What Is a Preapproval Letter?

If you're looking to buy a home, you'll likely need a mortgage preapproval letter that states how much a lender is willing to loan you for a new home. Preapproval letters also include other important information about your potential home loan, including your expected interest rate and monthly mortgage payment.

Getting a mortgage preapproval letter will clarify how big of a loan the lender determines you can afford. Providing one with your offer shows home sellers that you're a serious buyer who's ready for a mortgage.

Prequalification vs. Preapproval

You may hear prequalification and preapproval used interchangeably, but the terms don't mean the same thing with a mortgage:

- Mortgage prequalification indicates that a lender has reviewed the financial information you provided and checked your credit. A credit check associated with prequalification results in a soft credit inquiry, which doesn't impact your credit scores.

- Mortgage preapproval is a more in-depth process that involves a detailed review of your finances and a hard credit inquiry, which can have a negative but temporary effect on your credit scores.

| Mortgage Prequalification | Mortgage Preapproval | |

|---|---|---|

| Does the lender verify your financial information? | No; the financial information you provide is self-reported | Yes; the lender will require verified information regarding your finances |

| Does it typically involve a hard credit inquiry? | No | Yes |

| How accurate is your loan estimate? | It can provide a good estimate if the information you provided is correct | It provides a more accurate loan estimate because it's based on verified financial information |

| Does it make you a more credible homebuyer? | Not necessarily because the lender hasn't fully vetted your financial situation | A home seller may take your offer more seriously if you've been preapproved for financing |

Whether you get preapproved or prequalified, however, neither is a guarantee that you'll ultimately be approved for a home loan. You'll still need to submit a mortgage application and meet the lender's eligibility requirements. Still, getting preapproved can give you a competitive edge as a homebuyer.

Compare mortgage rates

Check today’s rates to find the best loan offers. Staying updated on current rates helps you secure a competitive mortgage and save more over time.

How Does a Preapproval Letter Work?

Think of a mortgage preapproval letter as a snapshot of your potential home loan. Every lender has its own process, and things could change when your mortgage application goes through the underwriting process. Still, the preapproval letter can give you a general idea of your loan details. That includes:

- The maximum amount you may be able to borrow

- The maximum sale price and loan-to-value ratio

- Your expected interest rate, fees and closing costs

- The type of mortgage you've been preapproved for

- How long the preapproval letter is valid

What Does a Preapproval Letter Look Like?

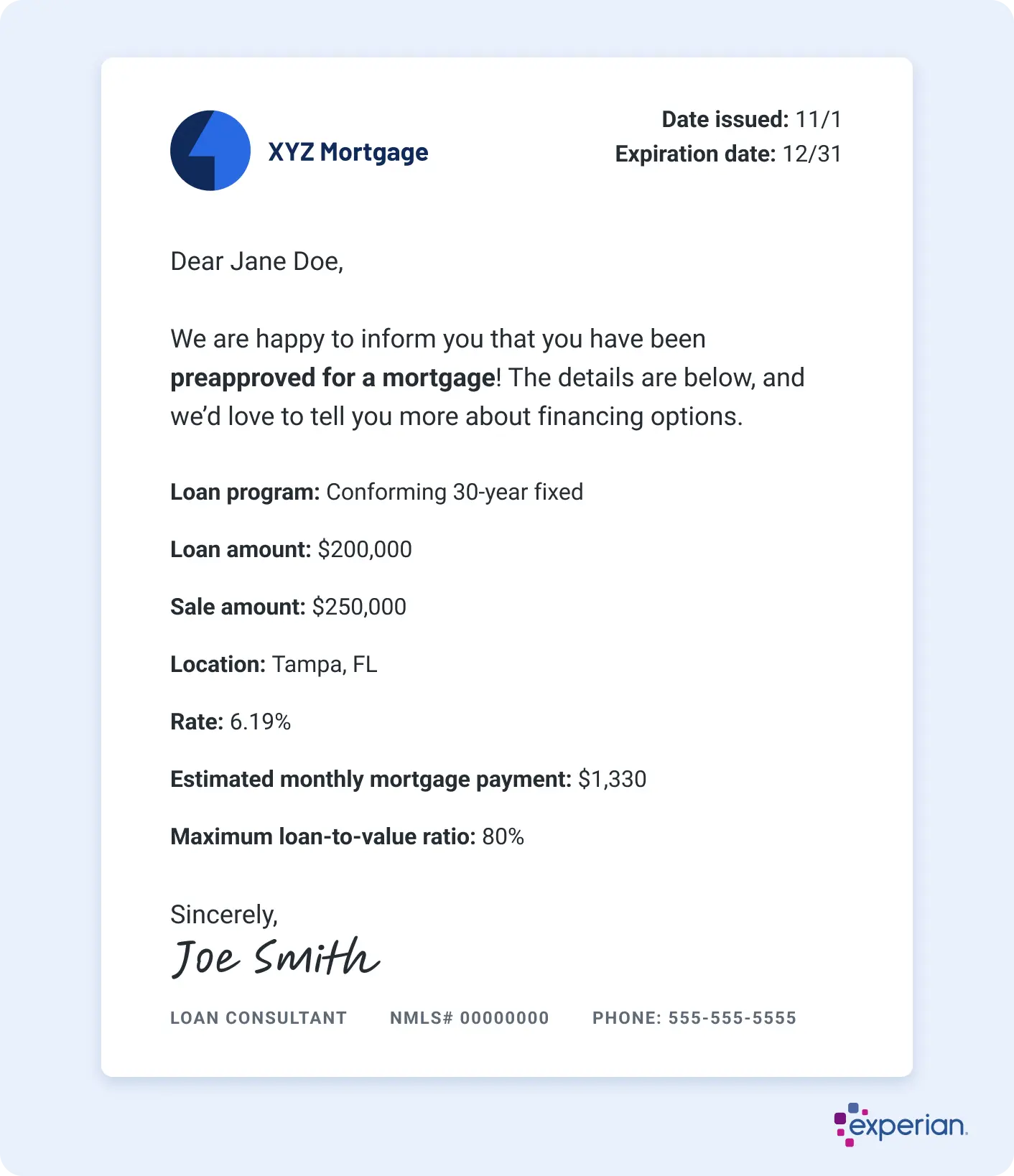

Every mortgage lender will have its own format, but you can expect to see the information listed above, plus a loan ID number. The letter might also include information about that particular lender's financing options, along with next steps and contact information if you choose to work with them.

Here's an example of what a preapproval letter may look like:

Do You Need a Preapproval Letter to Make an Offer?

You can make an offer without a preapproval letter, but including it can put more muscle behind your bid—especially in a competitive housing market. That's because it shows lenders that you've gotten the ball rolling on your home loan and will likely get approved for financing. That can set the stage for a smooth home sale with limited delays.

If it comes down to you and another buyer, you could get edged out of the sale if you don't have a preapproval letter.

Does Mortgage Preapproval Affect Your Credit?

In most cases, getting preapproved for a mortgage will have a small, temporary negative impact on your credit score because it often requires a hard credit inquiry. But this shouldn't deter you from getting preapproved with multiple lenders. If you do so within a brief time period—typically 45 days for FICO scoring models—it will be treated as a single inquiry.

How Do I Get a Preapproval Letter?

Every lender is different, but here's a closer look at how to get a mortgage preapproval letter:

- Provide the required documentation. Be prepared to provide a government-issued ID and Social Security number, along with documents to verify your financial situation. That includes proof of income, assets, debt and expenses. You'll also be asked about your down payment amount. If any funds have been gifted to you, expect to include a gift letter.

- Research several lenders. Shop around and compare potential mortgage lenders to work with. Be sure to look at mortgage rates, fees and customer reviews before making a decision.

- Apply for preapproval. Once you've identified a few lenders, you can visit their websites or reach out to them directly to submit preapproval applications.

- Compare preapproval letters. If all goes well, each lender should provide you with a preapproval letter—sometimes in a matter of minutes. Other lenders may take up to 10 days. You can then compare preapproval letters and decide which lender is the best fit. If you make an offer on a home, be sure to provide a copy of the preapproval letter. (Your real estate agent can help with this.)

How Long Is a Preapproval Letter Good For?

Most mortgage preapproval letters are valid for 60 to 90 days, although some expire after 30 days. You'll want to clarify beforehand so you know how much time you have to make a competitive offer on a home. To that end, it's wise to time your mortgage preapproval to when you plan on house hunting. That can prevent you from making an offer after your preapproval letter has expired.

The Bottom Line

Getting a mortgage preapproval letter is often the first step to securing a home loan. After you provide some basic financial information, the lender will likely check your credit and let you know how much you can expect to borrow—and at what interest rate. This information will be included in your preapproval letter. With this in hand, you can start house hunting and negotiating with home sellers.

Your credit score will be a key factor in getting preapproved. It can also affect your interest rate and, in turn, your monthly mortgage payment. You can get your FICO® ScoreΘ and credit report for free from Experian.

Curious about your mortgage options?

Explore personalized solutions from multiple lenders and make informed decisions about your home financing. Leverage expert advice to see if you can save thousands of dollars.

Learn moreAbout the author

Marianne Hayes is a longtime freelance writer who's been covering personal finance for nearly a decade. She specializes in everything from debt management and budgeting to investing and saving. Marianne has written for CNBC, Redbook, Cosmopolitan, Good Housekeeping and more.

Read more from Marianne