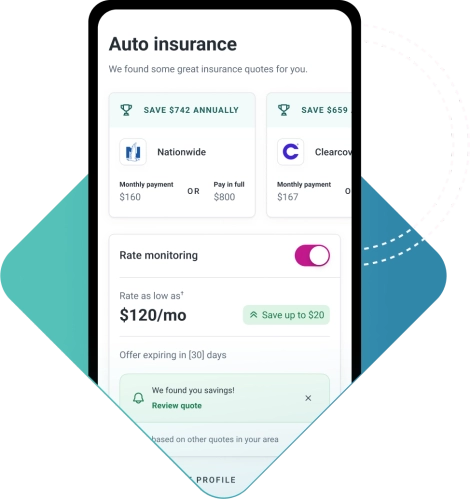

Compare car insurance quotes from trusted companies

You could save over $1,000β a year with our insurance marketplace. And we’ll continue to shop for better rates in the future–for free.

Rates are illustrative only. Your rates may vary.

English fluency is required for full access to Experian’s products and features.

Se requiere dominio del inglés para tener pleno acceso a los productos de Experian.

Find out if you’re overpaying

We shop and compare quotes for you from over 30 top insurers.

Get notified when rates drop

Know when it’s a good time to shop and save with rate monitoring.

Learn how to improve your rate

See the factors impacting your rate or ability to get quotes.

Compare rates from over 30 top insurers

Find your same coverage for less

You may be overpaying for insurance. We can help take the hassle out of shopping and find you a better deal.

Compare rates

We actively monitor rates in our network to make sure you’re always getting our best deal.

Save time

There’s no need to visit other sites or fill out multiple forms—we do it all in one place.

Have peace of mind

Rest easy knowing you have the right price. Plus, we’ll keep shopping for you so you find the coverage you need.

Get potential savings

Let us find you a lower rate—you may even be able to get a partial refund on your previous plan.

Types of auto insurance coverage

Liability

Liability insurance helps cover the other party’s property damage expenses, medical bills and lost wages if you’re found at fault in an accident. It may also cover legal fees if someone sues you. Most states require a certain amount of liability coverage by law.

Collision

Collision insurance covers the cost of repairing or replacing your vehicle if you collide with another vehicle, animal or object. While not legally required in any state, you may be required to buy collision coverage if you’re financing or leasing your car.

Comprehensive

Comprehensive insurance protects you from damage caused by anything outside of your control, such as theft, vandalism, fire or floods. You may be required to buy comprehensive insurance if you’re financing or leasing your car.

Uninsured motorist

Uninsured motorist (UM) protects you if you’re in an accident caused by an uninsured or underinsured driver. UM can cover property damage and medical expenses, and it may also kick in if you’re the victim of a hit-and-run accident.

Personal injury

Personal injury protection (PIP) covers medical bills and lost wages for you and your passengers if you’re involved in an accident. Some states require PIP coverage as part of your auto insurance policy, and it’s also available as an optional add-on.

Roadside assistance

Roadside assistance offers protection if you’re stranded on the road. It may include towing, gas delivery, flat tire replacement and battery jumpstarts. You can typically add roadside assistance to your insurance policy for an affordable rate.

What you need to get a car insurance quote

Vehicle information

You’ll need to provide the following details for the car you want to insure:

- Vehicle identification number (VIN)

- Year, make and model

- Body style

- Car’s mileage

- How much you typically drive

- A list of registered owners

- Whether your car is financed, leased or owned outright

Driver information

You’ll need to provide some basic personal details to get a car insurance quote:

- Full name

- Date of birth

- Marital status

- Home address and the address where the vehicle will be parked

- Driver’s license number

- Phone number and email address

- Driving history

Verified user reviews

4.8

Choose policies from over 30 top insurers

Car insurance by state

Compare auto insurance by state and see state averages, including top cities and providers.