How to Unfreeze Your Credit Report at All 3 Credit Bureaus

Quick Answer

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

Freezing your credit reports can help safeguard you against identity theft, but if you're planning on applying for a loan or credit card or taking any other action that requires access to your credit reports, you'll need to unfreeze them.

To do so, you'll need to contact each of the three credit bureaus—Experian, TransUnion and Equifax—individually. Here's what you need to know to get started.

How to Unfreeze Your Credit

You have two options for unfreezing your credit files:

- Schedule a temporary thaw. This allows creditors to check your file for a set length of time and then restores the freeze when the scheduled window ends.

- Remove the freeze permanently. This leaves your files open until you request another credit freeze.

Here's a quick summary of the different methods offered by each of the three national credit reporting agencies:

| Online | Phone | ||

|---|---|---|---|

| Experian | Experian Freeze Center | 888-397-3742 | Experian Security Freeze P.O. Box 9554 Allen, TX 75013 |

| TransUnion | TransUnion Service Center | 800-916-8800 | TransUnion P.O. Box 160 Woodlyn, PA 19094 |

| Equifax | Equifax Consumer Services Center | 888-378-4329 | Equifax Information Services LLC P.O. Box 105788 Atlanta, GA 30348-5788 |

How to Unfreeze Your Experian Credit Report

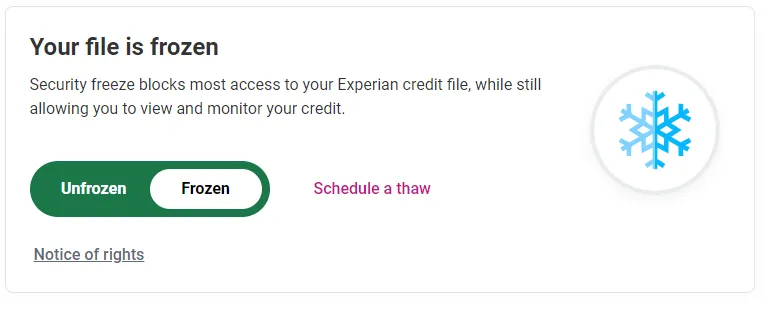

To unfreeze your Experian credit report, log in to your Experian account or create one for free—either through your desktop browser or the Experian mobile app.

After you log in, you can navigate to the Help Center at the bottom of the page; in the mobile app, tap on the three bars at the top right of your dashboard to see the option. In the Help Center, you'll find "Manage freeze" or simply "Security freeze" in the quick actions section.

Alternatively, you can also call 888-397-3742, or send a request by mail to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013, along with the appropriate documentation.

In particular, you'll need to include the following with your written request to verify your identity:

- Full name, Social Security number and date of birth

- Government-issued identification card, such as a driver's license

- Complete addresses for the past two years

- Copy of a utility bill or bank statement

How to Unfreeze Your TransUnion Credit Report

To unfreeze your TransUnion credit file, you can visit the TransUnion Service Center and either log in or create a TransUnion account.

You can also reach TransUnion by phone at 800-916-8800, or mail your request to TransUnion, P.O. Box 160, Woodlyn, PA 19094 with the appropriate documents.

How to Unfreeze Your Equifax Credit Report

To unfreeze your Equifax credit file, visit the Equifax Consumer Services Center and log in to or create a myEquifax account.

Alternatives include calling 888-378-4329 and verifying your identity to lift a freeze or sending the appropriate forms and documentation to Equifax Information Services LLC, P.O. Box 105788, Atlanta, GA 30348-5788.

How Long Does It Take to Unfreeze Your Credit Report?

Unfreezing your credit report can happen in real time or it can take several days, depending on which method you choose and the legal requirements. If you unfreeze your credit report online or over the phone, it's typically done in real time, though the Federal Trade Commission allows the credit bureaus to take up to an hour to complete the process.

Alternatively, if you decide to submit your request via mail, the security freeze will typically be removed within three days of receipt, and that's on top of the time it takes to deliver your letter.

Tip: In most cases, it's best to submit your request online or over the phone to avoid delays.

When Do You Need to Remove a Credit Freeze?

You need to remove a credit freeze when you plan to apply for credit in any form. Even if you're just shopping around to compare rates via prequalification tools, it's best to thaw your credit to be safe.

Tip: You don't have to worry about thawing your credit report when applying for an apartment lease, undergoing a background check for a new job or buying an insurance policy.

You can also continue to receive prescreened credit offers with frozen credit reports.

Frequently Asked Questions

Monitor Your Credit to Protect Yourself

Regardless of your reasons for unfreezing your credit report and how long it stays thawed, monitoring your credit report regularly can help you stay on top of your credit score and spot both opportunities to improve your credit and threats to your overall credit health.

With Experian's free credit monitoring service, you can access your FICO® ScoreΘ and Experian credit report anytime at no cost. You'll also get real-time alerts when changes are made to your credit report, making it easier to stop identity theft before it causes significant damage.

Freeze your credit file for free

A security freeze, often known as a credit freeze, limits access to your Experian credit report—helping protect you against identity theft.

Create a free accountAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben