What You Need to Know About the FICO® Score 10

FICO periodically releases new credit scoring models, and its FICO 10 Score Suite has many of the latest versions. There are six scoring models in the FICO® ScoreΘ 10 Suite. Each considers slightly different information, and some are designed for specific types of lenders. But the underlying base FICO® Score 10 is the same for all of the models.

What Is FICO® Score 10?

FICO® Score 10 is FICO's latest generation of credit scores. Similar to how there were different types of FICO® Score 9 scores, there are several versions of the FICO® Score 10:

- FICO® Score 10

- FICO® Score 10T

- FICO Auto Score 10

- FICO Bankcard Score 10

- FICO® Score 10 BNPL

- FICO® Score 10 T BNPL

FICO designs the base score, the FICO® Score 10, to predict the likelihood that someone will fall behind on any type of loan obligation, such as a mortgage or credit card payment. It also offers industry-specific versions for auto lenders and card issuers.

The scores with "T" and "BNPL" in their names include trended data and buy now, pay later data, respectively. We'll discuss those differences, along with the general differences in all the FICO® Score 10 models compared to previous FICO® Scores, in the next section.

Learn more: Credit Score Basics: Everything You Need to Know

How Is FICO® Score 10 Different?

New versions of credit scoring models are often similar to prior versions. However, FICO makes minor adjustments to account for changing market forces, regulations, data availability and consumer behavior. The FICO® Score 10T and BNPL models have more meaningful differences as they consider data that previous models didn't.

Late Payments Could Hurt Scores More Under FICO® Score 10

Lenders generally report late payments to the credit bureaus once you have gone at least 30 days past the due date. Late payments on your credit reports can lead to lower credit scores for many years, regardless of the scoring model or generation of credit score.

Under the FICO® Score 10 Suite, late payments may have a greater impact on your scores. This means people who miss payments are likely to experience a more severe drop in their credit scores under FICO® Score 10 than under previous FICO scoring models.

Learn more: How Long Do Late Payments Stay on a Credit Report?

Personal Loans Might Lower Your FICO® Score 10

Personal loans, sometimes called signature loans, are unsecured installment loans that are commonly used for large expenses or to consolidate debt. Debt consolidation often involves using the money to pay off one or more credit cards that have higher interest rates than the loan.

Debt consolidation can be a smart financial move, since lowering the interest rate on your debt can help you save money and get out of debt sooner. Additionally, converting revolving credit card debt to an installment loan might help your credit scores.

However, if you use those newly paid off credit cards to make new purchases, your FICO® Score 10 might take a hit.

Credit Card Utilization Could Have a Bigger Impact on FICO® Score 10

Credit utilization rates can have a large impact on most types of credit scores, and that could be even more pronounced with a FICO® Score 10.

Your credit utilization is calculated by dividing your credit card balances by your credit limits, as they appear in your credit report. For example, if you have $5,000 of credit card debt and $10,000 of total available credit, then your utilization is 50%.

A lower credit utilization rate is better for all of your credit scores.

Learn more: What Is the Best Credit Utilization Ratio?

FICO® Score 10T Considers Trended Data

Most credit scoring models calculate your score by analyzing the information in one of your credit reports from Experian, TransUnion or Equifax. The analysis often focuses on the most recently reported data, but the FICO® Score 10T also looks for trends from at least the last 24 months of history.

For example, your credit utilization often varies from month to month, and most credit scores only consider your most recent utilization rate. But the FICO® Score 10T can additionally consider whether your credit utilization rate has been increasing or decreasing over time.

Learn more: What Is Trended Data in Credit Scores?

FICO® Score 10 BNPL Considers BNPL Data

Although buy now, pay later (BNPL) plans are popular among consumers, some BNPL providers don't report your account or payment to the credit bureaus. As a result, the information doesn't appear in your credit reports and can't affect your credit scores.

Even when BNPL providers do report data to the bureaus, many credit scoring models don't consider the plans when calculating your score. But the FICO® Score 10 BNPL and FICO® Score 10 T BNPL are the first two FICO® Score models that consider your BNPL plans when calculating your score, if the information is in your report.

If you have more than one BNPL plan, the scores will aggregate data from the plans before calculating your score. The FICO® Score 10 T BNPL version considers trends in your credit history, but it's unclear whether that includes trends in your BNPL usage.

Learn more: What You Need to Know About Buy Now, Pay Later at Experian

What Else You Need to Know About FICO® Score 10

Here are a few quick things you might want to know about the FICO® Score 10 suite of scores:

- The minimum scoring requirements are the same. If your credit report at any of the credit reporting agencies does not qualify for a FICO® Score, your credit report will not qualify for a score under FICO® Score 10 either. Credit reports must meet a variety of minimum data standards to be considered "scoreable," including having at least one open credit account for at least six months and at least one account reported to the credit bureaus within the last six months.

- The score ranges are the same as other FICO® Scores. The base FICO® Score 10, 10T, BNPL, and 10 T BNPL scores range from 300 to 850. The industry-specific auto and bankcard scores range from 250 to 900.

- Your score will likely vary from other FICO® Scores. In general, people with good scores have slightly higher FICO 10 Scores, and people with poor credit have slightly lower FICO 10 Scores.

- The FICO® Score 10T could affect mortgage applications soon. The mortgage lending market is undergoing a big shift as mortgage lenders move from using older FICO® Score versions to the VantageScore® 4.0 and FICO® Score 10T. There isn't an exact timeline for the FICO® Score 10T, but the scoring model might affect your mortgage purchase or refinance application soon.

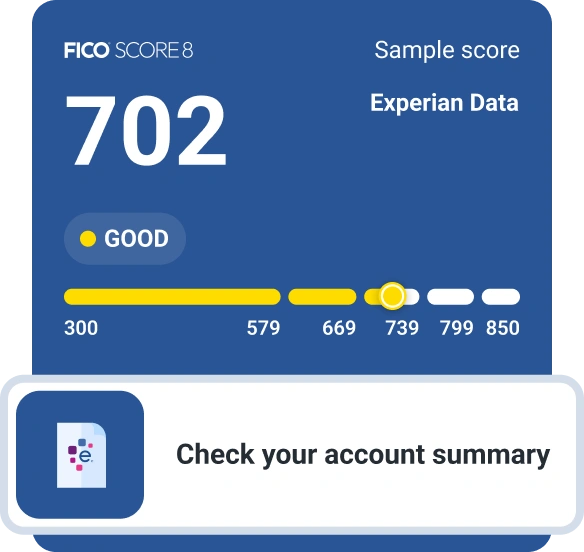

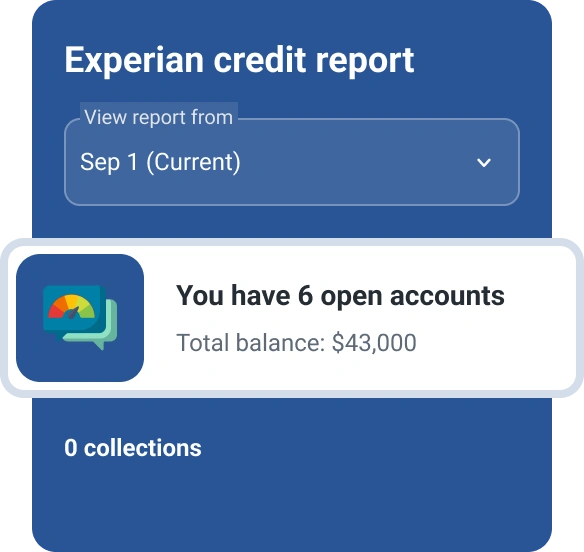

How to Check Your FICO® Score

There are many ways to check one or more of your FICO® Scores, but the options sometimes require a one-time fee or a monthly subscription. The scores you get will also depend on the service, and some companies only update your score weekly, monthly or quarterly.

If you want to check your FICO® Score for free, you can get your FICO® Score 8 from Experian with daily updates. Experian also shows you how recent credit report changes can impact your score and what factors are helping or hurting your score the most.

Learn more: What's the Difference Between a Credit Report and Credit Score?

The Bottom Line

FICO periodically releases new credit score models, and the FICO® Score 10 Suite is the latest lineup. The fundamentals are largely the same as previous FICO® Scores, but there are some important differences, including the introduction of the models that consider trended and BNPL data.

When it comes to managing your credit and improving your score, focusing on those fundamentals is often the most important thing you can do. Generally, people who pay their bills on time, maintain low credit utilization rates and apply for credit sparingly will have good credit scores. And that's true for all the credit scoring models.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

John Ulzheimer is a recognized expert on credit reporting, credit scoring and identity theft. With over 29 years of industry experience, including time with both FICO and Equifax, John is one of the few recognized credit experts who actually comes from the credit industry.

Read more from John