Why Did My Minimum Payment Go Up?

Quick Answer

Your credit card’s minimum payment is based on your interest rate and your statement balance. If those go up, your minimum payment might increase as well.

The minimum payment due on your credit card can go up if your balance is growing or if you are late with a payment. Those are two common reasons, but there are others.

Because your minimum payment is based on your interest rate and current balance, when those increase, whether from additional purchases or from fees or interest, your minimum may also go up.

What Is a Minimum Payment on a Credit Card?

A minimum payment is the smallest amount you can pay a credit card issuer to keep your account in good standing.

Minimum payments are not typically an effective way to get out from under credit card debt, but if you have a particularly difficult or expensive month, they can give you some financial breathing room.

You can also consider automating at least the minimum payment on credit cards to avoid a late fee should you overlook a payment or otherwise fail to pay on time.

How Do You Find Your Minimum Payment?

Your minimum payment is listed at the top or on the first page of your credit card statement. It is typically listed under "Payment Information." There, you will also see how long it would take to pay off your current balance if you pay only the minimum and don't continue to add new charges.

How Are Minimum Payments Calculated?

There is no single, standard way that all credit card issuers calculate minimum payments. Two common ones, though, are:

- A flat percentage of the balance owed, usually between 2% and 4%

- A percentage (1% is typical) plus interest and fees for the billing period

In some cases, if your balance is below a certain required minimum of, say, $25 or $35, then payment would be due in full.

5 Reasons Your Minimum Payment Can Go Up

Among the reasons your minimum payment could increase:

- You missed a payment. Missing a payment due date, even by a day, can have consequences. Missing it entirely can result in having a late payment reported to the credit bureaus (this happens once it's at least 30 days late). That can hurt your credit standing and also result in late fees and a penalty interest rate. Late fees and penalty interest rates are part of your minimum payment in some calculations. But even if they are not, they will be added to the amount of money you owe.

- You paid late. Even if you pay within 30 days of the due date, there's a chance you'll be charged a late fee. It might also trigger a penalty interest rate. The best thing to do if a payment is overdue is to pay as quickly as you can and then reach out to the card issuer. If you've never been late before (or if it's been a very long time), you may be able to get the fee and penalty interest rate waived.

- You incurred more debt on the card than you paid off. If the total amount you owe on the card increases month over month, your minimum payment may increase as well, because the total amount you owe is part of the calculation.

- You took advantage of special financing through your card issuer. If your card issuer offers you, for example, interest-free payments over time, you would owe those monthly payments in addition to your regular minimum payment, so the least you'd need to pay to stay in good standing would be higher.

- You took a cash advance. Cash advances have fees that are added to your balance, and the interest rates on cash advances are typically higher than those on the rest of your balance. Interest also accrues immediately, without a grace period. As such, a cash advance could increase your minimum payment due.

The Bottom Line

If your credit card statement balance changes, your minimum payment might change as well. That's because minimum payments are calculated based on what you owe, so they are affected by your monthly spending, interest rates and possible fees.

If you carry a balance, it's important to pay at least the minimum payment. Paying more than the minimum will help you pay off debt more quickly.

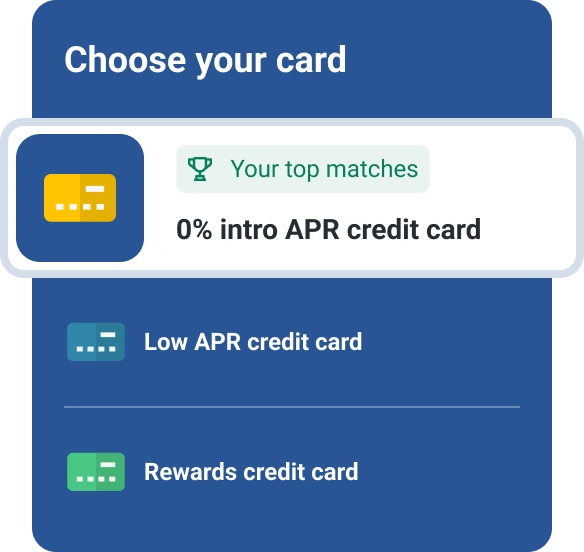

If you need to carry a balance on a credit card, it can be useful to find one that offers the lowest interest rate you can qualify for—possibly even one with an introductory 0% rate. Experian offers a free tool that can help you find a credit card that matches your needs and qualifications.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Bev O'Shea is a Georgia-based freelance journalist specializing in personal finance and consumer credit. Most recently, she was a staff writer at personal finance website NerdWallet, where she was an authority on credit reports, credit scores and identity theft.

Read more from Bev