Emergency loans

Get an emergency loan that can provide fast funds to help you handle unexpected expenses when you need it the most.

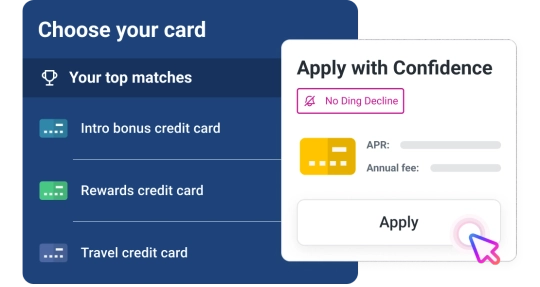

Checking your options won’t hurt your credit scores

Compare emergency personal loans from our partners

As of February 2026, compare personal loans with rates as low as 4.99% and get the one-day funding options available.

Best for fast funding: LendingPoint

Recommended FICO® ScoreΘ

Fair - Good

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 48 mo |

| Loan amount | $2,000 - $30,000 |

| Est. monthly payment | $90 - $1,187 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 8.74 - 35.49% |

|---|---|

| Term | 24 - 84 mo |

| Loan amount | $5,000 - $100,000 |

| Est. monthly payment | $228 - $3,237 |

Best for small amounts: Upgrade

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.45 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,731 |

Best for flexible term length: Avant

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 9.95 - 35.95% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $35,000 |

| Est. monthly payment | $92 - $1,264 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 6.70 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $31 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $62 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 4.99 - 32.39% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $1,000 - $60,000 |

| Est. monthly payment | $44 - $2,030 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 8.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $2,000 - $50,000 |

| Est. monthly payment | $91 - $1,806 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.70 - 24.50% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $225 - $1,453 |

Recommended FICO® ScoreΘ

Fair - Very Good

| Est. APR | 11.11% |

|---|---|

| Term | 12 - 60 mo |

| Loan amount | $1,000 - $15,000 |

| Est. monthly payment | $88 - $327 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 7.99 - 35.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $5,000 - $40,000 |

| Est. monthly payment | $226 - $1,445 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.99 - 26.99% |

|---|---|

| Term | 24 - 60 mo |

| Loan amount | $15,000 - $50,000 |

| Est. monthly payment | $672 - $1,526 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 6.39 - 24.99% |

|---|---|

| Term | 60 - 120 mo |

| Loan amount | $20,000 - $250,000 |

| Est. monthly payment | $390 - $5,686 |

Recommended FICO® ScoreΘ

Good - Exceptional

| Est. APR | 9.98 - 26.80% |

|---|---|

| Term | 24 - 72 mo |

| Loan amount | $5,000 - $50,000 |

| Est. monthly payment | $231 - $1,403 |

Recommended FICO® ScoreΘ

Poor - Good

| Est. APR | 9.99 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $35,000 |

| Est. monthly payment | $32 - $1,264 |

Recommended FICO® ScoreΘ

Fair - Exceptional

| Est. APR | 8.47 - 33.64% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,000 - $50,000 |

| Est. monthly payment | $32 - $1,731 |

Recommended FICO® ScoreΘ

Poor - Exceptional

| Est. APR | 18.00 - 35.99% |

|---|---|

| Term | 36 - 60 mo |

| Loan amount | $1,500 - $20,000 |

| Est. monthly payment | $54 - $723 |

How to find the best personal loan for you

Know your FICO® ScoreΘ

It plays a big role in the personal loans you’re likely to qualify for, and the rates and terms you might get.

Compare loan options

Determine how much you’ll need, then look for a low APR and monthly payment that fits your budget.

Look for extra benefits

Consider lender-specific perks, like getting a reduced interest rate if you set up autopay.

Get pre-qualified

Once you find a personal loan to apply for, pre-qualifying first can tell you if you’re likely to be approved.

No impact to your credit scores if you’re not approved

Experian’s No Ding Decline™⊛

When applying for a loan, most lenders will perform a hard inquiry on your credit report which can negatively impact your credit scores. With Experian’s No Ding Decline, only a soft inquiry is performed when applying for loans labeled No Ding Decline, so if you are declined there is no impact to your credit scores.

You could save up to $151* with a low, fixed-rate emergency loan

| High-interest credit card | Emergency loan | |

|---|---|---|

| Balance | $1,000 | $1,000 |

| Monthly payment | $55 for 24 months | $48 for 24 months |

| Average interest rate | 27.30% | 14.48% |

| Total paid with interest | $1,309 | $1,158 |

| *Estimated interest savings: $151 | ||

Personal loan calculator

Use this calculator to compare loan amounts, rates, and terms to estimate what you’ll pay for your loan.

Frequently asked questions

Explore more personal loans