What Is a Rebate on a Car?

Quick Answer

A car rebate is cash back that auto manufacturers offer toward the purchase of a new car. You can typically use a rebate as part of your down payment or to reduce the purchase price of the vehicle.

Perusing new car ads and auto dealers' websites, you're likely to see tempting promotions for rebates of $500, $1,000 or more on the purchase of a new car. A rebate on a car is a cash incentive you can use toward a down payment or to reduce the purchase price of a new vehicle. Taking advantage of these rebates can save you hundreds or even thousands of dollars on a new car. Here's how car rebates work, how to find them and how to evaluate them.

What Is a Rebate on a Car?

A rebate on a car is a cash incentive offered by the manufacturer to the buyer after the purchase of a new vehicle. Sometimes called bonus cash, customer cash, cash allowance or cash back, rebates can range from a few hundred to several thousand dollars. At the end of 2024, the average new car incentive was $3,958 (about 8% of the average transaction price), according to Cox Automotive.

Rebates typically apply to certain models or trims and are used to help move inventory. For example, when new models are released, dealerships often offer rebates on the previous year's vehicles to make space on the lot for the newer cars. It's also common to see rebates around holidays such as Presidents Day, Memorial Day, July Fourth, Labor Day, Black Friday and New Year's.

Tip: Car rebates are typically not available on used cars, as these special promotions mainly apply to new vehicles. However, there is an electric vehicle tax credit for used cars.

How Do Car Rebates Work?

You can typically either apply a car rebate to the purchase price to lower the total cost of the car or apply the rebate to your down payment if you're financing the vehicle. Either way, a rebate can reduce the amount you need to borrow, which can lower your monthly car payment and the total interest you'll pay.

To get the most value from a rebate, you should always negotiate the price of the car before applying the rebate. That way, you may be able to get a rebate on top of a lower sale price.

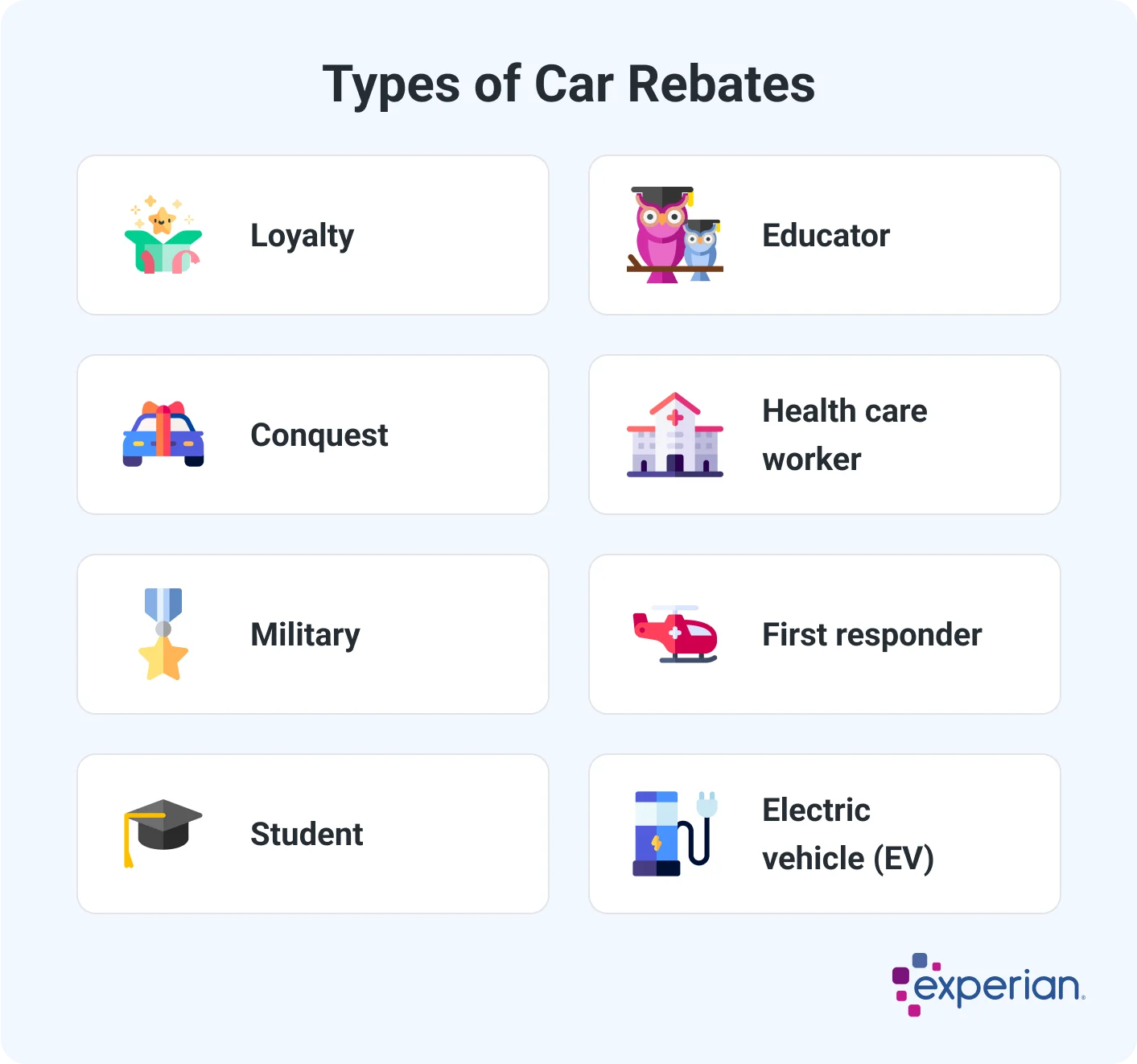

Types of Car Rebates

Some car rebates are available to anyone who buys a certain model and trim line of a new car and meets other dealer criteria. Other rebates are available only to certain customers. Here are some common rebates you may run across:

- Loyalty rebates reward loyal customers who currently or formerly owned or leased a vehicle from the same manufacturer.

- Conquest rebates are available for customers who currently or previously owned or leased a vehicle from one of the manufacturer's competitors.

- Student rebates are offered to current college or graduate students or recent graduates.

- Military rebates are generally available for active military service members, veterans and reservists.

- Educator rebates target instructors, professors and other professionals who work for schools, colleges and universities.

- First responder rebates are typically open to firefighters, police officers and paramedics, but can also extend to correctional officers, park rangers, animal control officers and more.

- Health care worker rebates (sometimes lumped in with first responder rebates) are designed for health care professionals ranging from nurses, doctors and dentists to pharmacists, dietitians and psychologists.

- Electric vehicle (EV) rebates aren't offered by automakers, but may be available from a wide range of other sources when you buy a qualifying alternative fuel vehicle. For example, the federal clean vehicle tax credit of up to $7,500 for qualifying buyers and vehicles can be transferred to the dealership when you buy a car, reducing the price of the vehicle. You may also qualify for EV rebates from your state or local government, utility providers and more, although these typically require filing your taxes to receive the rebate.

Tip: If you qualify for a rebate based on your occupation or military status, your spouse or other family members are sometimes eligible as well.

Where to Find Car Rebates

To find and learn more about car rebates, visit the websites of:

- Auto manufacturers

- Dealerships

- Car-buying marketplaces such as Edmunds, Cars.com or AutoNation

- Professional associations you belong to

- Membership organizations such as Costco or Sam's Club

Check rebate eligibility requirements carefully to see if you qualify and if the rebate is available for a vehicle you want. In some cases, you can maximize your savings by "stacking" rebates from different sources, such as a federal EV rebate on top of a manufacturer's rebate.

Car Rebates vs. Low-Interest Financing

Cash rebates are one tool automakers and dealerships use to boost sales; low-interest financing is another. If you have an excellent credit score, a low debt-to-income ratio and a steady income, you may qualify for low interest financing, which can save you a lot of money.

The average new car price is $48,039, according to Kelley Blue Book data from February 2025. Finance that vehicle at 0% annual percentage rate (APR) and you'd pay no interest. By comparison, the average new car loan APR is 6.35%, according to fourth-quarter 2024 data from Experian's State of the Automotive Finance Market report. Financing the same $48,039 car for five years at 6.35% APR would cost you $8,155 in total interest.

Low-interest financing has its benefits, but like car rebates, it typically involves some restrictions:

- Financing offers are typically limited to certain vehicle models and trims.

- In-house financing through the automaker's financing division is generally required.

- Some low-interest auto loans have short repayment terms, such as 36 months.

Both rebates and low-interest financing can help you keep more money in your pocket. However, you usually can't combine the two types of offers. The table below shows some key differences between rebates and low-interest financing to keep in mind when deciding which option is best for your situation.

| Rebates | Low-Interest Financing | |

|---|---|---|

| Eligibility | May be available to all buyers or limited to certain demographics | Typically requires excellent credit |

| Savings type | Immediately reduces down payment or vehicle price | Reduces cost of financing |

| Financing requirements | Financing can be handled through any lender | Usually requires in-house dealer financing; repayment timeline may be short |

| Best for | Buyers who prefer an upfront discount or don't have good credit | Buyers with excellent credit who want to reduce interest costs |

You can use a car payment calculator to see how different down payment amounts, vehicle prices and interest rates would affect your monthly car payment and the total interest you'll pay.

Car payment calculator

The Bottom Line

By reducing your new car's price or boosting your down payment, rebates on cars can deliver significant savings. Before visiting the dealership, though, check your credit report and FICO® ScoreΘ for free with Experian to see where you stand. Paying bills on time and bringing late accounts current can help improve your credit score if needed.

Once your score is where you want it, see if you can get preapproved for an auto loan. Having a favorable loan offer in hand can help you negotiate a better deal. Combining a low interest auto loan from a bank or credit union with a hefty rebate from the dealership can give you the best of both worlds, maximizing your savings on your new car.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Karen Axelton specializes in writing about business and entrepreneurship. She has created content for companies including American Express, Bank of America, MetLife, Amazon, Cox Media, Intel, Intuit, Microsoft and Xerox.

Read more from Karen