How to Get a Secured Credit Card

Quick Answer

You can apply for a secured credit card by following these steps:

If you have a low credit score or limited credit history, getting approved for a secured credit card can be easier than getting a traditional credit card. Unlike a traditional credit card, however, secured cards require an upfront security deposit. Here's more on how secured credit cards work and the steps you can take to apply for one.

What Is a Secured Credit Card?

A secured credit card is a type of card that requires you to provide a cash deposit as collateral when opening the account. Your deposit is typically equal to your credit limit.

A secured card could be a good option for improving your credit if you're just starting out or have a low credit score. Because the issuer can use your deposit to recoup your balance should you default, issuers can be less restrictive when approving applications for secured cards. That could open the door to building credit, and you may be able to graduate to an unsecured card down the line.

Who Qualifies for a Secured Credit Card?

Depending on the card, you may be able to get approved for a secured credit card with a low credit score or no credit history at all. Some card issuers may be willing to work with you even if you have a bankruptcy on your credit report—though it typically needs to be discharged first.

Keep in mind that the typical deposit is $200 or more. If you can afford to cover the upfront security deposit, a secured card could be a good option to get started building—or rebuilding—your credit.

5 Steps to Get a Secured Credit Card

If you're new to credit or looking to rebuild credit after some missteps, a secured credit card could be the answer. Before you apply, though, follow these steps to make sure a secured card is the right move and to maximize your chances of approval.

1. Check Your Credit

Depending on your situation, you may be able to get approved for an unsecured credit card, removing the need for an upfront security deposit. In particular, there are unsecured options available to consumers who are new to credit or have at least a fair credit score—generally a FICO® ScoreΘ for free of 580 to 669.

If you're a college student, you may be able to get approved for an unsecured student credit card instead. To determine whether a secured credit card is right for you—or if you have other options—check your FICO® Score for free with Experian to evaluate your situation.

2. Shop Around

If you've ruled out unsecured credit cards, it's important to shop around and compare several secured credit cards to find the best fit. Start by reviewing secured credit cards matched to your credit profile for a sense of what you might be likely to qualify for, and compare some top contenders side by side.

The more cards you consider, the better your chances of getting the best offer available to you.

3. Compare Secured Card Features

Once you've gathered information about a handful of secured credit cards, take a look at the following features:

- Security deposit: Many secured cards require a deposit of $200 or more, with your credit limit equal to your deposit. However, some cards may offer lower deposits based on your creditworthiness.

- Deposit refund policy: With some major card issuers, you may be able to get your deposit back after you demonstrate responsible credit behaviors over the course of six to 12 months. Once your deposit is refunded, your card will be converted to an unsecured card. Other issuers may hold on to the deposit until you close the account, which can negatively impact your credit.

- Rewards: Many secured credit cards offer rewards on your everyday purchases. While having a low credit limit doesn't give you a lot of room to rack up cash back, points or miles, it can be a nice bonus as you work to improve your credit.

- Fees: While many major card issuers typically offer secured credit cards without an annual fee, others may charge one. These fees are often low, but it's best to avoid them as much as possible.

- Interest rate: Some secured credit cards charge higher annual percentage rates (APRs) than others. If you plan to pay off your balance on time and in full every month, this may not be an issue. But if you think you may carry a balance sometimes, try to avoid higher-interest cards.

4. Submit Your Application

Once you've selected a card, visit the card issuer's website to submit an application. You'll generally need to provide the following information:

- Full name

- Date of birth

- Social Security number or individual taxpayer identification number

- Citizenship status

- Address

- Contact information

- Employment and income details

- Housing costs

You may also need to share your highest level of education completed and whether you have a bank account. After you submit your application, you'll typically receive a decision within seconds.

5. Pay the Deposit

If you're approved, you'll need to fund your security deposit before you get your card. Some card issuers require you to make the deposit via a transfer from your bank account. Others, however, may allow you to pay with a money order, personal check or electronic money transfer.

Learn more: How Secured Credit Card Deposits Work

Can You Get Denied for a Secured Credit Card?

While a spotty or nonexistent credit history isn't as much of a problem for secured credit cards, you can still get denied for a secured credit card if the lender deems you too much of a financial risk.

In particular, your application may be rejected if your income is too low or you have a pending bankruptcy.

With that in mind, credit card issuers often gear secured cards toward people with a poor or limited credit history, so you have better chances of qualifying compared to other options.

Learn more: What to Do if You're Denied a Secured Credit Card

Frequently Asked Questions

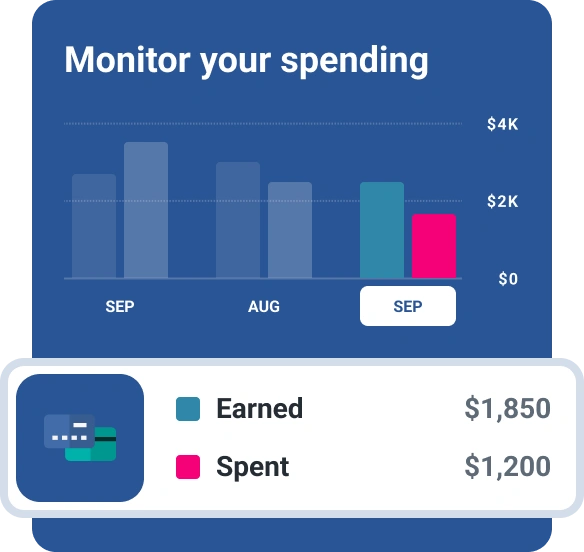

Monitor Your Credit-Building Process

If you plan to use a secured credit card to build or rebuild your credit history, it's a good idea to monitor your credit to track your progress and pinpoint other areas you can improve. Experian's free credit monitoring service provides you with access to your FICO® Score and Experian credit report, giving you the information you need to build and maintain good credit.

You'll also get real-time alerts when changes are made to your credit report, making it easier to spot potential inaccuracies and other problems that could threaten your progress.

Looking to build credit?

Discover secured credit card offers matched to you, so you can apply with confidence. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben