What to Know Before Getting a Retail Credit Card

If you're a frequent shopper, you've heard the pitch dozens of times: "Sign up for our store credit card and save 5% every time you shop!" The discounts that often come with store credit cards may sound tempting, but you should think carefully before signing up. If you're considering a retail credit card, it's important to know that you can end up hurting your credit score and paying a higher interest rate than usual.

Retail credit cards typically come in two forms. There are store-only cards, also called closed-loop cards, which can only be used for shopping at the business that issued it. And there are co-branded retail credit cards, or open-loop cards, which can be used anywhere just like a regular Visa or Mastercard—though you usually get special perks when you use it at the retailer.

Store credit cards are becoming more popular among U.S. consumers: According to Experian data, retail credit card balances in the U.S. totaled $90 billion in the second quarter of 2019, and new account signups have increased 5% since 2018.

Store Credit Cards Have Higher Interest Rates on Average

One of the biggest downsides of store credit cards is that they usually charge much higher interest rates than other credit cards. The average credit card APR currently hovers around 17%, according to the Federal Reserve. But retail credit card APRs are far higher—as much as 10 percentage points higher or more—and they continue to increase annually. This means a retail card is a flat-out bad idea if you need to carry a balance since you'll pay dearly in interest.

Also, beware that some retailers promote credit cards with so-called 0% APR period offers to tempt you to sign up. Unlike a 0% intro APR card from a major credit card issuer, however, a store-only interest-free offer might require you to pay the full amount of deferred interest if you have any balance whatsoever at the end of the offer period.

Retail Cards Can Impact Your Credit Score

Just like any traditional credit card, a retail credit card can either harm or help your credit depending on how you use it. If you pay your bills on time and keep your balance as low as possible, this wise use of the card can help your credit score over time. If you keep the account open and in good standing for several years, it can give your credit a noticeable boost since longevity of accounts and on-time payments play a major factor in your credit score. If you haven't been able to qualify for a traditional credit card, getting a retail card and using it responsibly can be a great way to start building credit.

On the other hand, retail cards can also cause harm if used irresponsibly. If you make late payments, miss payments or carry a high balance (to the point that you're close to your credit limits), you can hurt your credit score.

It's Easier to Qualify Even if You Have Bad Credit

One big perk of retail credit cards: They can be easier to qualify for than traditional credit cards, especially if your credit isn't in great shape. The average FICO® ScoreΘ in the U.S. in the U.S. is 703, according to Experian data. While the average score for Americans who have both a retail card and traditional card is 728, the average score for those with only a retail credit card is 575. This data seems to show that store cards have less stringent credit requirements, so if you need access to credit or want to build your credit and can't qualify for a regular card, a store credit card could be a good option.

Retail Cards Have Lower Credit Limits

Another thing to be aware of before applying for a retail credit card is they typically have lower credit limits than traditional credit cards. This means if you carry a high balance, it might lead to a high credit utilization ratio, which is a measure of how much of your available credit you're using at any given time.

If your ratio is high, it looks riskier to lenders since you're using a large amount of your available credit, which may indicate you're struggling to pay down your debt. A credit utilization ratio above 30% will hurt your score, so keep it as low as possible (low single digits or zero if you can).

In addition to a relatively low credit limit, retail cards often carry higher fees than regular credit cards. Foreign transaction fees, cash advance fees and penalties might be higher than with a traditional card.

Some Store Cards Can't Be Used Everywhere

Before you say yes to a store credit card, make sure you know where it is accepted. As mentioned, some retail credit cards can only be used when you shop at its issuing store. If you shop there frequently and the card comes with great discounts and perks, it could be worth it if you pay the card off every month. But if you need a credit card you can use everywhere, a store-only card won't help you.

Other retail cards are co-branded, meaning they can be used like regular cards just about anywhere, but can still net you perks with the issuing retailer. Before you apply, make sure you understand which type of card you'd be getting.

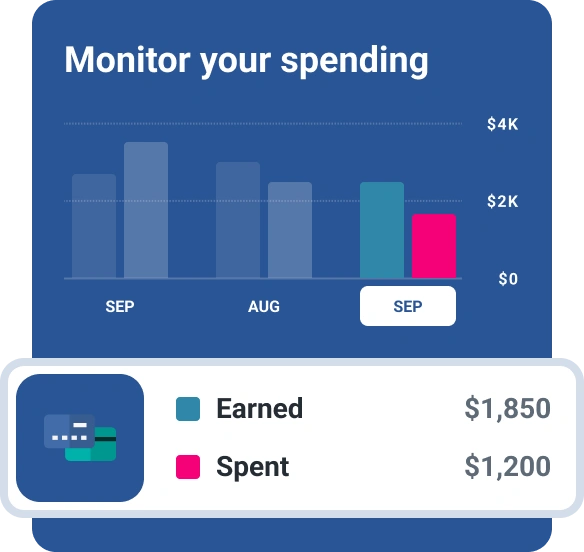

They Can Encourage More Spending

Store credit cards can offer great benefits, especially for those who shop at that retailer frequently. These cards usually offer compelling sign-up benefits, and many provide ongoing cash back rewards, special discounts or other exclusive perks. But this can also work against you. Retailers know it's hard to turn down a good deal, so they offer these perks knowing it will likely lure you to spend more at their store. If you already have a tendency to overspend, be wary of store credit cards, since they might encourage you to spend more in pursuit of rewards and discounts.

Check Your Credit Score First

If your credit score isn't great and you need a way to build or improve your credit but can't qualify for a regular card, getting a retail credit card can be a solid idea. But if you can qualify for a traditional card, that might be preferable since you'll likely enjoy a lower interest rate and lower fees. Not sure where your credit stands? Check your FICO® Score for free through Experian.

Get the rewards you deserve

Cash back? Miles? Points? Whatever suits your goals, we can help match you to personalized rewards card offers. Start with your FICO® Score for free.

See your offersAbout the author

Emily Starbuck Gerson is a freelance writer who specializes in personal finance, small business, LGBTQ and travel topics. She’s been a journalist for over a decade and has worked as a staff writer at CreditCards.com and NerdWallet. Emily’s work has appeared in CNBC, MarketWatch, Business Insider, USA Today, The Christian Science Monitor and the Chicago Tribute, among other websites and publications.

Read more from Emily Starbuck