Can Store Credit Cards Build Credit?

Are you thinking about applying for a credit card with your favorite retailer? Store credit cards may help build your credit if you responsibly manage the account and the lender reports activity to the credit bureaus. However, there are limitations to keep in mind before you apply.

What Is a Store Credit Card?

A store credit card works like a traditional credit card—you can use the card to make purchases you pay off at a later date, potentially with interest. You may be offered a store credit card by a cashier at a checkout counter and be instantly approved right then and there.

When you use a store card with the retailer that provided it, you may receive discounts, increased credit card rewards, free shipping or other perks you wouldn't receive if using a different payment method.

There are two types of store credit cards:

- Closed-loop retail cards: These cards can typically only be used with the retailer. However, some can be used with other brands and partners of the retailer.

- Open-loop retail cards: These cards are co-branded by both the retailer and a major payment network, like American Express, Mastercard or Visa. You can use open-loop retail cards with the specific retailer or anywhere that accepts the payment network displayed on the front of your card.

You can expect to pay more in interest on a store credit card than a traditional credit card. However, it may be easier to be approved for a store credit card versus a traditional, unsecured credit card. Closed-loop credit cards tend to have lower requirements than open-loop cards and can help you build credit just the same.

Some retailers only offer closed-loop cards, while others provide both types of store credit cards. Inquire before you apply to determine if you can choose between the two. You're likely to get more use out of an open-loop card, but closed-loop cards can also be appealing if the perks are generous and you frequent the merchant providing it.

How Can Store Cards Help You Build Credit?

Your use of credit cards is listed on your credit reports and is factored into credit score calculations done by credit scoring companies. Store credit cards can help you build credit if you use them responsibly by making at least the minimum payment on time every month and keeping your balance low.

But for your use of the card to reflect positively in your credit report, it's critical to make sure the card issuer reports account activity to the three credit bureaus—Experian, TransUnion and Equifax. Why so? Some credit card issuers do not report payment history to credit bureaus, or may only report it to one or two. Your store credit card usage will only help you build credit if it's included in your credit reports.

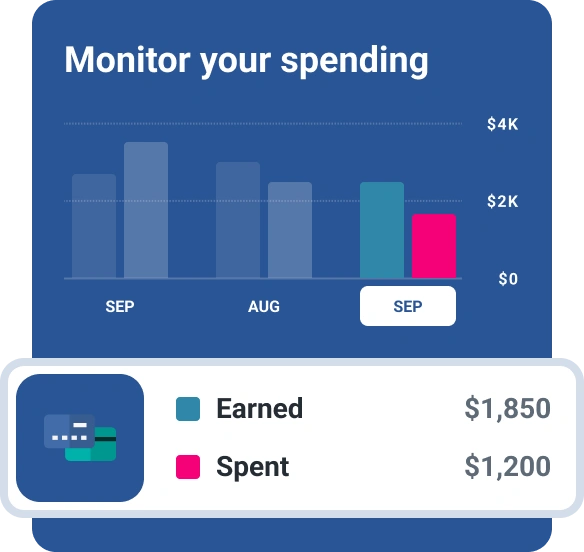

When building your credit, it's key to make sure the information in your credit reports reflects wise financial management. Payment history is the most critical factor in your credit score calculation, and consistent on-time payments may help improve your score. Credit utilization is another large part of the credit score calculation.

Your credit utilization ratio compares the amount of credit you're using with your credit limits. To illustrate, if your credit limit on your store card is $1,000 and you owe $500, your credit utilization ratio is 50%. If you were to pay your balance down to $100, your utilization drops to 10%, which could help your credit.

Credit utilization above 30% can drag down your scores, so keep your balances below that threshold if at all possible. As you think about this factor, make sure to consider all your cards together, as utilization is measured on a per-card and an overall basis.

If not used properly, store credit cards can hurt your credit. Late payments that remain outstanding for 30 days or more can be reported to the bureaus and potentially lead to a significant drop in your credit score. Making large purchases and letting the balance sit for several billing cycles increases your utilization ratio and can also damage your score.

Here are a few tips for managing your credit with a store credit card:

- Pay your bill on time. Set up autopay to pay at least the minimum each month. This helps you avoid missing payments, incurring late fees, being charged more in interest (or a penalty APR) or having the account reported to the credit bureaus as delinquent.

- Keep your credit utilization low. Avoid overspending on your store credit card. If you make a large purchase, try to pay down the balance before your statement period ends. Although financial experts recommend that you keep it below 30%, a utilization ratio of 10% or lower will help you get the best credit score.

- Look for help if you need it. If you're not able to make your payments, or you're stuck with a debt you can't pay down, look for other options. You may explore help from a professional who provides credit counseling services. These services are typically provided free of charge by nonprofit organizations. Alternatively, a debt consolidation loan can shift your credit card payments to a lower-interest loan you pay off in equal payments over time.

Is it a Good Idea to Get a Store Credit Card?

Not sure if a store credit card is worth it? A store clerk may have a flashy sales pitch for you, but it's important not to make any hasty decisions when it comes to your credit. Many offer enticing perks to attract customers, but it's also essential to understand the drawbacks before you apply.

Some key benefits of store credit cards to consider:

- Qualification criteria: It might be easier to get approved for a store credit card, especially if you have bad or limited credit.

- Cardholder benefits: Some store credit cards offer exclusive benefits to cardholders, like promotional financing offers and access to select products.

- Customer rewards: This perk allows you to earn points, cash back or loyalty rewards that can be used toward future purchases.

You may want to steer clear of store credit cards if there are traditional cards with better incentives that you can qualify for. Here's why:

- Higher interest rates: Store cards generally have a steeper interest rate than traditional credit cards. This can be an issue if you don't pay the balance in full each month. Also, be mindful of deferred-interest promotions—a 0% APR offer can be a great deal if you pay off the balance before the promotional period expires. Otherwise, interest may be retroactively applied when the offer ends, even if you've paid off a bulk of the balance.

- Minimal rewards: The rewards offered by some retailers may be far lower than what you can get with a traditional rewards credit card.

- Lower credit limits: Expect a lower credit limit with a store credit card. This can mean bad news for your credit utilization ratio and credit score if you carry a balance each month.

- Limited use: Closed-loop store credit cards can only be used with the retailer, so you will need to apply for another card to make other purchases. In this case, you may be better off applying for an open-loop credit card or avoiding cards from the retailer altogether.

Deciding if a store credit card is right for you is a personal decision. It depends on how you intend to use the card, if the cardholder benefits are worthwhile and whether you think you can afford to make payments.

A store credit card could be a good option if you frequently shop with the retailer and plan to take full advantage of the card's incentives. It may also help build credit if you use the card responsibly.

However, you may be better off skipping the store credit card if you qualify for a traditional credit card with a lower interest rate and better perks if you can qualify. You should also avoid store cards if you already carry high debt balances or could struggle to keep your spending under control and possibly carry a balance.

Other Ways to Build Credit

Beyond responsibly managing a store credit card, here are some other ways to build credit:

- Get a secured credit card. Secured credit cards are easier to qualify for, but issuers require a security deposit to activate the account. The money is usually held in a savings account and serves as collateral in case you fall behind on payments. If you're having trouble getting an unsecured credit card because of a limited credit history or low scores, a secured credit card may be a good option. Before applying, confirm that the card issuer reports account activity to the credit bureaus. After six months or more with the card, you may have improved your credit enough that you're able to get an unsecured credit card. Some card issuers may even convert a secured card to a traditional credit card after you demonstrate you can responsibly manage the account.

- Consider a credit-builder loan. You can also apply for a credit-builder loan from a bank or credit union to build credit. With a credit-builder loan, the lender puts the loan balance into an account and has you make monthly payments on it over time. When you pay off the loan, you'll get what you paid toward it. It's a way to build credit while saving money, and you may even make a little bit in interest. Check with the lender before applying to confirm payment activity is reported to all three major credit bureaus.

- Ask for a credit limit increase. Already have a credit card you manage well? Reach out to the card issuer and request a credit limit increase. An increased limit can help you keep your credit utilization lower, which could help your credit scores.

- Become an authorized user on someone else's credit card. Ask a parent, relative or friend with good credit history to add you as an authorized user on their credit card. The positive payment history will be added to your credit report and could improve your score. You can request to be removed from the account at any time, and you won't be held responsible for the balance.

- Add your utility, cellphone and other on-time payments to your credit reports. Experian Boost®ø, a free service from Experian, can add this positive payment history to your credit report, which can instantly help your score.

The Bottom Line

Store credit cards can help you build credit, and you will also have access to exclusive perks that are only available to cardholders. However, there are drawbacks you want to consider before you apply.

If you decide the card is a good fit, check your credit score first to know where you stand. It may be better to build your credit first to qualify for competitive terms if your score is low. You can view your FICO® ScoreΘ and credit report and credit report for free with Experian.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Allison Martin is a Certified Financial Education Instructor (CFEI), syndicated financial writer and author. Her work has been featured in The Wall Street Journal, ABC, MSN Money, Yahoo! Finance, Fox Business, Investopedia, The Simple Dollar and a host of other publications.

Read more from Allison