What Is a Bank Statement?

Quick Answer

Bank statements provide a detailed description of all activity on your account. Statements are typically sent out monthly by mail, or you can access your statements online or through your bank’s mobile app.

A bank statement is a formal document sent by your financial institution that shows details about your account during a specific span of time, known as a statement period. If you have a checking or savings account, you have likely been sent a bank statement. Here's a closer look at what bank statements are and how to read them.

What Is a Bank Statement?

A bank statement is a detailed record of your bank account activity during a specific period of time. Banks and credit unions are required to regularly send you a statement for each type of account you have, such as checking and savings accounts—even if the accounts are at the same bank.

Statements are typically sent monthly and show a full list of transactions for the statement period, including deposits, withdrawals and fees. Bank statements usually also show the account's starting and ending balance.

Banks statements are an important financial record and can be used to:

- Check for account errors and fraud. Review your bank statements regularly to double-check that all of the transactions look correct. Look for duplicate charges, signs of potential fraud, like unauthorized purchases, or any other errors.

- Reconcile your accounts. If you keep a separate ledger or track spending with an app, you can use your bank statement to reconcile your accounts. This process is commonly known as balancing your checkbook.

- Review your budget. Knowing what money you have coming in and going out each month can help you see trends in spending and keep your budget on track.

- Apply for credit. Bank statements may be requested to confirm your income or review spending habits when you apply for credit, such as a personal loan or mortgage.

- Prepare tax returns. Bank statements can help you confirm income and itemize expenses accurately when doing your taxes.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

What Does a Bank Statement Look Like?

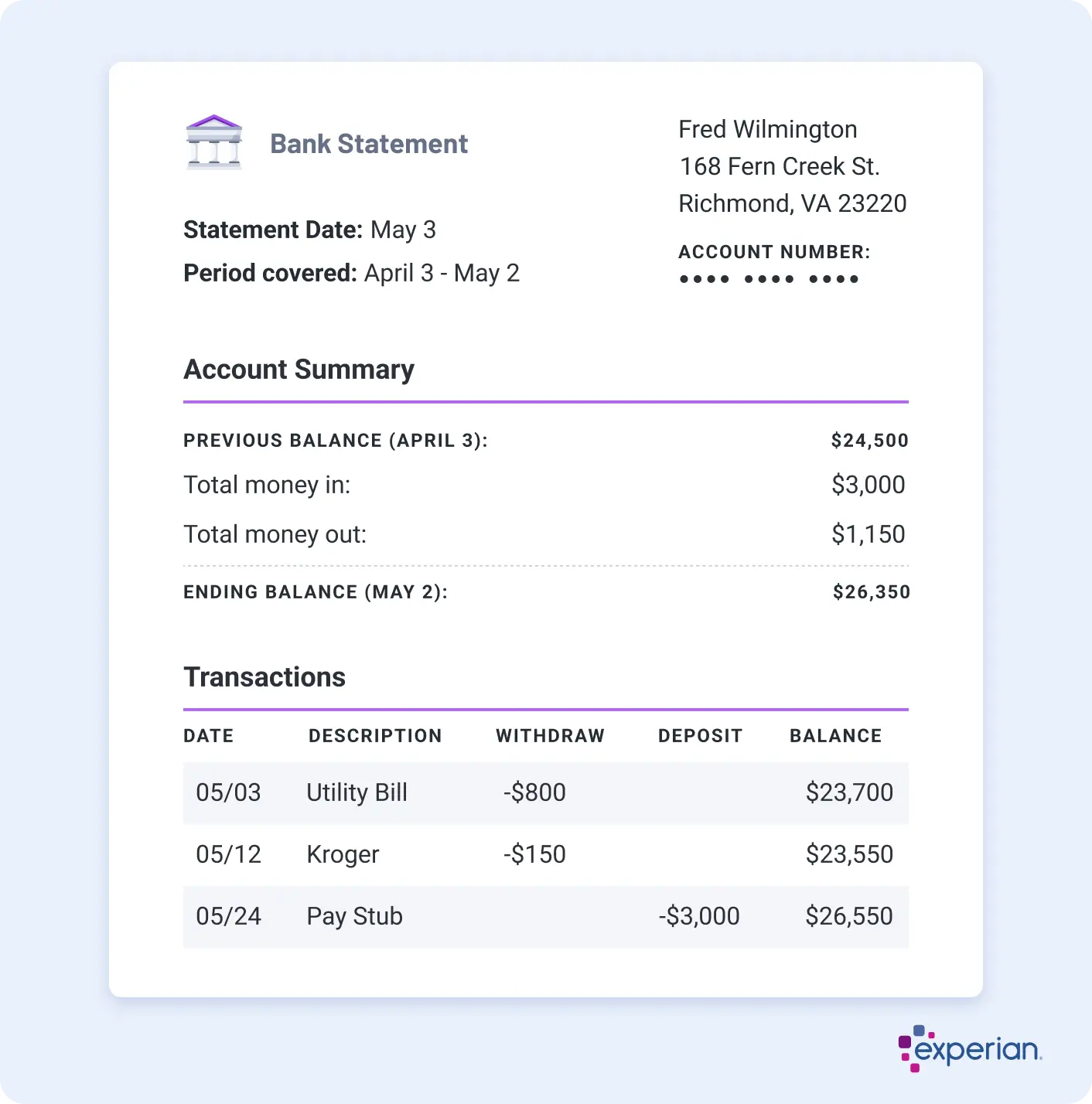

How a bank statement looks varies from bank to bank. But in general, you can expect a formal document on bank letterhead and the following types of information:

1. Personal Information

Bank statements include personal details such as your name, address and phone number. When you receive your statement, review this information carefully to make sure it's correct. Errors could mean signs of fraudulent activity, but not always.

If you've recently changed your address or switched phone numbers, let your bank know right away. Usually you can request an update to your personal information over the phone, at a local branch, online or on the bank's mobile app.

2. Account Information

Key details about your bank account, like the name of the financial institution and your account number, are included on all bank statements. Every time you receive a statement, double-check that this information is correct to make sure the statement is for the right account.

Contact your bank immediately if you receive a bank statement that's addressed to you but isn't for an account you own. Mistakes happen, but it could also be a sign of fraud, such as an account being opened in your name without your knowledge.

Learn more: Routing Number vs. Account Number: What's the Difference?

3. Statement Period

The exact date ranges of the statement period are clearly listed on every bank statement. For instance, if your statement period begins on the first of the month and runs for 30 days, your bank statement may be marked April 1 through April 30. Statement periods often vary by bank and type of account. So, you may see different ranges on your statements even if you have your checking account and savings account with the same bank.

4. Starting and Ending Balances

Bank statements include your account's beginning and ending balance for the statement period. You can use this information to see how much money went in and out of your account, look for spending trends and refine your budget. Some financial institutions also show your average daily account balance in the account.

5. Account Activity

All transactions made during the statement period are itemized on your bank statement in chronological order. Account activity typically includes deposits, cash withdrawals and debits. If your bank charges fees, like a monthly maintenance fee, this is also shown in account activity. And for interest-bearing accounts, such as high-yield savings accounts, any interest earned during the statement period is listed. Review your statement carefully to check for suspicious activity or charges you may have forgotten about, such as autopay subscriptions or memberships.

Reminder: Your account balance may include deposits and debits that are still pending. To see how much money is available to use now, log in to your bank account and look at your available balance. This can help you avoid overdraft fees, nonsufficient funds fees or returned payment fees.

Learn more: How Long Does It Take for a Check to Clear?

How Long to Keep Bank Statements

It's a good idea to keep recent bank statements handy for a few months if you plan to apply for credit or want to use the information for budget planning. Bank statements are also commonly used for tax preparation to confirm income and track deductible expenses. So, a good rule of thumb is to keep them accessible until your taxes are filed for the year. If you use your statements for tax purposes, the IRS generally recommends keeping them on file for seven years.

Tip: Bank statements available online or through your bank's mobile app may not be accessible indefinitely. It's good practice to download your statements when they arrive and keep them securely stored in case you need them down the line.

How to Get a Bank Statement

Banks and credit unions are required to send you a bank statement each statement period. Generally speaking, there are three ways to get a bank statement:

- By mail: If you've opted in to receive paper statements, your financial institution will send your bank statement to the address listed on your account. Keep your account address up to date to make sure you never miss a statement.

- Online: For paperless statements, most banks let you easily view and download your statement from their online banking website.

- Via mobile app: If your bank or credit union has a mobile app, you can likely check your statement right from your phone and download a copy for safekeeping.

Frequently Asked Questions

The Bottom Line

Bank statements are an important financial tool that help you keep close tabs on your bank accounts, monthly spending and personal financial information. They also are commonly used for tax returns and applying for credit, so it's a good idea to keep copies of your bank statements for at least a year.

Remember, if anything looks suspicious when you check your bank statement, let your bank know right away to help prevent fraudulent activity.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

Sarah Archambault is a personal finance writer and editor who enjoys helping others figure out how to make smart financial decisions. She’s an expert in credit education, auto finance, banking, personal loans, insurance and credit cards.

Read more from Sarah