Get a $3,000 personal loan today

Whether it’s for emergency expenses, home repairs or consolidating debt, we’ll help you find a $3,000 loan.

Checking your options won’t hurt your credit scores

Compare $3,000 personal loans from our partners

As of February 2026, compare $3,000 personal loans with APRs as low as 6.7% and one-day funding options available.

Best for small amounts: Upgrade

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.74 - 35.91% |

|---|---|

| Term | 36 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $2,288 |

Best for fast funding: LendingPoint

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Best for peer-to-peer lending: Prosper

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Best for all credit score types: Upstart

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.90 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $45 - $2,168 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 13.37 - 35.99% |

|---|---|

| Term | 12 - 60 mo |

| Loan amount | $1,000 - $15,000 |

| Est. monthly payment | $89 - $542 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 11.69 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $33 - $1,806 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

How to find the best personal loan for you

Know your FICO® ScoreΘ

It plays a big role in the personal loans you’re likely to qualify for, and the rates and terms you might get.

Compare loan options

Determine how much you’ll need, then look for a low APR and monthly payment that fits your budget.

Look for extra benefits

Consider lender-specific perks, like getting a reduced interest rate if you set up autopay.

Get pre-qualified

Once you find a personal loan to apply for, pre-qualifying first can tell you if you’re likely to be approved.

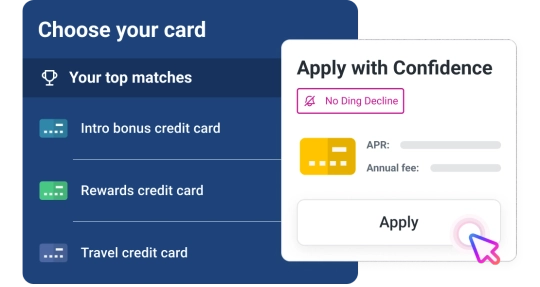

No impact to your credit scores if you’re not approved

Experian’s No Ding Decline™⊛

When applying for a loan, most lenders will perform a hard inquiry on your credit report which can negatively impact your credit scores. With Experian’s No Ding Decline, only a soft inquiry is performed when applying for loans labeled No Ding Decline, so if you are declined there is no impact to your credit scores.

You could save up to $453* with a low, fixed-rate $3,000 loan

| High-interest credit card | $3,000 loan | |

|---|---|---|

| Balance | $3,000 | $3,000 |

| Monthly payment | $164 for 24 months | $145 for 24 months |

| Average interest rate | 27.30% | 14.48% |

| Total paid with interest | $3,926 | $3,473 |

| *Estimated interest savings: $453 | ||

Personal loan calculator

Use this calculator to compare loan amounts, rates, and terms to estimate what you’ll pay for your loan.

Frequently asked questions

Explore more personal loans