How Do I Check My Credit Score?

Quick Answer

You can check your credit score for free by creating an account with Experian, as well as using free credit score websites, credit card issuer or lender sites and nonprofit credit counselors.

There are many ways to check your credit for free, and doing so on a regular basis can help you assess your overall credit health. Having a good credit score can make it easier to qualify for affordable financing and lower insurance rates, and it can also give you an advantage when trying to lease an apartment or get certain jobs.

Here's what you need to know about how to check your credit score and what this important three-digit number means.

How to Check Your Credit Scores

You can check your credit scores with the credit bureaus, free credit score websites, your credit card issuer or lender or a nonprofit credit counselor.

Depending on the source, you might receive a credit score from either FICO or VantageScore®. Both credit scoring companies calculate several versions of their credit scores, and the scores can be based on your credit report from Experian, TransUnion or Equifax.

Tip: Both FICO and VantageScore maintain lists of where you can get your credit scores for free—there are hundreds of options.

1. Check With the Major Credit Bureaus

The major credit bureaus might offer you a free copy of your credit report and a free or paid credit score based on the report.

- Experian: With Experian, you can get your credit report and FICO® ScoreΘ 8 for free anytime. An Experian account also comes with free credit report and score tracking, so you can get notified of changes in your credit report and track your score over time. You'll also receive tips for improving your credit score.

- Equifax: You can access your Equifax credit report and VantageScore 3.0 credit score for free through the Equifax Core Credit service. The score is updated once a month. If you want access to alerts and the ability to lock your report, however, you'll need to pay $4.95 per month for Equifax Credit Monitor.

- TransUnion: This credit bureau doesn't offer free reports or scores directly. TransUnion's credit monitoring service, which comes with access to your credit report and VantageScore 3.0 credit score, costs $29.95 per month.

2. Use a Free Credit Score Website

Some websites offer a free credit score to their users as an incentive for creating an account. The type of score and underlying report can vary from one website to the next, as can the insights that the website offers about your score. Sometimes, the websites offer paid subscriptions with additional features or show users loan or credit card offers.

Tip: It's important to note that while you can obtain free weekly credit reports through AnnualCreditReport.com, the service doesn't offer credit score access.

3. Check With Your Credit Card Issuer or Lender

Many credit card issuers and lenders give current cardholders and borrowers a free credit score, which may be a FICO® Score or VantageScore credit score. You can usually see your score by logging in to your online account or using your card issuer's mobile app.

The score often gets updated with your monthly statement, and it might be the same one that the company uses to evaluate new applicants and current customers.

Find out if any of your current creditors offer this as a free service and whether you automatically get your credit score each month or have to sign up for the free credit score program.

4. Visit a Nonprofit Credit Counselor

If you have questions about your credit, budgeting, buying a home, bankruptcy or managing your credit card debt, consider a free consultation with a nonprofit credit counselor. Credit counseling agencies can help with various financial questions or problems, and a counselor can help you check your credit score and explain how to improve your credit.

What Are the Credit Score Ranges?

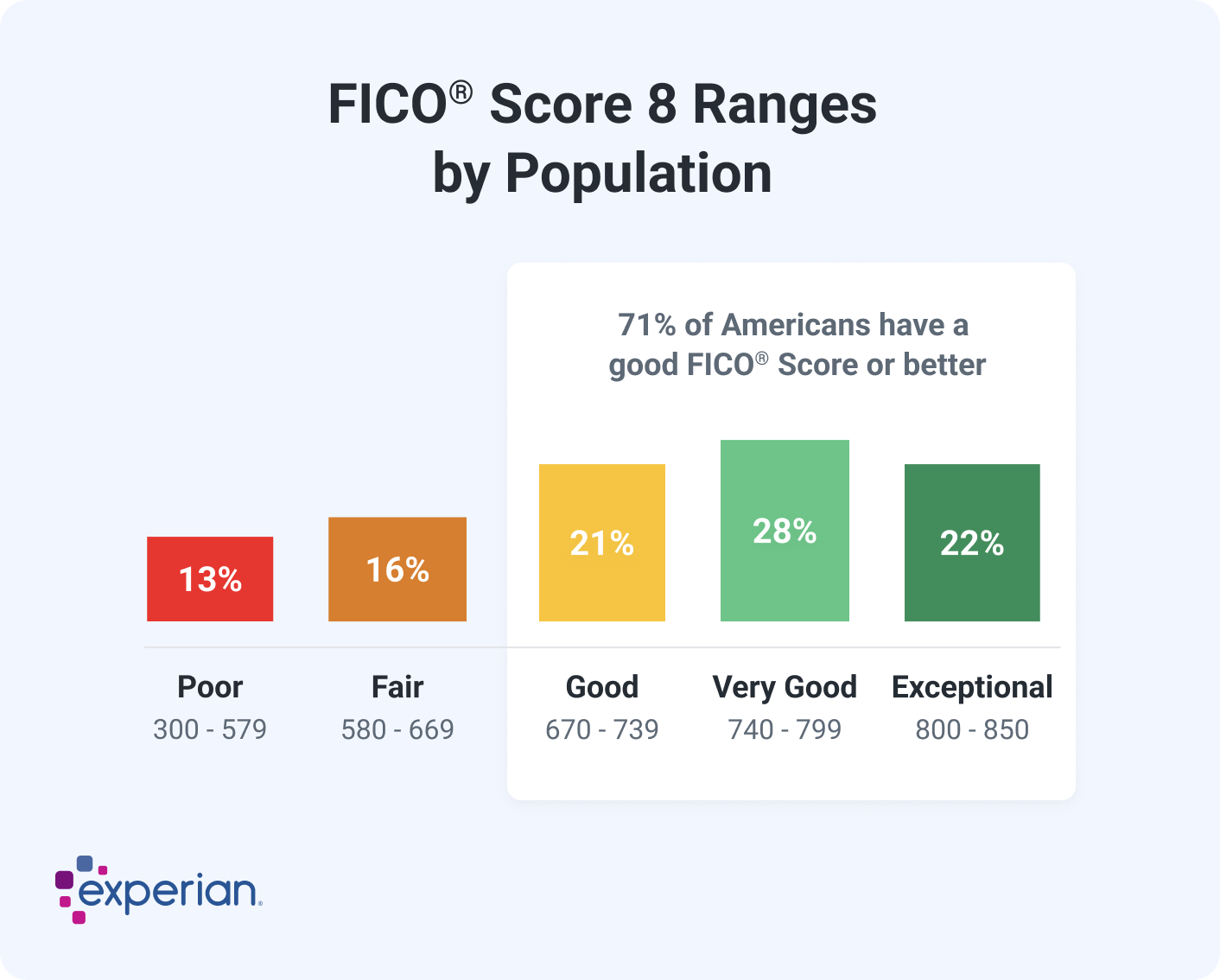

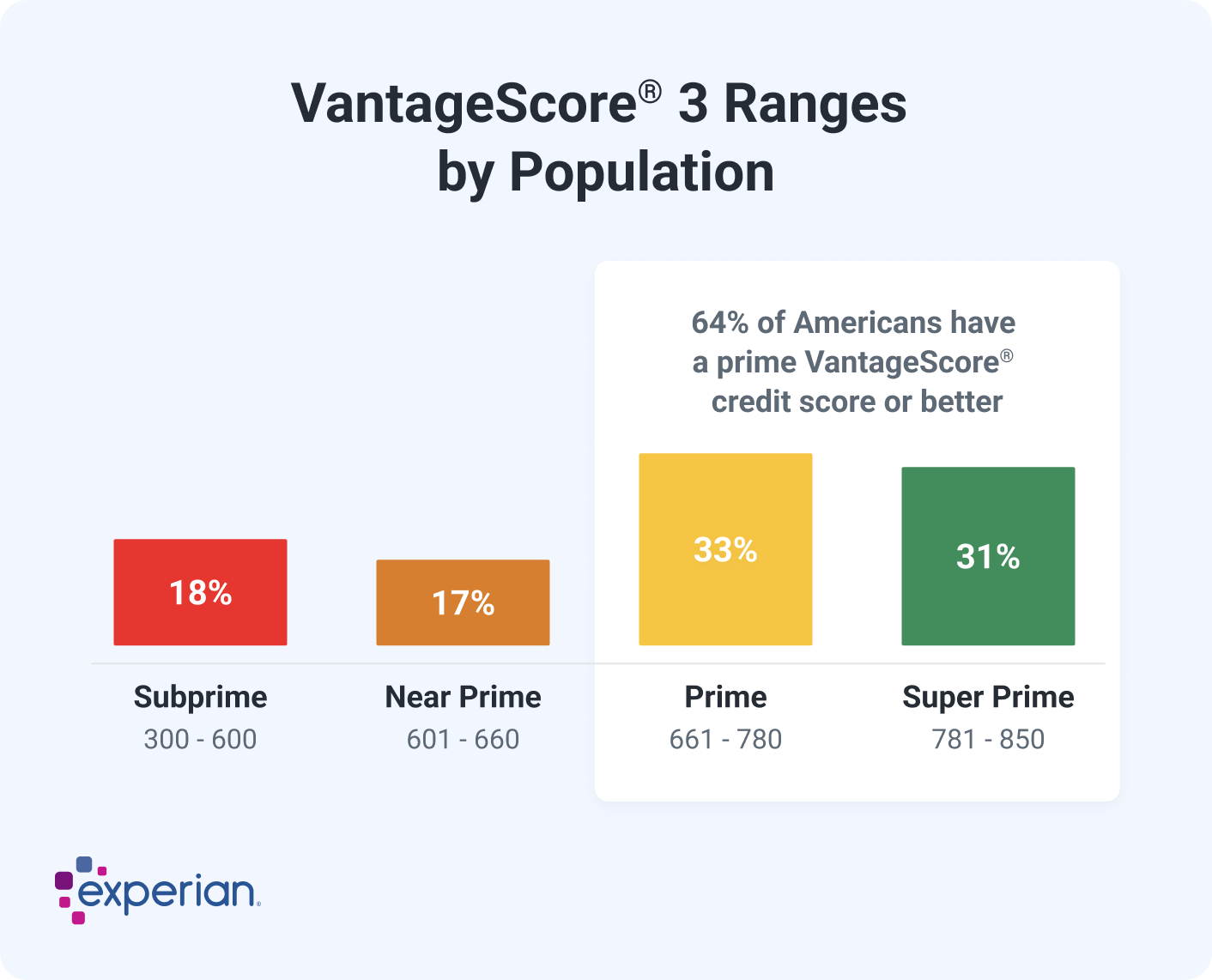

Most credit scores range from 300 to 850. Improving your credit score could help you qualify for more financial products, lower interest rates and fewer fees. Many creditors also break down the credit score range into smaller groups.

Although creditors can choose their own definitions or ranges for these groups, FICO and VantageScore offer their own benchmarks you can use to understand where you fall. For example, a good credit score could be a FICO® Score from 670 to 739 or a VantageScore credit score from 661 to 780.

What Do Credit Scores Mean?

Credit scores help organizations quickly assess the risk that someone they lend money to won't repay the loan. Most credit scores are designed to rank people based on the likelihood that they'll miss a payment by at least 90 days within the next 24 months.

- Having a high credit score means: You're statistically less likely to miss a loan or credit card payment. As a result, you pose less of a risk to the lender and may qualify for lower interest rates and fees.

- Having a low credit score means: You're statistically more likely to miss a loan or credit card payment. Because you pose a higher risk to the lender, you may receive higher interest rates and fees, or you may be denied credit altogether.

What Factors Affect Your Credit Score?

Most credit scores only consider information from one of your credit reports to determine your score. But the scores use complex calculations, and the impact of each new data point depends on the rest of the information included in your credit profile. In other words, it's impossible to say that a specific action will have the same credit impact for everyone.

There are, however, general categories of what affects your credit scores. You can order these from most to least important based on how the factors within each category tend to affect your score.

For the FICO® Score, the score used by 90% of top lenders, the factors that affect your credit score are:

- Payment history (35%): Paying bills on time could improve your credit as this is the most important factor of your credit score. On the other hand, late or missed payments, collection accounts and filing for bankruptcy can drastically hurt your scores.

- Amount of debt (30%): The number of accounts you have with balances and your progress repaying loans also have a large impact on your credit scores. Another crucial factor is your credit utilization rate, which measures how much of your credit limit you're using on your credit cards. A low utilization ratio is best for your scores.

- Length of credit history (15%): The age of the oldest and newest accounts in your credit report, as well as the average age of all your accounts, can also affect your scores. Generally, the longer you've used credit, the better for your scores.

- New credit (10%): Opening new accounts and applying for credit, indicated by a hard inquiry in your credit report, can also affect your scores. In general, a hard inquiry might hurt your scores a little. This category doesn't have a major impact on your scores, and opening new credit accounts is often a necessary step for building good credit over time.

- Credit mix (10%): Having open revolving and installment credit accounts shows that you can manage multiple types of credit, which might help your credit scores. This also isn't a major scoring factor, however, and you shouldn't open new credit accounts with the sole purpose of improving your credit mix.

How to Maintain a Good Credit Score

Building and maintaining a good credit score can take time, so the sooner you get started, the better. While the specific steps you need to take will depend on your unique credit profile, here are some general guidelines you can follow:

- Always pay your bills on time. Your debt payment history is the most important factor in your credit score, so it's crucial that you always pay on time. Late payments aren't reported to the credit bureaus until they're 30 days past due, so if you accidentally miss a payment, get caught up as quickly as possible.

- Keep your credit card balances low. Your credit utilization rate is another critical factor, and people with excellent credit tend to have rates below 10%. You can keep your utilization low by paying your credit cards in full every month and maintaining low balances whenever possible.

- Monitor your credit score. Frequently monitoring your credit score and reports can help you track your progress and gain additional insights into how your actions influence your credit health. It'll also make it easier to spot and address potential problems as they develop so you can minimize their potential negative impact.

Learn more:How to Maintain a Good Credit Score

Frequently Asked Questions

Monitor Your Credit Score for Free

Experian's free account includes your credit report and FICO® Score, as well as ongoing credit score monitoring so you can see how your score changes over time. You can also receive insights into the factors that are affecting your credit score the most and get tips on how to improve your score.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben