Credit Mistakes to Avoid When You Are Young

Good credit is always a plus, but it's especially helpful when you're starting your adult life. At that time—when you may need a new job, a car loan, car insurance, an apartment and maybe a credit card—having a positive credit history and a good credit score can open doors.

To arrive at this point in life with good credit, you may want to start establishing credit sooner than you expected. Using your young adult years, between 18 and 21, to build your credit history and score can be a smart move. But when you're young, it's also important to understand that credit is something to cultivate—and not necessarily to maximize right away. If you're thinking about venturing into the world of credit, beware of these common mistakes you'll want to avoid.

1. Waiting to Build and Establish Credit

No one comes into the world with good credit. In fact, until you begin using credit, you won't have a credit report or score. For most, establishing credit means starting small with a low line of credit that may require a security deposit. And if you think about it, that's not a bad place for a young person to start. You get a card to use for emergencies or to cover expenses without too much risk of running up a giant balance.

More importantly, you get the opportunity to learn how credit works—how to manage an account, make timely payments, mind your credit limit and avoid overspending. Play your cards right, and you'll graduate with solid credit to help launch you into independent adulthood.

Here are two ways to establish credit when you're young:

- Get added as an authorized user. One place to start is to be added to a parent's or loved one's credit card account as an authorized user. As an authorized user, you will benefit from the primary cardholder's payment history, get your own credit card and be allowed to make purchases on the card (as long as the primary cardholder agrees).

- Open your own credit card. A few student credit cards allow you to open an account with no security deposit. Alternatively, secured cards are common for those with little or no credit history. With a secured card, you provide a deposit upfront that is typically equal to your credit line: A $200 deposit typically secures a $200 credit limit, for example. If you were to default on your credit card balance, the card issuer would use this deposit to pay off your debt. After a period of successful card management, your card issuer may refund your deposit or raise your credit limit.

Credit cards are a great way to build credit—but they can also start you off on the wrong foot if you're not careful. That brings us to the next credit mistake you'll wait to avoid.

2. Using Credit Cards Irresponsibly

You can build a positive credit history and grow your credit score with a secured card or student card, but only if you maintain good credit habits. Before you open credit card accounts and begin using your cards, learn about the factors that go into building a good credit score: payment history, credit utilization, credit mix, length of credit history and new credit. Each of these has an upside and an equally consequential downside.

If you don't feel prepared to manage credit responsibly, you may want to wait. After a year or two, when you have some experience managing money on your own, you may feel better equipped to handle regular bills and a credit line. Here are a few things it takes to manage credit responsibly:

- Pay on time, every time. Payment history accounts for 35% of your credit score, and every payment counts. A single 30-day late payment stays on your credit report for seven years.

- Spend conservatively. Just because you have $1,000 in available credit doesn't mean you should use it. To start, use your card to make a small purchase every month or so and pay it off right away; you don't have to carry a balance to build credit. Always try to keep your balances to 30% or less of your credit limit to maintain good credit.

- Learn your card's terms. Not only do your purchases add to your revolving balance, but if you don't pay your balance in full every month, you'll incur interest charges. How much interest? Read your card's terms carefully. They spell out how much time you have to pay off a purchase before interest kicks in, as well as what your interest rate is and what you'll pay in late fees.

3. Losing Track of and Not Paying Bills

Late payments can be costly to your credit and otherwise. One payment made over 30 days late will ding your credit score, and accounts that end up in collections for nonpayment will damage your credit further. Even if you make a credit card payment before it's 30 days late (when it's reported to the credit bureaus), your card issuer may charge you a late fee and increase your interest rate as a penalty.

Best strategy: Don't forget. Put a recurring reminder on your calendar or set up alerts on your credit card account and in your bank's mobile bill pay system. If you're confident you'll have enough money in your checking account at all times to cover a payment, consider setting up automatic minimum payments to remove the risk of missing a due date.

If your mailing address, email or phone number changes, remember to alert your card issuer or loan provider if you have student loans or a car loan. You want to be sure they can contact you with bills and any other notices. Also update any accounts that use your card for payment, especially automatic payments. If your contact or card information has changed, or your card has expired, your payments may not go through—and unpaid bills can result in credit-damaging collections.

4. Not Checking Your Credit Regularly

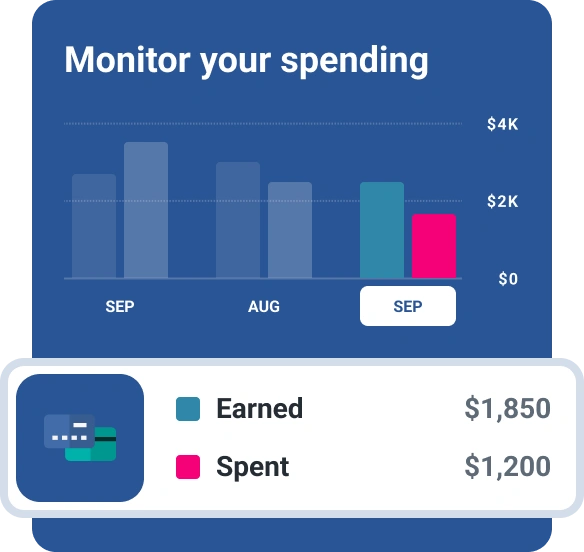

Checking your credit report and score regularly can do a few important things for you. If you're doing a good job of managing your credit, you'll see your progress on your credit report, and tracking your rising credit score can be motivating. Monitor your report regularly, and you'll also get an intuitive sense of how your actions affect your credit. Make a few large purchases on your credit card and your credit score may dip due to increased credit utilization. Pay off your balance, and your score may rise. A certain amount of fluctuation is common with credit scores, so the point isn't to prevent or stress out over these minor changes, but rather to develop an understanding of how they play out.

Finally, when you receive your credit score and report from Experian, you can see which factors are impacting your credit score along with suggestions on how to improve. You can receive a free copy of your credit report from all three credit reporting agencies at AnnualCreditReport.com or access your Experian FICO® ScoreΘ and credit report for free at any time. You can also use Experian's free credit monitoring to get alerts whenever there are changes to your credit report and score.

A Good Time to Build Credit

Establishing credit and learning to manage it skillfully while you're still young isn't mandatory, but if you begin your credit journey early in life, you'll have the opportunity to create an advantage for yourself. With a good credit score and a clean credit report, you'll have an easier time passing scrutiny from prospective employers, getting approved for a car loan or an apartment lease, refinancing student loans at good rates and maybe even venturing out into rewards credit cards. It takes some effort, but if you're willing and able, it's always a good time to build good credit.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Gayle Sato writes about financial services and personal financial wellness, with a special focus on how digital transformation is changing our relationship with money. As a business and health writer for more than two decades, she has covered the shift from traditional money management to a world of instant, invisible payments and on-the-fly mobile security apps.

Read more from Gayle