What Is a Chargeback?

Quick Answer

A chargeback is a charge that is returned to your credit card after you successfully dispute a transaction. You can initiate a chargeback with your card issuer when a merchant is unresponsive to your request to fix a charge or won’t refund your purchase.

It's a common scenario many credit cardholders face: You log in to your credit card account and notice a transaction that doesn't look right. Maybe it's an unauthorized charge, a double payment or an order you never received.

No matter the reason, the ideal resolution is for the merchant to fix the problem and give you a refund. But if they refuse or don't respond, it's nice to know you have a valuable tool in your back pocket: a credit card chargeback. A chargeback is a charge that is returned to your credit card after you successfully dispute a transaction or return the purchased item. Here's how a chargeback works and how you can request one.

What Is a Chargeback?

Credit cards are often lauded for the points, miles, cash back rewards and travel perks they offer. But one of the most overlooked benefits of using a credit card is the consumer protection it gives you when there's a problem with a transaction. Specifically, credit cards allow you to request a chargeback.

The Fair Credit Billing Act (FCBA) gives you the legal right to dispute a credit card charge and have it reversed. You can ask your card issuer to reverse a charge when you can't resolve the problem directly with the merchant. If your card issuer grants your request, the payment is credited back to your account so you don't end up paying for an unauthorized, unsatisfactory or fraudulent transaction.

Chargeback vs. Refund

While both a chargeback and a refund can help you reverse a charge, the difference between the two lies in who is issuing the refund. With a chargeback, you'll receive credit from your card issuer, whereas a refund occurs when the merchant gives your money back.

Example: You order a laptop that you never receive. You try contacting the merchant to resolve the issue. If they send the money back to your account, that's a refund. But if the store ignores your request or refuses to return your money, you can initiate a chargeback with your card issuer to reverse the charge.

Learn more: How Do Credit Card Refunds Work?

How Does a Chargeback Work?

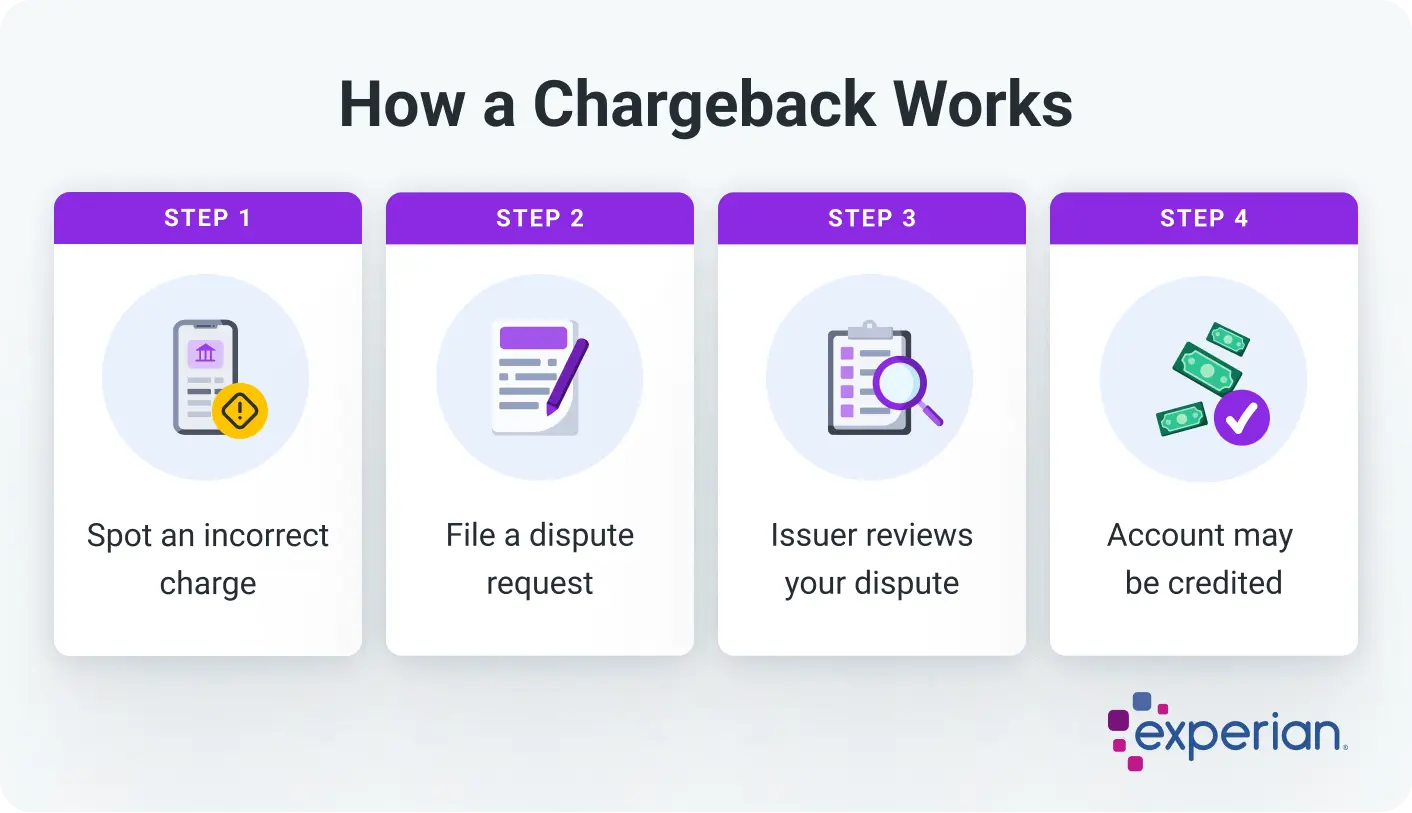

Here's how a chargeback works and what typically happens when you file a dispute:

- A transaction posts to your account. You notice there's a charge on your account that shouldn't be there. For example, the charge could be fraudulent, the result of a billing error or for a product you never received.

- You file a chargeback dispute. You generally have 60 days to file a dispute for a billing error or fraudulent purchase and up to 120 days for product or service complaints, but timelines can vary depending on the card issuer. You can contact your card issuer by phone, email or online, but a written request may afford you more protections (more on that in a moment).

- Your card issuer investigates your claim. You may receive a temporary, or provisional, credit while your card provider looks into the matter, but not always. The card issuer may contact the merchant's bank, called the acquiring bank, and the card network, such as Visa or Mastercard, to verify the transaction. The merchant can either accept the chargeback or dispute it by providing evidence that the charge was valid.

- You receive a decision. According to the FCBA, your issuer must complete its investigation within two billing cycles and no later than 90 days after receiving your billing error notice. Ultimately, you'll either be found responsible for paying the transaction, or the amount will be permanently credited to your account.

Issuers win about 75% of chargeback disputes on your behalf, according to an analysis by Chargeback Gurus of Mastercard's 2025 State of Chargebacks Report. With such a high success rate, filing a chargeback claim is worth pursuing if you have an unauthorized charge on your account.

When to Ask for a Chargeback

You should only ask for a chargeback when it's truly warranted. Generally, you should contact the merchant first and try to resolve the issue directly. But if that doesn't work, you have the right to file a chargeback with your card issuer. Here are some common scenarios when you might ask for a chargeback:

- Fraudulent charges: If someone uses your card or account information without your authorization, you can file a chargeback to reverse the charge. This is the very reason chargebacks exist: to help protect you from fraud. You have the right to take additional steps to protect your finances, such as adding fraud alerts to your credit reports or signing up for identity theft protection.

- Merchant issues: You might file a chargeback if you never receive a product or service you purchased. You can also request one if you're double-charged or billed the wrong amount. Another common reason is if a subscription service keeps billing you after you've canceled.

- "Friendly fraud": This common scenario occurs when cardholders mistakenly dispute legitimate transactions. In these cases, the cardholder likely made the purchase but doesn't recognize it, or someone in their household used the card without their knowledge. Before filing a chargeback dispute, make every effort to make sure the purchase was legitimately made by you or someone in your household.

Tip: Chargebacks should be used judiciously. They're designed to help you when you're dealing with real fraud or merchant issues. Don't ask for a chargeback if you simply have buyer's remorse when the merchant has a clear no-return policy.

How to File a Chargeback

The chargeback process can vary from one credit card company to another, but it generally works like this:

- Review your statement. Check receipts and recent purchases to make sure the charge is a legitimate one.

- Try resolving it with the merchant first. It may be faster to contact the store or business directly and attempt to resolve the issue.

- File a dispute. If the merchant refuses to refund your purchase or doesn't respond to your request, you can quickly file a dispute with your credit card issuer online, through your mobile app or by phone. But for full protection under the FCBA, you'll want to send a written notice to your card issuer within 60 days of the charge posting to your statement. Provide your account details, the transaction amount and a short explanation of the issue. You should also submit receipts, copies of merchant emails or chats and any other documents that support your claim.

- Receive a provisional credit. Your credit card company will typically issue a provisional credit while they're reviewing your dispute. This credit equals the full amount of the transaction you're disputing.

- Wait for a resolution. The credit card company has 30 days to send you a letter acknowledging receipt of your dispute. They may ask you for additional details or documentation, which you'll need to provide within a certain time frame, usually around 30 days. From there, the process must be resolved within two billing cycles, or up to 90 days, after the issuer receives your letter.

If your card issuer grants your chargeback request, the provisional credit becomes permanent. But if they deny your claim, they must send you a letter stating the amount you owe and when it's due.

Tip: If your dispute is denied, you can appeal the process within the time period you need to submit payment or 10 days after getting the decision, whichever is later.

Learn more: How to Dispute a Credit Card Charge

Does Disputing a Charge Hurt Your Credit?

No, disputing a charge doesn't affect your credit score. You're merely asking your credit card issuer to investigate a transaction that shouldn't be on your credit card bill. That said, the account might appear as in dispute in your credit report, which could make a potential lender think twice when deciding whether to approve you for a loan.

What could hurt your credit is if you don't pay the undisputed charges or at least the minimum payment during the chargeback process. In that case, your card issuer may report late or missing payments to the credit bureaus, which negatively affect your score. Your best bet is to keep making timely payments to avoid damaging your credit while you're waiting for the chargeback to be resolved.

Frequently Asked Questions

Protect Your Credit and Spot Suspicious Activity Early

Chargebacks offer a layer of protection against fraudulent transactions and purchases that fail to meet your expectations. Of course, you should try to work with the merchant first, but if that doesn't work, it's nice to know you have recourse.

While a chargeback is a valuable tool to reverse unauthorized charges to your account, you can protect yourself even further with free credit monitoring from Experian. You'll receive alerts to new accounts, credit inquiries and other suspicious activity on your Experian credit report so you can resolve issues early.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Tim Maxwell is a former television news journalist turned personal finance writer and credit card expert with over two decades of media experience. His work has been published in Bankrate, Fox Business, Washington Post, USA Today, The Balance, MarketWatch and others. He is also the founder of the personal finance website Incomist.

Read more from Tim