How to Get Your Credit Card’s Annual Fee Waived

Quick Answer

You might be able to get your credit card’s annual fee waived by contacting your card issuer to ask for an annual fee waiver or retention offer. Active-duty military members may also receive fee waivers.

Credit cards with annual fees may offer high rewards rates and enticing cardholder benefits. And some cardholders find the annual fee is worth paying for the added perks. However, if you haven't used the card as much as you planned, or you're looking for some extra savings, you can try to get your credit card's annual fee waived. Here's how.

How to Get a Credit Card Annual Fee Waived

There's no guaranteed way to get your credit card's annual fee waived, but there are a few methods that could be worth trying.

1. Contact Your Card Issuer Before It Charges the Fee

First, use the number on the back of your credit card to call your card issuer. Try to make this call a few weeks before the annual fee gets charged. You might want to ask for the retention or cancellation department, but you could also try speaking with the first representative who answers your call.

Explain why you want to keep the card and how you're going to use it, then ask if there's anything the person can do about the card's annual fee. You might ask for a fee waiver directly, or ask them to look for any retention offers on your account.

The representative might be able to waive your annual fee or offer you a statement credit or bonus rewards for keeping the card. These types of retention offers sometimes come with an additional requirement, such as spending a certain amount of money in the next few months.

If the person isn't able to offer anything, or you don't like the offer, you could ask to be transferred to someone who has more authority. Sometimes a supervisor or manager can give you an annual fee waiver or a better retention offer.

2. Try Contacting the Issuer Again Later

When your initial request for an annual fee waiver or retention offer isn't successful, you could try calling back later. Sometimes, different representatives may have access to different offers.

If you made your first call long before getting charged the fee, consider waiting a few days or weeks before calling back. There's a chance that your offers have changed in the interim.

Some credit card issuers will also refund part or all of your annual fee if you close the card within 30 or 60 days of getting charged the fee. Ask the card issuer if a refund is possible. And, if it is, you can try again after the fee appears in your current account balance.

3. See if You Qualify for Military Service Benefits

The Servicemembers Civil Relief Act (SCRA) and Military Lending Act (MLA) cap account fees and interest rates on existing and new credit cards and loans, respectively. These laws don't require credit card issuers to waive annual fees, but some credit card issuers choose to temporarily waive annual fees for active-duty military members.

Contact your card issuer to ask about military service annual fee waivers because eligibility requirements and benefits can vary. Some issuers might waive the fee for new applicants, while others apply the fee waiver to existing accounts as well. And sometimes, you might be able to get a previously charged annual fee reimbursed. The fee waivers may also apply to spouses or dependents who open a card or are an authorized user on one of your cards.

Active service members can also receive free credit monitoring from Experian and have the right to add an active-duty alert to their credit reports to help protect themselves from credit fraud while they're deployed.

4. Ask to Cancel Your Card

If all else fails, you can ask to cancel your credit card. Sometimes, this prompts the card issuer to give you an offer that you wouldn't receive otherwise. However, you should be prepared for the card issuer to close your card.

Review your card's terms to see what will happen. You can cancel a card that has a balance, but you'll still accrue interest, and promotional interest rates on the card might end early. Additionally, if you have rewards on the card, you might lose them when you close your account.

Alternative Ways to Avoid an Annual Fee

If you can't get the annual fee waived and don't receive alternative bonus offers, you might want to consider downgrading or canceling the card and applying for a card that doesn't have an annual fee.

Downgrade the Card

If the card issuer offers several cards that are part of the same program, you might be able to downgrade your credit card to an option without an annual fee. For example, there are often several credit cards for the same hotel brand or airline. Or, the card issuer might offer several rewards cards that are part of its rewards program.

Downgrading allows you to switch cards while keeping the same account. It can be a good option if you don't want to close and reapply for a credit card, but you often won't be eligible for an intro bonus when switching between cards.

Consider a No Annual Fee Credit Card

When you can't find a way to avoid the annual fee, closing the card might be the best option.

You could also look for a new credit card that doesn't charge an annual fee. You might find an option from a different credit card issuer that offers similar rewards rates or benefits. But even if the perks aren't quite as good, there are still many great cards that don't have annual fees.

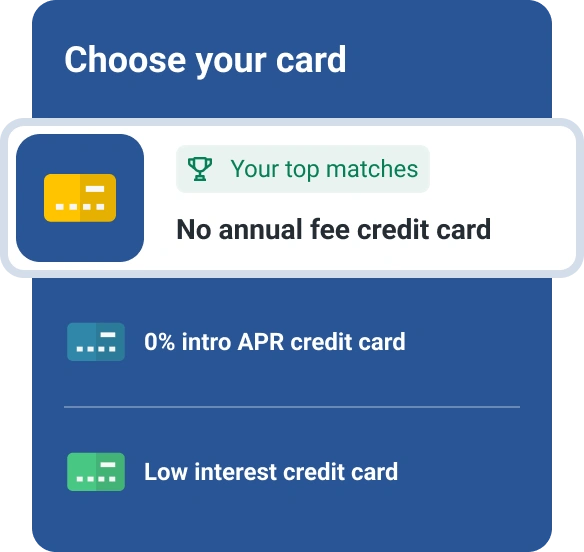

Check Your Credit and Get Matched With New Cards

Your credit history and score can affect your eligibility for a new credit card and the interest rate on your account. Check your credit score for free to see where you're at and learn how to improve your score. Whether you're looking for a card with or without an annual fee, Experian can also match you with card offers based on your unique credit profile.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Louis DeNicola is freelance personal finance and credit writer who works with Fortune 500 financial services firms, FinTech startups, and non-profits to teach people about money and credit. His clients include BlueVine, Discover, LendingTree, Money Management International, U.S News and Wirecutter.

Read more from Louis