What Is a Partially Secured Credit Card?

If you're considering getting a new credit card and researching your options, chances are you're mostly seeing unsecured cards. Unsecured credit cards are the most common type of credit card, and they require no collateral—instead, the lender approves applicants based on their creditworthiness.

Consumers with limited or bad credit histories may struggle to qualify for unsecured cards. As an alternative, some lenders offer secured credit cards, which reduce their risk by requiring a refundable deposit to secure the line of credit. In many cases, the credit line is equal to the deposit, so it tends to be low and doesn't offer much borrowing power. Where these cards shine is serving as a solid tool for establishing or rebuilding credit.

There's also a less commonly known hybrid option: a partially secured credit card. A partially secured credit card still requires a deposit, but it provides a higher credit line—some of it unsecured—that gives cardholders more borrowing power.

How Does a Partially Secured Credit Card Work?

When you take out a secured credit card, your security deposit usually equals your credit limit. If you default on the card, the issuer will use your deposit to cover the losses.

After consistently using your secured card responsibly, some issuers may "graduate" you to a partially secured card. They do this by raising your credit limit without requiring more collateral, so that some of your credit line becomes unsecured. Other issuers will take you straight from a secured card to an unsecured card after you establish a solid track record, usually after a year.

While it's less common, it's possible to start with a partially secured card. For example, some credit card issuers may review your credit and could make the determination that you qualify to make a refundable security deposit that is lower than your credit line. Credit line increases could also be available once you have made on time payments for six months in some cases.

How to Build Your Credit Using a Credit Card

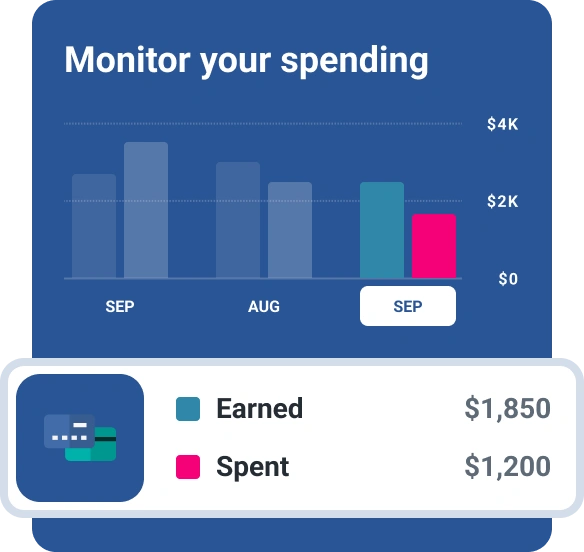

Whether you qualify for a secured, unsecured or partially secured credit card, these humble pieces of plastic are some of the best tools at your disposal for building credit. Try these tactics to use a credit card to build solid credit history:

- Pay every bill on time. Late or missed payments have the biggest negative effect on your credit, so prioritize making every payment by the due date. If due dates tend to slip your mind, set up autopay or add calendar reminders to keep you on schedule.

- Keep your balance low. Another major factor in your credit score is your credit utilization ratio, or how much of your card's balance you use at any given time. If you use more than 30% of your available credit, your score could suffer. Try to avoid carrying a balance—or at least aim to keep it as low as possible—to build strong credit.

- Keep accounts open. Your credit score also considers longevity of accounts in good standing. If you open a credit card and use it responsibly, keeping that account open for years increases the average age of the accounts on your credit report. Secured and partially secured cards are usually used temporarily, but if your issuer then converts you to an unsecured card, it's wise to stick with it if the terms are favorable, even if you don't use it often.

Alternatives to Building Credit With Partially Secured Cards

Partially secured credit cards aren't the only tools at your disposal. Here are some other ways to build credit:

- Apply for a fully secured credit card. If your credit file is thin or you're working to rebuild damaged credit, a partially secured card may not be an option just yet. You may need to start with a fully secured credit card. Be sure any cards you're considering report payments to at least one of the three credit bureaus (Experian, TransUnion and Equifax) so the card can help you build credit. Once you've shown consistently positive habits, you can eventually move up a partially secured or even unsecured card.

- Get added as an authorized user. If you have a close relative or friend who has excellent credit, you can ask to be added as an authorized user on their credit card. You'll receive your own credit card linked to their account; the primary account holder can view your activity and is responsible for payments. Not all issuers report authorized user accounts to the credit bureaus, but if yours does, being authorized on an account in good standing can help improve your credit. Conversely, bad behavior will reflect poorly on both of you, so only consider this arrangement if there's strong mutual trust.

- Consider a credit-builder loan. A credit builder loan is another vehicle you can use to establish a positive credit history—and it provides an opportunity to save money in the process. These loans are typically offered by credit unions or smaller banks, and there's no upfront deposit required. When you're approved, rather than the lender giving you a sum like with a traditional loan, they'll deposit your loan payments into a savings account. You repay the loan over set increments, and payments are reported to the credit bureaus to help you establish credit history. When the loan term ends, you'll receive the full amount back (sometimes plus interest). Make sure your lender reports your payment activity to all three credit bureaus.

Boost Your Credit

In the past, utility, phone and other monthly payments didn't contribute to your credit score, so on-time payments didn't do anything to help improve your credit. With the free Experian Boost®ø tool, you can now opt to have your utility, phone and streaming service payments counted toward your FICO® ScoreΘ powered by Experian. If you have a solid payment history, this can reward your credit score with an instant lift.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Emily Starbuck Gerson is a freelance writer who specializes in personal finance, small business, LGBTQ and travel topics. She’s been a journalist for over a decade and has worked as a staff writer at CreditCards.com and NerdWallet. Emily’s work has appeared in CNBC, MarketWatch, Business Insider, USA Today, The Christian Science Monitor and the Chicago Tribute, among other websites and publications.

Read more from Emily Starbuck