An Essential Guide to Your First Credit Card

Quick Answer

If you're thinking about getting your first credit card, it's important to know about how credit cards work and how to use them responsibly. This guide can help you establish a strong foundation for credit card use.

Getting your first credit card can be a smart way to start building a credit history, add security and convenience to your everyday purchases and even earn rewards on spending you already do. But before you open your first account, it's important to understand how credit cards work and what to look for.

Here's everything you need to know about how credit cards work, how to apply and what to do to ensure responsible use.

What Is a Credit Card?

A credit card is a type of revolving credit account that lets you borrow, repay and borrow again up to a set limit.

Card issuers include banks, credit unions and other financial institutions, and most cards operate on one of four major payment networks: American Express, Discover, Mastercard or Visa. These networks process transactions by acting as the intermediary between merchants and card issuers.

How Credit Cards Are Used

Credit cards are most commonly used for everyday purchases in stores or online. You can also use them for:

- Cash advances: A cash advance involves withdrawing cash from an ATM or at a bank branch. While it's a convenient feature, it comes with an extra fee and a higher interest rate.

- Balance transfers: Many credit cards allow you to move existing debt from another account to your card. This can help you consolidate debt or take advantage of lower interest rates, but balance transfers typically come with a transfer fee and may have promotional rates that eventually expire.

How Interest and Billing Work

Most credit cards have variable interest rates. As of October 2025, the average credit card annual percentage rate (APR) is 21.98%, according to Curinos.

Each month, your credit card issuer will send you a billing statement that includes your statement balance, a list of transactions for the month, interest and fees, the minimum amount due and your due date, among other things.

The period between your statement date and your due date is called your grace period. It lasts a minimum of 21 days, and if you pay your full statement balance within this window, you won't owe interest. If you carry a balance, though, interest will accrue on the unpaid amount, and you may lose your grace period for the following month.

Tip: A card's grace period can help you avoid paying interest, but it only applies to purchases. If you request a cash advance or balance transfer, interest will accrue from the date of the transaction.

Learn more: Current Credit Card Interest Rates

How Credit Cards Affect Your Credit

Using a credit card responsibly can help you build a good credit score over time, but it takes consistency. Lenders want to see that you can borrow money and pay it back without issues, and your credit card activity becomes part of that story. Here are two key habits that matter most:

- Paying on time: Your payment history is the single most important factor in your credit score, and even one missed payment can have a lasting impact.

- Keeping utilization low: Your credit utilization rate shows how much of your available credit you're using at any given time. Lower utilization signals that you're managing credit wisely.

Practicing these habits month after month shows lenders that you're a reliable borrower. Over time, responsible credit card use can help you build a stronger credit profile, qualify for better terms and unlock more financial opportunities.

Learn more: Credit Score Basics: Everything You Need to Know

Understand These Important Credit Card Terms

Before you get started with your new card, it's important to understand the jargon that comes with the account. Here are some of the more common credit card terms and their definitions:

- Annual fee: Some credit cards charge an annual fee for the privilege of using the card. This fee is common among rewards credit cards that offer additional perks and certain credit cards for people with bad credit.

- APR: The APR on your card is the interest rate it charges if you carry a balance from one month to the next. Credit card APRs are typically variable, which means they fluctuate over time.

- Autopay: You can set up automatic payments from your bank account to avoid missing your due date. Credit card issuers typically allow you to choose how much to pay every month—the full statement balance, the minimum payment or a flat amount.

- Balance transfer: This feature allows you to transfer a balance from one card to another. It can be helpful if you're struggling with a high-interest balance and can enjoy a lower rate or even a 0% introductory APR promotion on another card.

- Billing cycle: This is the time period between two statement dates. Billing cycles typically last a month, and the balance at the end of each one is typically what's due for that period.

- Cash advance: Most credit cards allow you to access cash using your credit line. That said, cash advances typically come with an upfront fee and a higher interest rate. Additionally, they don't qualify for a grace period, so interest accrues immediately.

- Credit limit: The total amount you're allowed to charge to your credit card is your credit limit. If you try to exceed your limit, the card issuer will typically decline the transaction. Credit limits are determined by your credit history, income and other factors, and they can be increased or decreased depending on how you manage your card.

- Credit utilization rate: This is the percentage of your credit limit that you're using at a given time. A low utilization rate typically correlates with a higher credit score.

- Grace period: The period between your statement date and your due date is your grace period, during which you can pay off your balance without interest charges. Credit card issuers aren't required to offer one, but most do.

- Introductory APR: Some credit cards offer an introductory low or even 0% intro APR on purchases, balance transfers or both for a set period, which can range from six to 24 months.

- Late payment fee: If you miss your due date, your card issuer may charge a late fee, which can vary from card to card.

- Minimum payment: This is the minimum amount that's due every month on your account. Credit card issuers typically have different ways to calculate minimum payments, but it's generally a small fraction of your total balance.

- Penalty APR: If you miss payments, your card issuer may assess a penalty APR, which is higher than your regular APR. This higher rate may remain in effect for six months or more.

- Rewards: Many credit cards offer rewards in the form of cash back, points or miles. You can earn rewards in the form of a sign-up bonus or on your everyday spending.

- Statement balance: The statement balance is the amount due at the end of each billing cycle. Paying the statement balance, rather than the minimum payment, helps you avoid interest charges.

What Are the Best Credit Cards for Beginners?

There's no single credit card that's best for everyone, but certain options tend to work well if you're new to credit or have limited credit history:

- Secured credit card: A secured credit card functions like a traditional credit card but requires an upfront security deposit—usually equal to your credit limit—to secure your application. You can typically get the deposit back after several months of on-time payments or when you close the account.

- Hybrid debit-credit card: Also known as a "crebit" card, this hybrid option links to your bank account and works like a debit card but reports your payment activity to credit bureaus. These cards don't require a credit check or security deposit, making them accessible if you're just starting to build credit.

- Student credit card: Designed specifically for college students, a student credit card typically has more lenient approval requirements than standard cards. These cards often feature lower credit limits and may offer rewards while helping you build credit while you're in school.

- Unsecured starter credit card: Some starter credit cards don't require a security deposit at all, though some charge exorbitant fees and interest rates. If you're considering an unsecured beginner card, be sure to compare annual fees, APRs and other features to find the right fit for your situation.

How to Compare Credit Cards

With thousands of credit cards available in the U.S., each offering different features and benefits, it's important to shop around before making a decision.

First things first: Avoid applying for the first offer you come across, even if it seems appealing at first glance. Take time to research cards that align with your spending habits and financial goals. A quick online search can help you compare top options based on your preferences, or you can explore personalized credit card offers with Experian based on your credit profile.

Here are some different factors to consider when comparing credit cards:

- Credit score: There are credit cards available for consumers across the credit spectrum, but many are specifically designed for borrowers in certain credit score ranges. Make sure you're comparing cards where you have a good chance of approval. You can check your credit scores for free to understand where you stand.

- Rewards: If you're considering rewards credit cards, look at the rewards rates. Some cards offer a flat rate on everything, while others may offer tiered rewards based on spending categories or even rewards categories that rotate every few months. You'll also want to compare sign-up bonuses and what it takes to earn them.

- Card benefits: Think about what other perks you want with your credit card. If it's a 0% intro APR promotion, compare promotion lengths. If it's travel benefits, compare how valuable the perks are, how usable they are and whether they fit your travel habits.

- Annual fees: Not all credit cards charge annual fees, but among those that do, you'll want to compare how much each card costs and what benefits it provides that can make up for some or all of the yearly fee.

- Interest rates: If you plan on paying your balance in full every month, a credit card's APR doesn't matter much. But if you think you might need to carry a balance, a lower APR can outweigh many other features on a card.

- Acceptance: Most credit cards can be used just about anywhere in the U.S., but if you travel internationally, cards that run on the Visa and Mastercard networks are typically best. Also, note that many store credit cards are closed-loop, which means you can only use them at that store. If you want more flexibility, consider a card that doesn't have that restriction.

How Do Credit Card Rewards Work?

Not all credit cards offer rewards, but if you choose one that does, you'll typically earn rewards in the form of cash back, points or miles. Here's a quick summary of how each option works:

- Cash back: Earn rewards as a percentage of your spending. For example, a card offering 2% cash back gives you $2 in rewards for every $100 you spend. You can typically redeem cash back as a deposit to your bank account, statement credit, paper check or gift cards.

- Points: Earn a set number of points per dollar spent. Redemption options vary by card but often include cash back, statement credits, gift cards and travel bookings. While many points cards focus on travel rewards, some offer broader flexibility for everyday redemptions.

- Miles: Typically offered by travel credit cards, you earn a set number of miles per purchase. Depending on the card, you can redeem miles for flights with a specific airline or, with general travel cards, cover a variety of travel expenses, including flights, hotels, rental cars, cruises and more.

If a card offers tiered rewards, you'll receive varying rewards rates depending on your spending category. For example, a card may offer 4% back at grocery stores and 3% back on gas, but only 1% back on everything else.

Also, a few cash back cards offer rotating categories, which change every few months. You'll typically earn a higher rewards rate on these categories with a cap on how much you can earn.

How to Apply for a Credit Card

The best way to apply for a credit card is typically online, but you may also be able to do so in person at a local bank or credit union branch or over the phone.

If you're applying online, here are some basic steps you'll take:

- Visit the credit card issuer's website and review the card's features and terms.

- Click on the Apply button to start the application process.

- Fill out the application, which typically requires your name, address, contact information, Social Security number, date of birth, income and employment status, and your housing status and monthly payment.

- Read the terms and conditions of the card, including its interest rates, fees and other fine print.

- Submit your application.

The underwriting process typically only takes a few seconds, and you should receive a response shortly after your submission. There are three possible responses:

- Approved: If you've been approved, you'll receive the card within seven to 10 business days in most cases.

- Declined: If you've been declined, you'll receive an adverse action notice detailing the reason for the denial and your rights as a consumer.

- Pending: In some cases, the card issuer may want more information to complete the application or may refer it to a credit analyst for human review. You should receive a letter asking for certain documentation or a letter with the final decision.

Learn more: What to Do When Your Credit Card Application Is Denied

How to Use a Credit Card Responsibly

Credit cards can provide a lot of value, whether it's through helping build a positive credit history, the added security they provide or the rewards and benefits you can get.

But if you don't use your credit card responsibly, you can easily rack up a lot of high-interest debt, which can cause more harm than good. Here are some tips to help you use your new credit card wisely:

- Read the card agreement carefully to understand your account terms.

- Create a budget to avoid spending more than you can afford to pay off every month.

- Plan to pay your balance on time and in full each billing cycle. Using autopay can help make sure you never miss a payment.

- Keep your balance low relative to your credit limit to maintain a low utilization rate—some experts recommend keeping your utilization under 30%, but there's no hard-and-fast rule. The lower, the better.

- Check your online account and monthly statements to ensure that all of the transactions are accurate.

- Avoid overspending for the sake of rewards.

As you use your card responsibly, you'll be able to enjoy all the benefits it has to offer without most, or even all, of the potential pitfalls.

Learn more: Reasons to Pay More Than the Minimum on Your Credit Card

Frequently Asked Questions

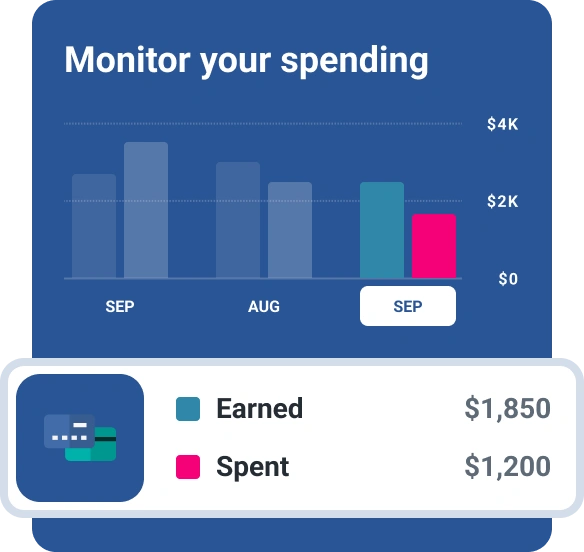

Monitor Your Credit to Track Your Progress

As you work to build your credit with a new credit card, it's important to monitor your credit so you can track your progress and see how certain actions impact your credit score.

Experian's credit monitoring service is free and offers access to your FICO® ScoreΘ and Experian credit report. Additionally, you'll get real-time alerts when changes are made to your credit report, so you can verify them for accuracy and address potential errors and fraud as they come up.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben