What Is the Difference Between Credit Counseling and Debt Settlement?

Credit counseling and debt settlement are two ways to manage your debt, but they work very differently and can have distinct impacts on your finances and credit.

Credit counseling focuses on helping you repay your full debt through structured payment plans and financial education, while debt settlement aims to reduce what you owe by negotiating with creditors to accept less than the full balance.

Understanding the key differences between these two approaches can help you choose the right strategy for your financial situation.

| Credit Counseling (Debt Management Plan) | Debt Settlement | |

|---|---|---|

| Goal | Repay full debt amount through structured plan | Reduce total debt owed by negotiating lower balances |

| How it works | Create debt management plan with reduced interest rates and monthly payments | Stop paying creditors and negotiate settlements, either on your own or through a company |

| Impact on credit | May initially lower score slightly; improves with consistent payments | Significant negative impact from missed payments and settlements |

| Cost | Setup fee ($25 to $75) plus monthly fee ($20 to $70) | Typically 15% to 25% of enrolled debt |

| Timeframe | Three to five years on average | Two to four years on average |

| Risks | Often requires closing credit card accounts; missing payments could cause you to lose concessions | Creditors aren't obligated to work with you; long-term impact on your credit score; potential tax liability on forgiven debt |

What Is Credit Counseling?

Credit counseling is a service that helps you understand your financial situation and develop a plan to manage your debt. A certified credit counselor reviews your income, expenses and debts, then works with you to create a budget and may enroll you in a debt management plan (DMP).

With a DMP, the credit counseling agency negotiates with your creditors to reduce interest rates, monthly payments and fees on unsecured debts such as credit cards. You make a single monthly payment to the counseling agency, which distributes the funds to your creditors. The goal is to pay off your full debt balance over time—typically three to five years—while making the payments more manageable through lower interest rates.

Credit counseling agencies are often nonprofit organizations, though some for-profit companies offer these services as well. Reputable agencies employ counselors certified by organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Learn more: Questions to Ask a Credit Counselor

Pros and Cons of Credit Counseling

Credit counseling can be an effective debt management tool, but it's not without limitations. Here are the main advantages and drawbacks to consider.

Pros

-

Simplifies your payments: Credit counseling consolidates multiple debt payments into one monthly payment to the counseling agency, which then distributes funds to your creditors. This makes budgeting easier and reduces the risk of missing payments.

-

May reduce interest rates and fees: Credit counseling agencies often negotiate with creditors to lower your interest rates and waive late fees or over-limit charges. These concessions can help you pay off debt faster and save money over time.

-

Provides financial education: You'll work with a certified counselor who can help you understand your finances, create a realistic budget and develop better money management habits for the long term.

Cons

-

Requires closing credit accounts: When you enroll in a debt management plan, you typically need to close the credit card accounts included in the program. This can affect your credit utilization rate and may temporarily hurt your credit score.

-

Takes several years to complete: Most debt management plans last three to five years, which requires a long-term commitment to making monthly payments. You'll need steady income and discipline to complete the program successfully. Also, remember that you'll be paying a monthly fee throughout the plan's term.

-

Doesn't reduce principal balance: Credit counseling helps you repay the full amount you owe, just with better terms. If you need to reduce your actual debt load rather than just manage it, this approach won't provide that relief.

What Is Debt Settlement?

Debt settlement is a strategy where you or a company negotiate with your creditors to accept less than the full amount you owe. When you work with a debt settlement company, the process involves stopping payments to your creditors, allowing accounts to become delinquent, then offering a lump sum to settle the debt. Depending on the creditor and the age of the debt, you could offer anywhere from 10% to 70% of the original amount owed.

Debt settlement companies work by having you make monthly deposits into a dedicated account. Once enough funds accumulate, the company negotiates with creditors to settle your debts for less than you owe. You can also attempt debt settlement on your own without hiring a company.

It's important to understand that creditors are under no obligation to settle, and the process can take several years. During this time, missed payments will severely damage your credit score, and creditors may pursue collection actions or lawsuits.

Learn more: Alternatives to Debt Settlement

Pros and Cons of Debt Settlement

Debt settlement offers the potential to reduce what you owe but comes with serious risks. Weigh these factors carefully before pursuing this option.

Pros

-

Can significantly reduce your debt: Debt settlement may allow you to pay 10% to 70% of your original balance, potentially saving you a significant amount of money.

-

May resolve debt faster: Settling your debts takes two to four years on average, which may be quicker than paying off high-interest debt through minimum payments alone.

-

Provides an alternative to bankruptcy: For people who can't afford to repay their full debts but want to avoid bankruptcy, debt settlement offers a middle-ground option that can resolve debt obligations without a bankruptcy filing on their record.

Cons

-

Can severely damage your credit: The debt settlement process requires you to stop paying creditors, resulting in multiple missed payments that can significantly harm your credit score. Additionally, settled accounts remain on your credit report for seven years and are viewed negatively by future lenders.

-

No guarantee of success: Creditors aren't obligated to negotiate or accept settlement offers. During the process, they may continue collection efforts, charge late fees and even sue you for the unpaid debt.

-

Can result in a tax bomb: The IRS considers most forgiven debt as taxable income, regardless of the amount. If you settle a $10,000 debt for $4,000, for instance, you may owe taxes on the $6,000 in forgiven debt, creating an unexpected financial burden.

How Do Credit Counseling and Debt Settlement Impact Your Credit?

Both options affect your credit, but in different ways and to different degrees. Understanding these impacts can help you make an informed decision about which approach is right for your situation.

Credit Counseling's Impact on Credit

- Account closures may affect your score. When you enroll in a debt management plan, you typically must close the credit card accounts included in the program. This can impact your credit utilization rate and reduce your average account age, which may temporarily lower your credit score.

- DMP notation doesn't harm your score directly. Some creditors may note on your credit reports that you're repaying through a debt management plan. But while this information appears on your reports and could affect your ability to get credit in the future, it doesn't factor into credit score calculations.

- Consistent payments improve your credit over time. As you make on-time payments through your DMP, your payment history will improve—that factor alone accounts for 35% of your FICO® ScoreΘ. This positive payment pattern can help rebuild your credit throughout the program.

Debt Settlement's Impact on Credit

- Missed payments severely damage your score. The debt settlement strategy requires you to stop making payments to creditors, causing your accounts to become delinquent. Each missed payment is reported to the credit bureaus and significantly harms your credit score.

- Settled accounts appear as negative information. When a debt is settled, it's typically reported as "settled for less than the full balance" on your credit report. This is considered negative information and can make it harder to qualify for credit in the future.

- Negative marks remain for seven years. Settled accounts stay on your credit report for seven years from the date of first delinquency. During this time, lenders will see that you didn't repay your debts as originally agreed, which can impact your ability to qualify for new credit.

Is It Better to Do Credit Counseling or Debt Settlement?

The right choice depends on your financial situation, goals and ability to repay your debts.

Credit counseling may be better if you:

- Can afford to repay your full debt amount with reduced interest rates

- Want to avoid severely damaging your credit

- Prefer working with reputable, nonprofit organizations

- Value financial education and budgeting support

- Have steady income to make consistent monthly payments

- Want to maintain better relationships with creditors

Debt settlement may be better if you:

- Can't afford to repay your full debt even with reduced interest

- Are already behind on payments or facing collection actions

- Want to potentially reduce your total debt balance

- Can handle potential significant credit score damage

- Have a lump sum available or can save for settlements

- Want to avoid bankruptcy but need substantial debt relief

Tip: Keep in mind that neither option is ideal for everyone. If you're current on your debts and can afford to continue making payments, you may be better off negotiating directly with creditors for lower interest rates, trying a debt payoff strategy such as the debt avalanche or debt snowball method, or exploring debt consolidation.

If your debt is overwhelming and you cannot realistically repay even a reduced amount, bankruptcy might provide a more comprehensive solution.

Learn more: Debt Settlement vs. Debt Management: Which Is Better?

Take Control of Your Debt Strategy

Choosing between credit counseling and debt settlement requires careful consideration of your financial situation and long-term goals. Credit counseling offers a structured approach to repaying your full debt with support and education, while debt settlement aims to reduce what you owe but comes with significant credit consequences.

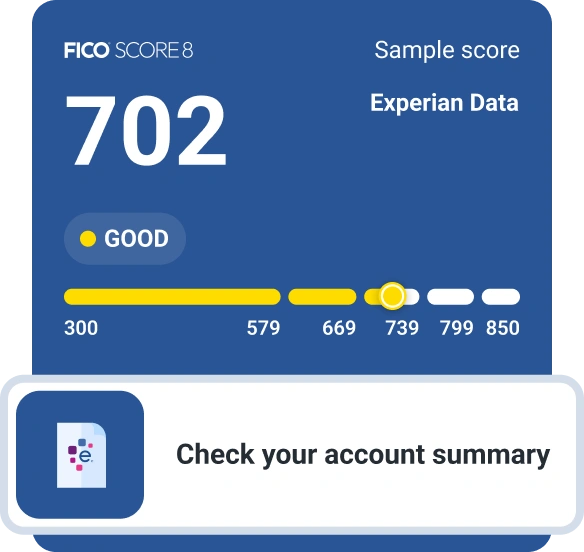

Before deciding, consider meeting with a nonprofit credit counselor to review all your options. Many agencies offer free initial consultations and can help you understand which debt relief strategy makes sense for your circumstances. You can also check your FICO® Score for free through Experian to understand your current credit standing and monitor how your chosen debt management approach affects your credit over time.

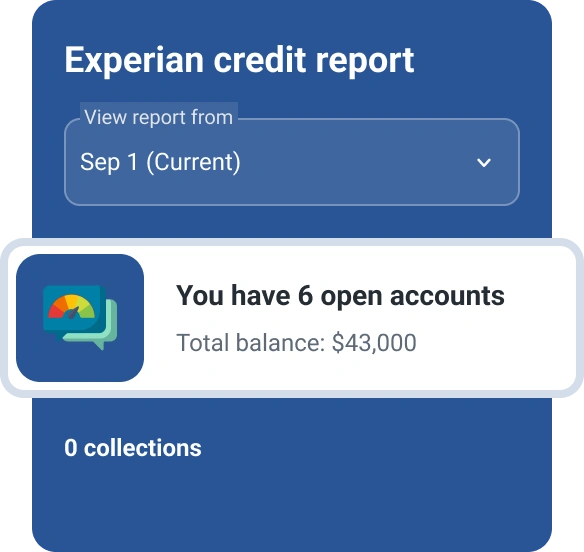

Find out what debts you owe

Your free credit report lists all your debts, such as credit card balances and loans, helping you create a plan to tackle your debt and improve your financial health.

Review your creditAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben