How Long Does It Take to Get a Secured Credit Card?

Are you considering a secured credit card to help build or repair your credit? These cards can be used the same way as unsecured credit cards, but require a refundable security deposit that protects the card issuer if you default on the payments. In most instances, the security deposit amount will equal your credit limit and will be returned to you if you cancel the card or convert it to an unsecured product in the future.

It can take a little over a week from the time you apply to when you have your new secured card in hand (assuming you're approved). Read on to learn more about the application process, which secured cards are best and how a secured card can improve your credit.

How Long Does It Take to Get a Secured Card Approval?

The application process for secured and unsecured credit cards is similar. You will need to fill out the online application, and the card issuer will then evaluate your income and possibly other factors to determine your ability to repay any debt you incur on the card. The lender might request income documentation to verify your claims, and may or may not do a credit check.

Once you submit your application, you could receive a decision in minutes. If approved, you will find out your credit limit and the security deposit required to open the account. To make sure the process goes smoothly, it's best to have the funds for the deposit on hand. Cardholders typically receive their new secured card within seven to 10 business days, and can begin using the card right away.

There are instances where an approval decision cannot be made using the automated system. If this happens, expect written correspondence in the next seven to 10 days notifying you of the credit card issuer's decision. If you are not approved, the lender will send you a letter noting why and explaining your rights.

How Fast Can a Secured Credit Card Help My Credit?

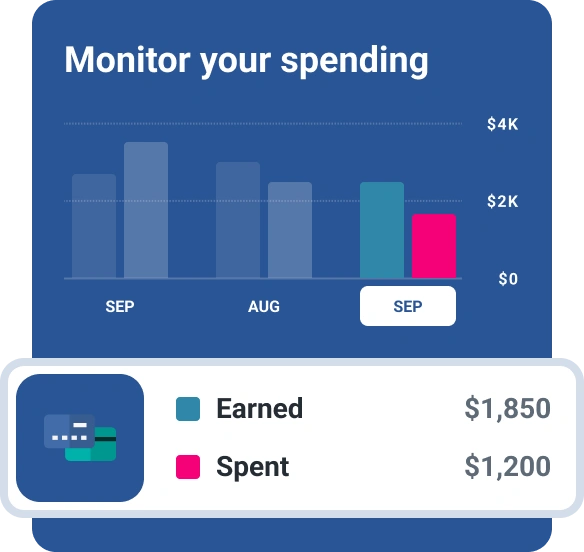

A secured credit card can help you build credit if you use it to make small purchases and pay the balance in full on or before the due date each month. This shows creditors that you're able to responsibly manage your debts. Your credit score could also benefit if you pay on time, as payment history accounts for 35% of your FICO® ScoreΘ. Keeping the balance low is another credit booster because it helps your credit utilization, which is the second most important component of your credit score.

There's no set time frame for how long it takes for a secured credit card to help you build credit. But opening an account and making timely payments can add positive information to your report that will benefit your score and possibly help improve it over time.

Alternatives to Secured Credit Cards

If you can't get approved for a secured credit card or would prefer to explore other options to build credit, consider these alternatives:

- Get added as an authorized user on someone else's account. You could benefit from becoming an authorized user on a parent's, family member's or close friend's credit card if you have minimal or no credit history—assuming the cardholder has exceptional payment history and is only using a small percentage of the total available credit. It's also important that the card issuer reports authorized-user account activity to the credit bureaus.

- Consider a credit-builder loan. Credit-builder loans allow you to save money while establishing or rebuilding your credit. You can typically borrow $300 to $1,000, which you'll be able to access once you're done making monthly payments to reach your approved amount. There's no deposit requirement, and some lenders do not require credit checks to get approved. You could also possibly save on steep interest that you might otherwise pay on a credit card. Make sure your lender reports your payment activity to all three credit bureaus.

- Open a debit card if you don't need additional credit. If you don't need additional credit and simply need a way to pay bills electronically, consider opening a debit card. Swiping a debit card to make purchases will not help you build credit. It will, however, allow you to stay current on your bills and help you avoid the risks of borrowing money.

Consider a Secured Credit Card to Rebuild Your Credit

It doesn't take very long to get a secured credit card. You can use it to build or repair your credit by making all payments on time and keeping the balance low (or paying it off each month). Consider using Experian's card comparison tool to find cards you may qualify for, or explore other alternatives to help boost your credit health if a secured credit card isn't a good fit.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Allison Martin is a Certified Financial Education Instructor (CFEI), syndicated financial writer and author. Her work has been featured in The Wall Street Journal, ABC, MSN Money, Yahoo! Finance, Fox Business, Investopedia, The Simple Dollar and a host of other publications.

Read more from Allison