Can Bad Timing Hurt Your Credit Application?

Even if you have good credit generally, timing can matter when you're applying for a loan or credit card. Your credit score naturally ebbs and flows, and life events—even positive ones like getting a new job—can affect your ability to get approved for credit.

Small changes to your creditworthiness may not sink your credit application—or save it. But putting your best case forward on an application is always wise. A higher credit score may earn you a lower interest rate or better terms, and a solid, verifiable income history can help you win approval. Before you submit a loan or credit card application, think about the following scenarios. If one or more apply to you, it might be best to hit the brakes, at least until you have time to address any issues.

You Haven't Checked Your Credit Score and Report

Maybe your credit file isn't hiding any surprises, but it's better to find out what's in there before you apply for a loan or credit. The first step is to get your free credit report and score, which you can do through Experian. You can get all three of your credit reports from the national credit bureaus (Experian, TransUnion and Equifax) for free from AnnualCreditReport.com.

If everything checks out with your credit report, you may be good to go. But if you find evidence of identity fraud, you'll want to address it. And if you discover late payments or other negative information you weren't aware of, investigate further. See information you believe is inaccurate? File a dispute with the credit bureau on whose report the information appears. Or consider putting time between negative events and your next credit application. While even a single 30-day late payment can impact your credit score, its effects diminish over time.

You Got a New Job

Even if you have a better salary to look forward to, you may want to wait a bit before you apply for a loan, open a new credit card account or ask for a credit limit increase. Your income is not part of your credit file, but it can factor in when you're applying for a loan or credit. Lenders may ask about your income and employment for reassurance that you'll be able to repay your debts. Getting at least a few paychecks under your belt ensures you can verify your income, if asked.

You Just Paid Off Your Credit Card

It sounds counter-intuitive, but if you just paid off a large credit card balance, you may want to wait before applying for new credit. Why? Paying off a credit card will almost certainly raise your credit score, but it will take time for your payment to post and for your card company to report your new zero balance to the credit bureaus. All told, it may take a month or more for your credit score and report to reflect your new information, so hang tight.

You Recently Opened a New Credit Card or Took Out a Loan

A new account can have both positive and negative effects on your credit. Hard credit inquiries made during the application process can have a minor and fleeting effect on your score. Adding a new credit card may increase your credit capacity and improve your credit utilization—and credit score—in time, though it may decrease your score slightly in the short term. All told, new loans and card accounts can cause minor turbulence in your credit file. As long as you use your new credit responsibly and pay your debts on time, these usually resolve in your favor over the course of a few months.

When You Should Apply Now, Not Later

Sometimes opportunity trumps timing. The house down the street you've always admired is on the market at an affordable price. Your computer broke and you want to use interest-free installments to pay for a new one. As long as you can qualify for the financing you need, timing need not be an issue.

Pre-emptively applying for credit sooner rather than later can also be a smart move. Say, for example, you're planning to change jobs after working in your current position for years. You may want to refinance your home now while your employment history shows stability. Are you planning to use your credit card to finance a large purchase? That can increase your credit utilization and possibly lower your credit score. If you're planning to finance a car around the same time, get the car loan first, before your credit takes a hit.

If you're setting priorities, consider applying for the biggest loans first—mortgage before car loan, car loan before credit card. Not only is a mortgage your biggest loan, but it spans many years. Saving even half a percent in interest over a 30-year mortgage can save you thousands or tens of thousands of dollars: It's worth prioritizing. Requirements are typically less onerous when you're applying for a credit card. And if your credit limit isn't quite what you hoped for, you can always apply for a credit line increase down the road.

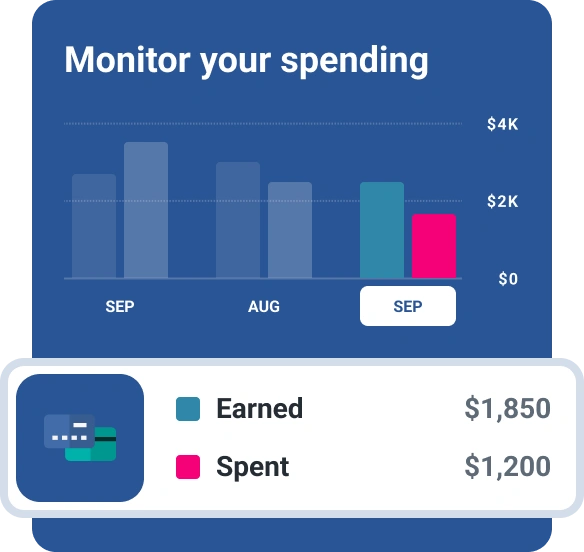

How to Time-Proof Your Credit

Knowing about these timing factors may help you optimize a loan or credit application and improve your chances of success. But you can also build in greater consistency—and better credit overall—by developing good credit habits and monitoring your credit on an ongoing basis. Free credit monitoring with Experian alerts you whenever changes to your credit file occur and offers tips on improving your credit score as you go, so timing issues are less likely to slow you down.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle