Dispute online

Correct inaccuracies on your Experian credit file for free.

Additional resources

Disputing credit information online with Experian

Frequently asked questions

If you receive your dispute results and don't agree with them, you have a few options:

Contact the source of the information

Your best next step is to contact the data furnisher that originally provided the information to Experian. This is usually the creditor, lender or financial institution that provided the loan or credit initially, but could also be a collection agency or office of the government. You can find contact information for every data furnisher that provides information on your credit report by viewing your credit report.

Add a statement of dispute

A statement of dispute allows you to explain why you believe the information is inaccurate or incomplete. The statement will appear on your Experian credit report whenever it's accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select "Add a Statement" from the menu of dispute reasons.

Dispute again with relevant information

If you have additional relevant information to substantiate your claim, you can submit a new dispute with the additional documentation in the Dispute Center. Disputes with additional relevant information can also be submitted by mail to Experian.

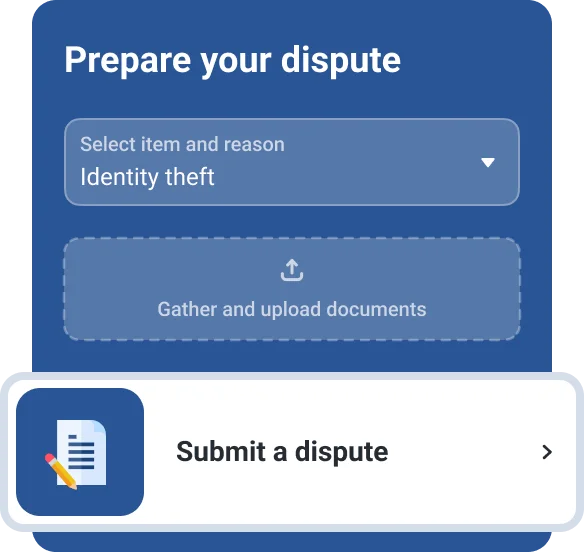

If you are disputing online: Experian's Online Dispute Center lets you easily add any required or pertinent documentation to a dispute. You can add documentation online when logged in on your computer or mobile device.

If you are disputing by mail: Please send copies (not originals) of any requested documentation, such as a utility bill or government-issued identification card. Experian cannot return copies from your mailed dispute request. Access the disputes form here and send your documents to:

Mail to:

Experian

Dispute by Mail

P.O. Box 4500

Allen, TX 75013

If you'd like to dispute information on your TransUnion or Equifax credit reports, please contact these bureaus directly.

Equifax Information Services LLC

Online: Equifax Online Disputes

Mail: P.O. Box 740256, Atlanta, GA 30374

TransUnion Consumer Solutions

Online: TransUnion Online Disputes

Mail: P.O. Box 2000, Chester, PA 19022-2000

Generally, a dispute should be resolved within 30 days with Experian's online dispute. We'll provide updates throughout the process and upon its completion.

Filing a dispute has no impact on your credit scores, but if the dispute is accepted and information on your credit file changes, it might. It depends on what you are disputing and the outcome of the dispute.

If you believe the information in your Experian credit file is inaccurate, Experian will look into it and correct or remove any inaccurate information or information that cannot be verified.

Accurate information cannot be deleted, so if you were late on a payment, that will remain on your report. Past issues or mistakes will come off your credit report after a certain amount of time depending on what the item is, and their impact to your credit scores will lessen over time.

Your Experian credit report includes information reported by creditors and lenders as well as public records, such as bankruptcies. Potentially negative information, such as missed payments, remain on a personal credit report for 7 years from the original missed payment. The exceptions are Chapters 7, 11 and 12 bankruptcies, which remain for 10 years.

Positive information may remain on a report indefinitely. Paid closed accounts generally display for 10 years. Requests for your credit history, also known as hard inquiries, remain on your personal credit report for 25 months (although these only impact your FICO® Score* powered by Experian data for one year).

Any account included in a bankruptcy remains on your Experian credit file for a maximum of 7 years from the date the bankruptcy was filed. The bankruptcy itself, listed in the public record information section of a credit report, remains for either 7 years from the filing date if it was a Chapter 13 or 10 years from the filing date if it was a Chapter 7, 11 or 12.

When your creditor turns over a seriously past-due account to a collection company, your credit report will show the status of the account as "collection." If you pay the account, the status will be "paid collection." The collection account will be removed 7 years from the date of the first late payment on the original account.

Creditors and other entities (also referred to as data furnishers) send us updated payment information routinely, but that does not guarantee that your most recent payment will show on your Experian credit file immediately. We update our records as soon as we receive the information from the data furnisher.

Revolving lines of credit, retail charge cards and bank credit card accounts are open-ended lines of credit. This doesn't mean that you still owe a balance; it only means that you have credit available. A "current" status tells creditors that the account is not past due. The report also tells creditors whether the account carries a balance.

By federal law, your Experian credit file must list all parties that have requested your information. According to the Fair Credit Reporting Act, businesses with a permissible purpose may review your credit information. Some examples of entities with permissible purpose are:

- Your current creditors who are monitoring your accounts

- Other creditors that want to offer you pre-approved credit

- An employer that wishes to extend an offer of employment

- A potential investor assessing the risk of a current credit obligation

Soft inquiries may be initiated by others, such as companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use credit monitoring services from companies like Experian. These inquiries do not impact your credit scores.

Hard inquiries are generally related to applications for new credit, and can affect your credit scores. They can stay on your credit report for up to two years, but they shouldn't affect your credit scores for more than a year. In most cases, inquiries cease to have any significant impact on scores after just a few months.

A divorce decree does not affect your contracts with creditors. You will need to negotiate repayment with each one. Learn more on divorce and how it affects your credit.

These statuses, either open or paid, are considered potentially negative:

- Missed payments

- Accounts included in bankruptcies

- Public record items

- Collection accounts

- Creditor-received deed

- Foreclosure proceedings started

- Foreclosed

- Claim filed with government

- Insurance claim filed

- Paid by creditor

- Paid in settlement

- Creditor cannot locate individual

- Repossession

- Defaulted on contract

- Voluntarily surrendered

- Charge-off

Learn more about Disputes