How to Get a Credit Card if You Don’t Have a Credit History

Quick Answer

Your credit card options may be limited if you don’t have a credit history. However, you may qualify for a secured credit card, store card or student credit card.

Getting a credit card can be challenging when you're just getting started. If you don't have a credit history, consider applying for a secured credit card or card designed for credit newbies.

Can You Get a Credit Card With No Credit?

Yes, you can get a credit card with no credit history, but your options may be more limited compared to someone with an established credit history. Some starter credit cards require a security deposit while others are geared toward students or have limited use.

Without a credit history, credit card issuers can't predict your payment habits. Because of this, they typically charge more interest and limit how much credit they'll extend you. Fortunately, after several months of responsible use, you can begin building a credit history and eventually qualify for a broader range of credit cards.

Learn more: Ways to Build Credit if You Have No Credit History

Credit Cards for People With No Credit History

There are several types of credit cards that are well-suited for people without a credit history.

Secured Credit Card

A secured credit card works like a regular credit card, but requires a refundable security deposit as collateral, often as low as $200. Your security deposit typically becomes your credit limit, so a $200 deposit equals a $200 credit limit.

The deposit lowers the risk for the card issuer and makes approval more likely. As long as you make your payments on time, your deposit will be refunded when you close the account in good standing. Some issuers refund the deposit when the card automatically graduates to an unsecured version.

Be sure to keep up with your payments. If you default, the card issuer will keep the deposit to cover the balance.

Store Credit Card

A store credit card is offered through a retailer and typically can only be used with that brand or its partner. Because they have lower credit requirements, store credit cards are often easier to qualify for without a credit history.

These cards often include perks such as discounts, rewards, free shipping and special financing. However, they generally carry higher interest rates and lower credit limits compared to traditional credit cards.

Student Credit Card

If you're a college student, you may qualify for a student credit card. These cards usually require proof of enrollment in a two- or four-year college or university. While credit limits may be low, many student cards offer benefits like low introductory interest rates and rewards.

Some card issuers restrict the number of credit cards you can open as a student, helping prevent you from taking on too much credit too quickly.

How to Get a Credit Card With No Credit History

Follow these steps to get a credit card without a credit history.

Decide on the Best Card

Since your options are limited, start with the type of credit card most likely to approve you. Student credit cards are often easiest for college students, while secured credit cards work well for anyone. Many card issuers allow you to prequalify with no credit check. This can give you an idea of your approval odds before applying.

When comparing credit cards, look at the annual fee, interest rate and reward programs. Make sure the card reports to all three major credit bureaus so your payment history helps you build credit.

Learn more: What Credit Card Should I Get?

Apply

You must be at least 18 to apply for a credit card. If you're under age 21, issuers may require proof of your income or a cosigner.

Once you've chosen a credit card, you can apply online in minutes. Be prepared to provide:

- Your name and address

- Date of birth

- Social Security number

- Monthly or annual income

- Housing costs

- School details if applying for a student card

Approval decisions are often instant. If you're applying for a secured credit card, you'll also make your security deposit at this stage.

Tip: Avoid applying for too many credit cards in a short period of time. Each application results in a hard inquiry, which can lower your approval odds.

How to Establish Credit With a Credit Card

Opening a credit card is only the first step. To build strong credit:

- Read the terms. Understand the interest rate, fees, rewards and other features of your credit card so you know how to use it and minimize your costs.

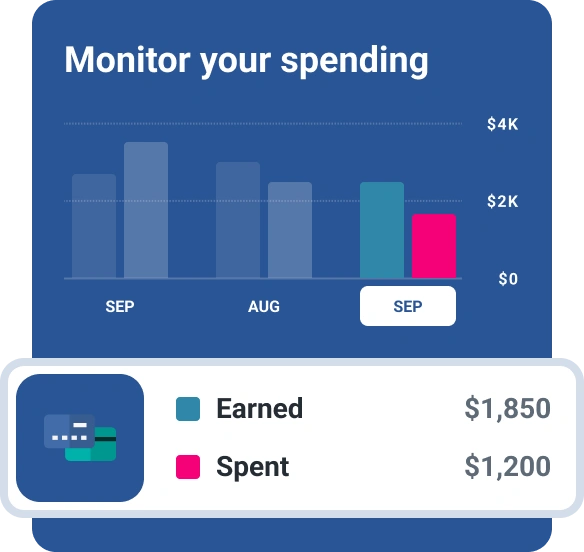

- Use your card regularly. Make small purchases that you can easily repay. Gas, groceries and streaming subscriptions are a good place to start. Maintaining reasonable spending habits keeps you out of debt.

- Make timely payments. Each month you have a balance, you'll be required to make a monthly payment by a specific date. Pay at least the minimum by the due date to build a positive payment history and avoid late fees.

- Keep a low balance. Ideally, you should pay in full each month to avoid interest. If you carry a balance, keep it low relative to your credit limit to protect your credit score.

- Upgrade or expand your cards. After several months of responsible use, many secured credit cards may graduate you to an unsecured card. You may also qualify for better credit cards as your credit grows.

Learn more: How to Build Credit: A Comprehensive Guide

What to Do if You're Denied for a Credit Card

Getting a credit card is challenging when you don't have a credit history. If you're denied a credit card, there are steps you can take to improve your approval odds with your next application.

Review the Denial Letter

Within a few days of the decision, the credit card issuer will send an adverse action letter explaining why your application was denied and the credit bureau report used in the decision. Reviewing this letter can help you understand what to do next time you apply.

Common reasons for being denied include:

- No credit history

- Low income

- Too many recent applications

Ask for Reconsideration

If you think there was a mistake, ask the credit card issuer to reconsider your application. Providing additional information, like another source of income, can help. After reviewing your request, the card issuer may reverse their decision and approve your application.

Wait Before Reapplying

Credit card applications add a hard inquiry to your credit report, which can hurt your chances of getting approved if you apply again too soon. Wait three to six months before applying again.

Your approval odds may be better with a different type of credit card. If you applied for a traditional credit card, consider applying for a secured credit card next time. Or, choose a student credit card if you're enrolled in a college or university. You may have to look at alternative ways to establish your credit history before you can be approved for a credit card.

Alternative Ways to Build Credit

A traditional credit card isn't the only option to build your credit. If you're having trouble getting approved, here are some other possibilities.

Get an Alternative Credit Card

Some newer fintech cards don't require a traditional credit history. Instead, the card issuer may look at your income and bank activity. These cards may operate more like charge cards, requiring you to pay your balance in full each month. The advantage is these cards often report to the major credit bureaus, helping you establish a credit history. However, features, fees and approval criteria can vary, so take time to compare options.

Become an Authorized User

A family member or friend can make you an authorized user on one of their credit cards. When you're added as an authorized user, the account's credit history is added to your credit report, establishing a credit history that can help you get approved for your own credit card.

Tip: Be careful—if the cardholder misses payments or carries a high balance, it will affect your credit too. For the best chances of benefiting your credit history with your authorized user status, choose someone with good credit and a positive history with the credit card.

Get a Credit-Builder Loan

When you get a credit-builder loan, the lender places the loan balance in a savings account and you make fixed monthly payments to pay off the loan balance. Loan amounts are typically small—like $1,000 or less—and repayment terms range from six to 24 months.

Once you're approved for a loan, your monthly payments are reported to the credit bureaus, which can help you build credit. At the end of the repayment term, you get the loan balance back plus any interest you've accrued.

Learn more: Credit-Builder Loans vs. Secured Credit Cards: Which Is Better?

Use Your Monthly Bills

Add certain on-time payments to your Experian credit report with Experian Boost®ø. This includes bills like utilities, phone and certain streaming services as well as eligible rent and insurance payments (not including health insurance). It's a quick, simple way to establish your Experian credit history and could help you improve your credit with bills you're paying anyway.

Learn more: Alternatives if You Can't Get a Credit Card

Frequently Asked Questions

The Bottom Line

There are several options for getting a credit card if you don't have a credit history. You can typically start with a secured, store or student credit card. If you have trouble getting approved, consider an alternative, like becoming an authorized user, to establish credit before applying for a traditional credit card.

After six to 12 months of timely payments, you can check your FICO® Score for free through Experian. From there, continue to check your credit regularly to see your progress and confirm your credit activity is reported accurately.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya