What Is an Authorized User on a Credit Card?

Quick Answer

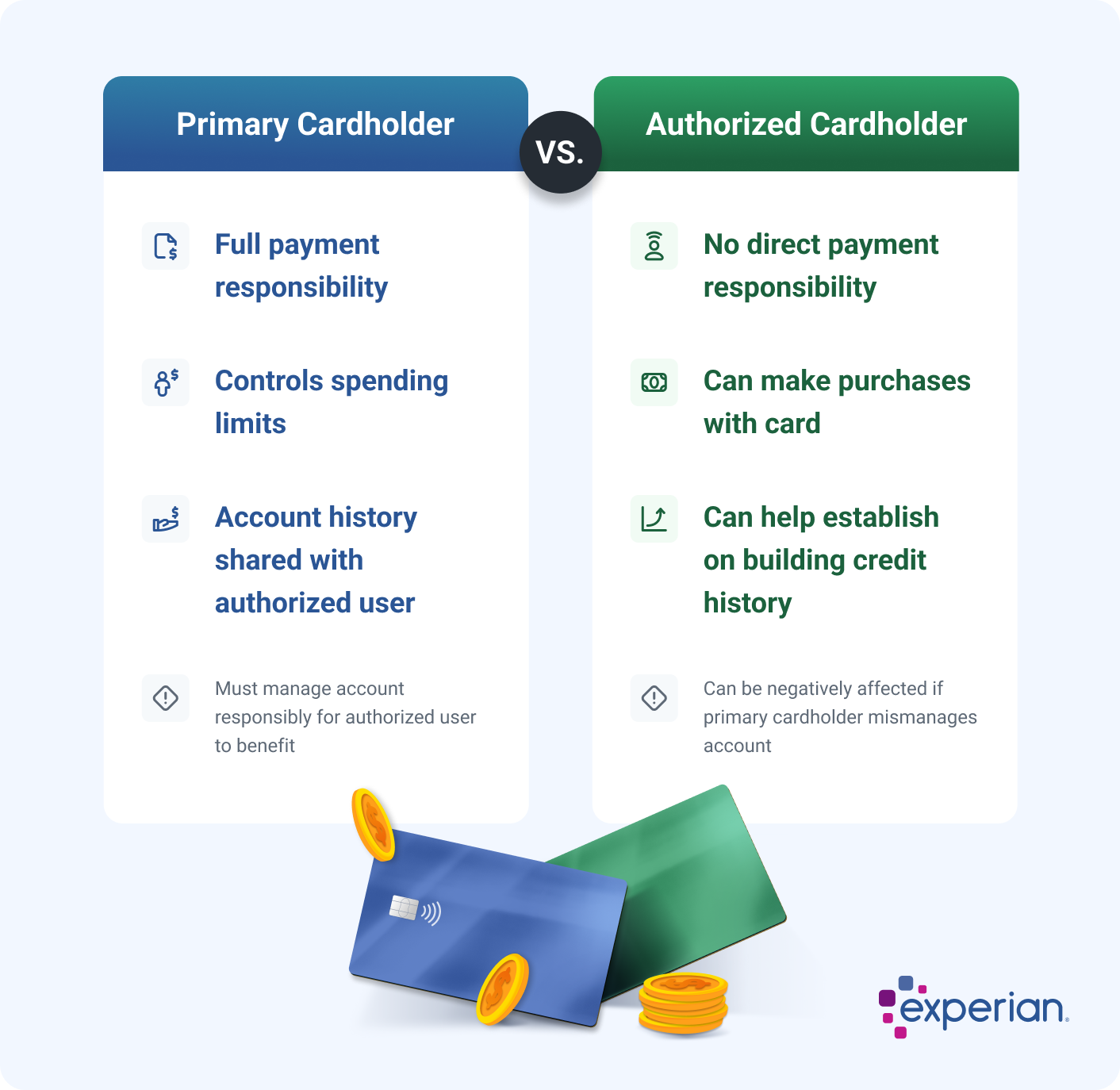

A credit card authorized user is someone who is added to another person's credit card account. An authorized user receives a card of their own to make purchases, but they aren't liable for payments.

An authorized user is an additional credit card holder who joins a primary cardholder's account, granting them the ability to make purchases. Authorized users typically get their own physical card. Becoming an authorized user can help you establish a history of good credit management and improve your score, but it all depends on how the primary cardholder manages the account.

If you're considering becoming an authorized user on someone's account, first make sure you understand the risks and expectations. Here's what you need to know.

What Is an Authorized User?

An authorized user is a person added to a credit card account by the primary cardholder. Becoming an authorized user on an account with a long history of on-time payments is one way to potentially improve credit—especially if you have a limited or damaged credit history.

To become an authorized user, you'll need the primary cardholder to add you to their credit card account. Keep in mind that there may be a fee for adding an authorized user. Cards that charge an annual fee might also charge an authorized user fee, which could be $75 or more.

Who Can Be an Authorized User?

Anyone can be an authorized user, as long as they meet the card issuer's age requirements. Adding an authorized user could be a good strategy when a trusted loved one needs help building credit.

For example, parents might choose to add their child to a card. Or, you could add your spouse, partner or a close friend as an authorized user.

What Responsibilities Does an Authorized User Have?

Officially, an authorized user is not expected to pay their portion of the monthly bill directly to the card issuer. While an authorized user can make purchases with their card, the responsibility for paying the monthly bills lies with the primary cardholder.

That said, to build good money habits and learn to manage credit, it may make sense to treat anything you charge to the card as your responsibility. Also, it's a good idea to make a plan with the primary cardholder for exactly how you'll use the card. For example, you might use the card to pay for a monthly subscription, then transfer money to the primary cardholder to cover the charge.

Some cards let the primary cardholder set spending limits for authorized users. But even if that's not possible, you can strike an informal agreement with the primary cardholder that you'll stick to a strict spending limit and repayment schedule.

Learn more: What Rights Do You Have as an Authorized User on a Credit Card?

Does Being an Authorized User Affect Your Credit?

Yes, being an authorized user can affect your credit. The credit card account is reflected on your credit report, which can help you make progress toward building a robust credit history.

Generally speaking, your own credit history will factor into how much your credit is affected by authorized user status. If you're new to credit, being an authorized user could have a bigger positive impact than it would for someone who has an established credit history or damaged credit.

When Being an Authorized User May Help Your Credit

If the credit card company reports authorized user activity to the credit bureaus, all of the credit card's characteristics will be reflected on your credit report, including:

- Credit limit

- Amount of credit being used (known as credit utilization)

- Payment history

If the card's been managed responsibly, meaning no missed payments or high levels of debt, an authorized user account has the potential to improve your credit scores.

Learn more: Will Being an Authorized User Help My Credit?

When Being an Authorized User May Not Help Your Credit

If the primary cardholder misses payments or uses a big portion of their credit limit, your credit may not improve. The impact of negative information depends on how the credit bureau views that history.

Experian won't include missed payment information on an authorized user's credit report. On the other hand, a high credit utilization—like a maxed-out credit card—will appear on their report and could damage the authorized user's credit.

If you're an authorized user on a credit card where the issuer doesn't report to all three credit bureaus, there will be no impact to the credit scores based on the credit reports that do not show the authorized user account.

Another situation in which becoming an authorized user may not help your credit is in the case of for-profit credit card piggybacking services. Paid piggybacking is an ethically questionable service in which someone who wants to build credit pays a fee to be added to a stranger's credit card, supposedly to benefit from the other card user's excellent credit history.

In reality, you can't trust that a stranger's credit habits will be to your benefit. On top of that, the legality of paid piggybacking is questionable, and piggybacking is both frowned upon by lenders and not likely to teach you good credit habits. That's why it's far better to instead ask a trusted loved one to add you as an authorized user, or look into alternative ways to improve your credit.

Learn more: What Is Credit Card Piggybacking?

How to Add or Become an Authorized User

To become an authorized user, ask a trusted family member or friend to add you to their account. The primary account holder will generally need some information to add you as an authorized user, such as your:

- Full name

- Date of birth

- Social Security number

- Address

Before you're added as an authorized user, make sure you can rely on the account owner to pay their bill on time every month. It's also important that they keep their credit utilization low—as a general rule, no higher than 30%—to avoid damage to their credit and yours.

How to Remove or Get Removed as an Authorized User

The primary account owner can remove an authorized user at any time. It's often possible to do so online, but calling your card issuer is your best bet if you're unable to find a way to do so on the issuer's website or mobile app.

You may also be able to remove yourself as an authorized user by requesting the change directly with the credit card issuer.

Keep in mind that your credit may be affected after the removal. If it was a card with a long history and you don't have any other accounts of similar age, or you have little credit otherwise, you may see a drop in your credit score.

Learn more: Will Removing Myself as an Authorized User Help My Credit?

Alternatives to Becoming an Authorized User

If your goal is to improve your credit, there are other options you could consider.

- Secured credit card: A secured credit card is a type of card that requires you to put down a security deposit. Your deposit typically becomes the credit limit for your card. By using the secured card responsibly, you may be able to graduate to an unsecured card down the line (and get back your deposit).

- Credit-builder loan: A credit-builder loan allows you to build your payment history by making monthly payments to a lender. At the end of the loan term, you get access to the balance you paid the lender. Credit-builder loans may come with interest and fees, but you may also get to keep some of the interest (called "dividends" on credit union loans) the money earns.

- Loan cosigner: If you're considering getting a personal loan to build credit but don't have the score to qualify, asking a loved one with good credit to cosign for you may help. Cosigners are legally responsible for the debt they sign for, so be sure your potential cosigner understands their obligation before going this route.

Learn more: How to Build Credit: A Comprehensive Guide

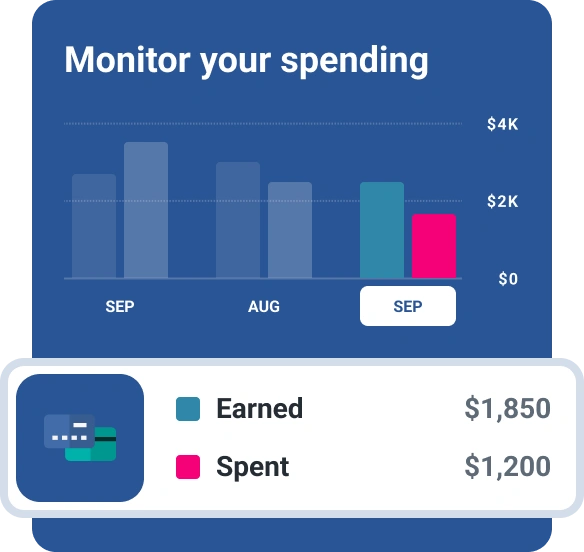

Managing Your Credit as an Authorized User

Even if authorized users aren't technically responsible for the credit card's balance, it's important that you take it as an opportunity to build good credit habits. That means sticking to a budget and having a clear plan for how you'll pay off purchases you charge to the card.

As you continue your credit-building journey, track your progress to see how your efforts are impacting your score. You can sign up for free credit monitoring through Experian to see where you stand. It's always important to keep an eye on your credit, but it's especially urgent when you're eager to build or improve it as an authorized user. Regularly check your credit report and score so you can determine if becoming an authorized user is helping your score grow.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Brianna McGurran is a freelance journalist and writing teacher based in Brooklyn, New York. Most recently, she was a staff writer and spokesperson at the personal finance website NerdWallet, where she wrote "Ask Brianna," a financial advice column syndicated by the Associated Press.

Read more from Brianna