How to Apply for a Credit Card

Quick Answer

To apply for a credit card, check your credit to see what you’ll qualify for, choose a credit card type, compare multiple card options and apply for the best credit card for your goals and spending habits.

You can apply for a credit card by checking your credit to see what you'll qualify for, choosing a credit card type, comparing card options and submitting an application.

Opening a new credit card can be a pathway to building credit and earning rewards on the purchases you regularly make. Before you apply for new credit, learn how to pick the best credit card for your goals and spending habits. It's also key to understand a credit card's terms and fees to ensure you avoid extra charges.

Here's how to apply for a credit card.

1. Check Your Credit Score

Your credit score typically has the biggest impact on whether you'll get approved for a credit card. It affects not only your odds of qualifying for a specific credit card, but the credit limit and interest rate a lender offers you.

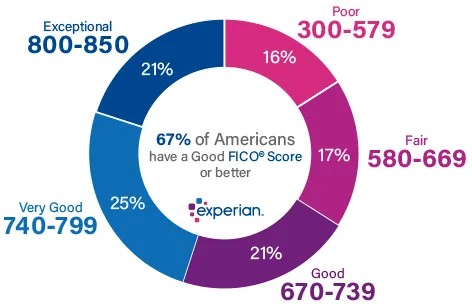

Check your FICO® ScoreΘ for free through Experian to understand which type of cards you'll be eligible for. Scores range from 300 to 850; a higher credit score indicates lower risk and can make it easier to qualify for credit, while a low credit score can limit your options.

Here's a breakdown of the FICO® Score ranges and how they may impact your ability to qualify for a credit card:

- Poor or fair credit: This can make getting approved for most credit cards challenging. If your score falls in this range, consider applying for a secured credit card, which tends to be easier to qualify for, to start building up positive credit history.

- Good credit: A good credit score can help you qualify for a broader range of credit cards. The higher your score in this range, the higher the likelihood you'll qualify for cards with favorable terms, such as a premium travel credit card with competitive rewards or a card with a low interest rate.

- Very good or exceptional credit: If your score is in this range, you'll likely qualify for most credit cards, with lower interest rates and higher credit limits.

Tip: You generally need good or excellent credit to qualify for cards with the best rewards and benefits.

If you want a credit card that may be difficult to qualify for with your current credit score, take some time to improve your score before applying.

Learn more: Does Checking Your Credit Score Lower It?

2. Decide How You Want to Use the Credit Card

There are several types of credit cards on the market, and the best option for you is the one that matches your current spending habits. Here's what to know about the most common types of credit cards:

| What It's Best For | Credit Score Requirements | |

|---|---|---|

| Rewards credit cards | Earning cash back, points or miles on your spending | Good or excellent credit; some issuers offer cards to applicants with fair credit |

| Balance transfer credit cards | Avoiding interest charges while you pay off a credit card balance | Good or excellent credit |

| 0% introductory APR credit cards | Financing a large purchase at 0% interest during the promotional period | Good or excellent credit |

| Student credit cards | Building credit and earning rewards while enrolled at a two- or four-year college | No minimum; some credit history may be required |

| Secured credit cards | Building or rebuilding credit | Generally available to those with poor credit |

| Store credit cards | Earning rewards and discounts at a store where you frequently shop, though other credit card types may be better bets | Generally available to those with fair credit; some issuers may approve applicants with poor credit |

3. Shop Around for Credit Cards

Once you've identified the type of card you'll apply for, compare multiple options to make sure the card you choose has the best benefits and terms available. You can submit a prequalification online to see what cards you're likely to qualify for.

Here's what to look for when comparing a few credit cards that you think could meet your needs:

- Interest rate and fees: Look at the card's annual percentage rate (APR) on purchases. To understand how a card's interest rate compares in the marketplace, it can help to check the current average APR nationally. You should also consider if there's an annual fee and if it's worth the benefits offered by the card. (Read on for more about additional types of interest rates and fees to be aware of.)

- Features: If you're opting for a specialty card, make sure the card meets your goals. If it's a balance transfer card, does it offer a high enough maximum credit limit to accommodate the balance transfer you want to make? If it's a 0% intro APR card, is the promotional period long enough to pay off the large purchase you've planned?

- Rewards: Check not only how you'll earn rewards and on what types of purchases, but what the options are for redeeming them (for travel or as a statement credit, for example).

- Benefits: Aside from earning rewards on spending, some cards come with additional benefits, like travel insurance, roadside assistance or purchase protection. Go with a card that has benefits you're most likely to use based on your lifestyle and interests.

Learn more: What Credit Card Should I Get?

4. Review the Card's Terms

Once you've picked a specific card, it's time to get granular and look closely at its terms. These include specific fees and interest rates that can affect the card's cost to you. Most of this information is available in a format called the Schumer Box on a credit card offer or statement.

- Annual fee: A yearly fee for owning the card. Not all cards have an annual fee, and some lenders waive the first year's fee. Make sure you can afford the annual fee and that you can justify it based on any rewards you receive.

- Annual percentage rate (APR): How much interest you'll pay per year if you carry a balance.

- Balance transfer fee: How much it will cost you to transfer another credit card balance to the card, usually charged as a percentage of the transferred balance.

- Cash advance fee: A flat fee or percentage of the amount you've withdrawn as a cash advance from the card. You'll also generally pay a higher interest rate when repaying this amount.

- Foreign transaction fee: A charge on transactions made in countries outside of the U.S. Some credit cards may not have a foreign transaction fee, while others charge 1% to 3% of the purchase amount.

- Late payment fee: The fee you could be charged if your credit card payment is late even one day. The average late fee is $32, according to the Consumer Financial Protection Bureau.

- Minimum payment: The amount you must pay to keep your account in good standing, as calculated by the card issuer. It can be a flat amount or a percentage of your balance. Paying only the minimum often means carrying a balance and paying interest charges.

- Penalty APR: A higher interest rate that could kick in if you make a late credit card payment.

5. Submit an Application

Next, apply for the credit card you've chosen. You'll need to submit the following information:

- Name

- Address

- Birthdate

- Social Security number or individual taxpayer identification number (ITIN)

- Income info

- Employment status

- Monthly housing payment

Tip: You need to be 18 to apply for a credit card. And if you're under 21, you'll need to show proof of income.

The application process itself is relatively quick online, and you may be approved right away if you meet the issuer's credit requirements. If not, the issuer may take up to a week to review your application.

You may receive a notification that your credit card application is under review. That means the issuer needs more time to decide whether you're approved, and it could be due to missing information on the application, verification of certain data or other reasons. You can contact the issuer to check the status of your application and to offer additional information to aid in the decision-making process.

6. Get Your Credit Card

If you're approved, it can take up to 10 days to receive a credit card in the mail. The issuer might offer the option for expedited shipping, which could come with a fee. Some lenders provide you with a temporary virtual credit card number you can use for online purchases while you wait for your regular credit card to arrive.

Once you get your new credit card in the mail, you must activate your card and online account. Check its credit limit, billing cycle and payment due date, and note that the best way to keep your credit in good shape is to aim to pay off at least the statement balance each month.

Learn more: Things to Do When You Get a New Credit Card

Frequently Asked Questions

The Bottom Line

Applying for a credit card is usually quick. The research required to make sure you've chosen the right one to apply for can be a longer process. Take the time to ensure you're opting for a card that you can confidently manage without accruing substantial interest charges and fees—and that will most benefit you and your credit.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna