Best debt consolidation loans of 2026

Tired of juggling multiple balances? A debt consolidation loan can combine your high-interest debts into one manageable monthly payment.

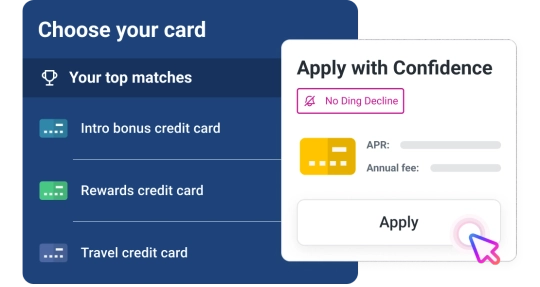

Checking your options won’t hurt your credit scores

Compare debt consolidation loans from our partners

As of March 2026, compare personal loans with interest rates as low as 6.7%. You could potentially save thousands of dollars in interest.

Best for all credit score types: Upstart

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Best for excellent credit: SoFi

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 8.74 - 35.49% |

|---|---|

| Term | 24 - 84 mo |

| Loan amount | $5,000 - $100,000 |

| Est. monthly payment | $228 - $3,237 |

Best for fast funding: LendingPoint

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Best for paying lenders directly: Upgrade

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.74 - 35.91% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,804 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.90 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $45 - $2,168 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.95 - 29.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $226 - $1,617 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 13.37 - 35.99% |

|---|---|

| Term | 12 mo |

| Loan amount | $1,000 - $15,000 |

| Est. monthly payment | $89 - $1,507 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $40,000 |

| Est. monthly payment | $226 - $1,445 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.99 - 29.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $15,000 - $50,000 |

| Est. monthly payment | $685 - $1,617 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 9.98 - 26.80% |

|---|---|

| Term | 24 - 72 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $231 - $1,403 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 11.69 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $33 - $1,806 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

How to find the best personal loan for you

Know your FICO® ScoreΘ

It plays a big role in the personal loans you’re likely to qualify for, and the rates and terms you might get.

Compare loan options

Determine how much you’ll need, then look for a low APR and monthly payment that fits your budget.

Look for extra benefits

Consider lender-specific perks, like getting a reduced interest rate if you set up autopay.

Get pre-qualified

Once you find a personal loan to apply for, pre-qualifying first can tell you if you’re likely to be approved.

No impact to your credit scores if you’re not approved

Experian’s No Ding Decline™⊛

When applying for a loan, most lenders will perform a hard inquiry on your credit report which can negatively impact your credit scores. With Experian’s No Ding Decline, only a soft inquiry is performed when applying for loans labeled No Ding Decline, so if you are declined there is no impact to your credit scores.

You could save up to $3,531* with a low, fixed-rate debt consolidation loan

| High-interest credit card | Debt consolidation loan | |

|---|---|---|

| Balance | $11,700 | $11,700 |

| Monthly payment | $334 for 60 months | $275 for 60 months |

| Average interest rate | 23.62% | 14.48% |

| Total paid with interest | $20,041 | $16,510 |

| *Estimated interest savings: $3,531 | ||

Personal loan calculator

Use this calculator to compare loan amounts, rates, and terms to estimate what you’ll pay for your loan.

Frequently asked questions

Explore more personal loans