personal credit, checking your credit report and FICO® Score for free from Experian can give you an idea how well-received your application is likely to be.

If your credit score isn't where you'd like it to be, consider waiting a bit and working to improve your credit score before applying for a line of credit to give yourself the best chances of approval.

Need a personal loan?

Whether you're looking to eliminate debt or access cash fast, compare personal loan offers matched to your credit profile.

Start now for freeAbout the author

Jim Akin is freelance writer based in Connecticut. With experience as both a journalist and a marketing professional, his most recent focus has been in the area of consumer finance and credit scoring.

Read more from Jim