Is AnnualCreditReport.com Safe?

Quick Answer

AnnualCreditReport.com is an official site and a safe and free way to check your credit reports from the three major consumer credit bureaus: Experian, TransUnion and Equifax.

AnnualCreditReport.com is a safe website that you can use to request your credit reports from the three major consumer credit bureaus: Experian, TransUnion and Equifax. You can get free copies of your credit reports from other sources, but AnnualCreditReport.com is the official site you can use to request your free credit report once a week.

What Is AnnualCreditReport.com?

AnnualCreditReport.com is the only federally mandated website where you can access your free credit reports from all three major credit bureaus. It was established following the Fair and Accurate Credit Transactions Act (FACTA) as a way to help Americans better keep tabs on their credit. Whether you're checking information creditors may have reported in error or looking for signs of fraud and identity theft, AnnualCreditReport.com is where you can get started.

When you pull your credit report, you'll find it's packed with information about your financial history. Here's what you can expect to see:

- Personal information: This includes your name, current and previous addresses, date or year of birth and employment history. Personal information doesn't impact your credit score, but you'll want to make sure everything's accurate.

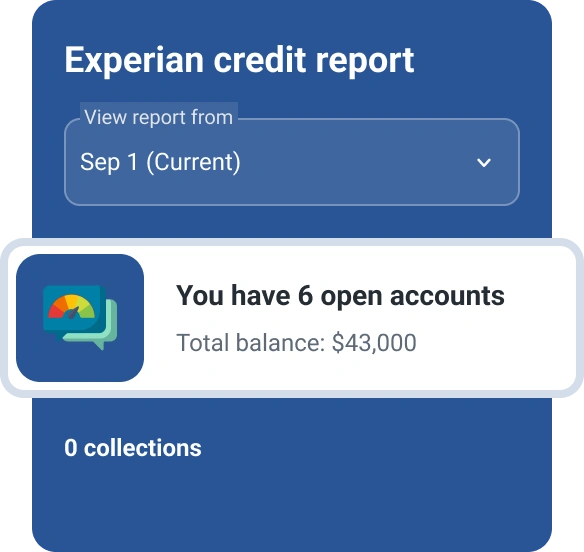

- Credit account information: The main purpose of your credit report is to provide an overview of open and recently closed credit accounts, also called tradelines. You'll see credit cards, mortgages, auto loans, student loans and other credit accounts listed here. For each one, the report shows the creditor's name, what type of account it is, your credit limit or loan amount, current balance, payment history and whether the account is open, closed or paid off. Closed accounts can stay on your credit report for seven to 10 years after closure, depending on the account's payment history.

- Inquiries: This section shows who's been checking out your credit report. When you apply for credit, that creates a hard inquiry that can result in a small but temporary ding to your credit scores. Soft inquiries happen when you check your own credit or when companies send you preapproved offers and won't affect your score at all.

- Collections: If you've had accounts sent to collections, they'll show up here.

Learn more: What Is AnnualCreditReport.com?

How AnnualCreditReport.com Protects Your Data

The three credit bureaus sponsor Central Source LLC, the company that's in charge of maintaining AnnualCreditReport.com.

When you use AnnualCreditReport.com, you'll need to share your personal information, including your name, Social Security number, date of birth and address to request your credit report. The website uses "physical, electronic and procedural safeguards" to help protect the private and personal information you share.

The site has an SSL certification, which is indicated by the "s" in the "https" in your browser's address bar. SSL creates an encrypted connection between your device and the website's servers, which can help keep people from snooping on the information you're sending.

Once AnnualCreditReport.com receives your information, it encrypts everything before sending it to the relevant credit bureau to request your credit report.

Additionally, the credit bureau that you're requesting your credit report from may ask a series of verification questions. These can help keep other people from using AnnualCreditReport.com to request a copy of your credit reports.

How to Get Your Credit Report From AnnualCreditReport.com

Getting your credit report is straightforward and only takes a few minutes. The process is designed to be secure, so you'll need to verify your identity along the way. Here's how to do it:

- Visit AnnualCreditReport.com. Start by visiting the official website. While many other websites offer free access to one or more credit reports, this is the only one mandated by federal law.

- Click "Request your free credit reports." You'll see a big button on the homepage that gets the process started. Click it and you'll be on your way.

- Fill out the request form. You'll need to provide some basic information like your name, date of birth, Social Security number and current address. Make sure everything matches what's on file with the credit bureaus.

- Answer security questions. To verify your identity, you'll be asked questions based on your credit history. Examples include previous addresses, vehicles you've owned or creditors you've worked with. These can be tricky, so take your time and answer carefully.

- Choose which credit reports you want. You can request reports from Experian, TransUnion, Equifax or all three at once.

- Review and download your reports. Once you're approved, you can view your credit reports online right away. It's a good idea to save or print them for your records so you can reference them later.

Watch Out for Credit Report Scams

While AnnualCreditReport.com is a safe way to get a copy of your credit report, scammers may try to trick you into entering your personal information on look-alike websites. They can then collect your personal information and possibly sell it or use it to steal your identity.

You might wind up on one of these phishing sites after clicking on a link from another website. Or, you might receive an email that looks like it's coming from the website (a "spoofed" email) with a link to the scammer's website.

Be similarly suspicious of other websites that ask for your personal information and claim they'll give you a free copy of your credit report. While there are legitimate companies that offer these services, some are scams.

Also, beware that scammers can get SSL certifications for their websites, so the certification isn't always an indication of safety. While your connection is encrypted, you could still be sending your encrypted personal information to a criminal.

If you want to use the website to request your credit reports, the safest option is to enter (or copy and paste) https://www.AnnualCreditReport.com directly into your browser.

Check Your Credit Report With Experian

While AnnualCreditReport.com is legitimate and safe, you can get free copies of your credit reports from other trusted sources.

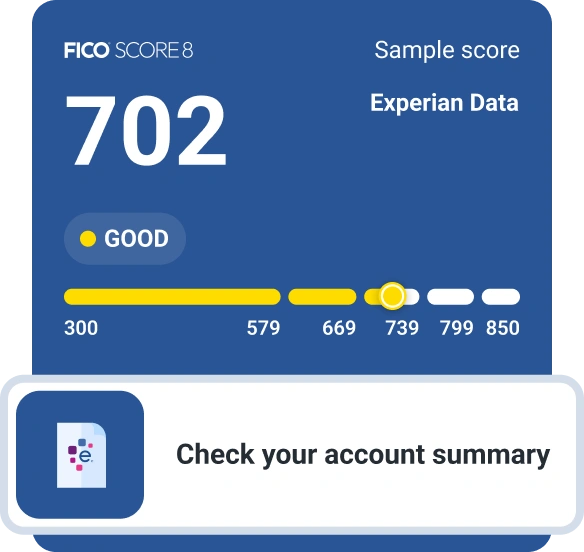

For example, rather than using AnnualCreditReport.com to request a copy of your Experian credit report, you can go directly to Experian's website. There, you can get your free Experian credit report, a FICO® ScoreΘ based on the report for free (AnnualCreditReport.com's reports don't include credit scores) and free credit monitoring.

The Bottom Line

AnnualCreditReport.com is a safe, federally authorized resource that gives you free access to your credit reports from all three major bureaus. It's a smart tool for staying on top of your financial health, catching errors and spotting potential identity theft before it becomes a bigger problem.

Just make sure you're visiting the real website. Scammers love to create look-alikes that can steal your personal information. By checking your credit reports regularly and reviewing them carefully, you're taking an important step toward protecting your financial future.

What’s on your credit report?

Stay up to date with your latest credit information—and get your FICO® Score for free.

Get your free reportNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben