7 Different Types of Credit Cards

Quick Answer

There are credit cards suited for a variety of needs and preferences. Different credit cards let you earn rewards, save money on interest, access travel perks, reward brand loyalty or help you build credit.

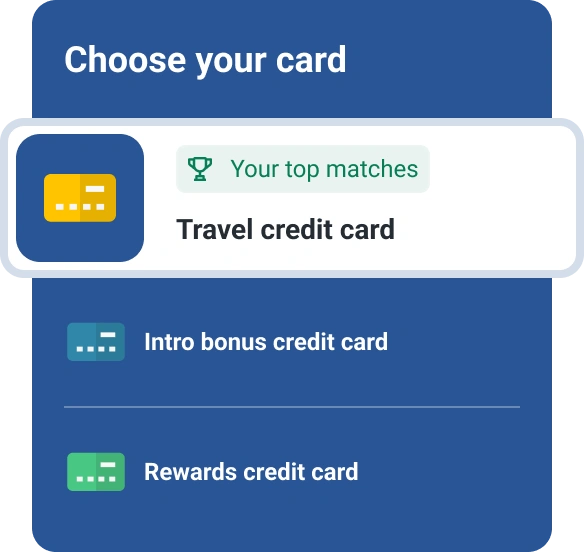

There are many different types of credit cards you can choose from. Finding the right card often depends on how you plan on using the credit card and which cards you can qualify for. Understanding how different types of cards work and who they're best for can be helpful when you're comparing options.

Here are seven common types of credit cards to consider.

1. Rewards Credit Cards

How rewards cards work: Rewards credit cards allow you to earn cash back, points or miles on your purchases. Depending on your card's terms, you may earn the same amount of rewards on all purchases or receive higher rewards in specific categories, like dining, groceries or gas. Over time, your rewards accumulate and can be redeemed for cash back, travel, gift cards or other options depending on the card's rewards program.

Many rewards cards offer an intro bonus, also called a sign-up bonus, where you can earn extra rewards if you meet a minimum spending requirement within the first few months of opening your account. It's important to note that you'll only earn rewards on purchases, not balance transfers or cash advances.

This type of credit card is best for:

- People who want to earn rewards on their purchases

- People who pay their balance in full each month

Learn more: Are Credit Card Rewards Worth It?

Cash Back Credit Cards

How cash back cards work: Cash back credit cards allow you to earn cash rewards on your spending. You can typically redeem these rewards as a statement credit, gift card, check or deposit into your bank account.

The way you earn rewards varies by credit card. Some cards offer a flat rate on all purchases, while others offer bonus rewards in specific categories. These bonus categories can be fixed or rotate periodically, helping you maximize rewards based on your spending habits.

This type of credit card is best for:

- People who want to earn cash on their everyday spending

- Those who spend more in specific categories, like gas or dining

- Those who want the benefit of earning rewards but don't want to keep track of specific rewards categories

Learn more: How Do Cash Back Credit Cards Work?

Travel Credit Cards

How travel cards work: With a travel credit card, you can earn points or miles that can be redeemed for flights, hotel stays, rental cars and other travel-related expenses. These rewards may be transferred to other loyalty programs, depending on your card's terms. You can typically earn rewards on all purchases, with higher rewards on travel-related purchases.

In addition to earning rewards, many travel credit cards offer valuable travel benefits like airport lounge access, reimbursement for expedited security fees and trip insurance. These perks enhance your travel experience while helping you save money.

This type of credit card is best for:

- Frequent travelers who want to earn points or miles on travel purchases

- People who can benefit from travel perks like airport lounge access

Learn more: Are Travel Credit Cards Worth It?

2. Low Interest Rate Credit Cards

How low interest cards work: Low interest credit cards offer a lower-than-average annual percentage rate (APR), allowing you to save money on interest when you carry a balance. These cards focus on cost-saving benefits and may offer fewer features and rewards compared to other credit cards. The main advantage of a low interest rate credit card is helping you manage debt and reduce the amount of interest you pay over time.

This type of credit card is best for:

- People who may need to carry a balance

- People who want to minimize interest charges

- Those with good to excellent credit, since they're more likely to qualify for the lowest rate

Learn more: What Is a Low Interest Credit Card?

Balance Transfer Credit Cards

How balance transfer cards work: A balance transfer credit card offers a promotional APR on balances transferred to the card, usually within the first few weeks of account opening. Most cards charge a balance transfer fee, which can be either a flat fee or a percentage of the transferred amount. Some balance transfer credit cards offer a low promotional balance transfer fee during the promotional period.

Paying off the balance transferred during the promotional period is key to maximizing your interest savings. Once the introductory period expires, the standard balance transfer APR will apply to any remaining balance.

This type of credit card is best for:

- People who want to pay off higher-interest credit cards

- People who can pay off a transfer balance during the promotional period

Learn more: Pros and Cons of Balance Transfer Cards

0% Intro APR Credit Cards

How 0% intro APR cards work: An 0% intro APR credit card offers an initial interest-free period on balance transfers, purchases or both when you open an account. This 0% APR period typically lasts anywhere from 12 to 21 months. During that time, your balance won't accrue interest.

After the introductory period expires, the standard APR will apply to any remaining balance and new purchases.

This type of credit card is best for:

- People who want to spread out payments on a large purchase

- Those looking to consolidate other higher-interest credit card debt into one payment with no interest for the introductory period

Learn more: How Do Intro 0% Credit Cards Work?

3. Student Credit Cards

How student cards work: Student credit cards offer features and benefits that cater to college students. They're typically easier for students to get approved for, but may require proof that you're enrolled in a college or university. Student credit cards may have lower credit limits, but often offer rewards and perks that cater to student spending.

This type of credit card is best for:

- College students who want to establish or build credit while in school

- Students who can't qualify for other credit cards

Learn more: How Is a Student Credit Card Different From a Regular Credit Card?

4. Secured Credit Cards

How secured cards work: Secured credit cards require a security deposit that often becomes your credit limit. This deposit lowers the card issuer's risk and makes it easier to get approved if you have no credit history, limited credit experience or poor credit. As long as you maintain a positive payment history, the deposit is usually refundable when you close the account or upgrade to an unsecured credit card.

When used responsibly, secured credit cards can be an effective tool for building or rebuilding your credit, provided the card is reported to the three major credit bureaus (Experian, TransUnion and Equifax).

This type of credit card is best for:

- People who need to establish or rebuild their credit

- People who've recently been denied a credit card because of their credit history

Learn more: What Is a Secured Credit Card?

5. Store Credit Cards

How store cards work: Store credit cards are issued by retail stores and offer rewards and benefits tailored to shopping with that particular retailer. They can be easier to qualify for than other types of cards.

Store cards may offer exclusive discounts and special financing offers for cardholders. Special financing with store credit cards is typically deferred interest, where you need to pay off your balance within a specified time period or you'll be charged interest on your entire purchase—not just the remaining balance.

This type of credit card is best for:

- Frequent shoppers at specific retailers

- People who need to build or rebuild their credit

Learn more: What to Know Before You Apply for a Store Credit Card

6. Co-Branded Credit Cards

How co-branded cards work: Co-branded credit cards are a collaboration between a credit card issuer and specific brands, like an airline, hotel chain or retail store. Unlike some store credit cards, co-branded credit cards can be used anywhere when they're associated with a major processing network.

These credit cards provide rewards and benefits tailored to the affiliated brand, often offering higher rewards on purchases made with that brand. Redemption options are typically focused on the brand's products. For instance, you may be able to redeem points for a gift card for the co-branded retailer, but not for a gift card from another retailer.

This type of credit card is best for:

- People who frequently shop with specific brands or retailers

- People who want perks, discounts or loyalty status with their favorite brands

Hotel Credit Cards

How hotel cards work: A hotel credit card offers rewards and perks on hotel stays with a specific hotel chain. You can use the card for all purchases, usually earning higher rewards on hotel reservations and a flat rate on all other purchases. Card ownership and rewards points can help you earn elite status in the hotel's loyalty program. This status can offer valuable benefits like room upgrades or late check-out.

This type of credit card is best for:

- People who frequently stay at a particular hotel chain

- People who want access to perks like free nights and room upgrades

Airline Credit Cards

How airline cards work: Airline credit cards offer rewards and benefits that are tailored to travel with a specific airline. Purchases earn miles for every dollar spent, with more miles offered on purchases made directly with the airline. These miles can be redeemed for flights and other airline perks like airport lounge access and seat upgrades. Your spending can help you achieve elite status with the airline's frequent-flier program, unlocking more benefits like priority boarding, waived baggage fees and discounts on in-flight purchases.

This type of credit card is best for:

- Frequent fliers who are loyal to a specific airline

- People who want to access airline-specific perks like free checked bags and priority boarding

- Frequent fliers who want to reach elite status sooner

Learn more: 12 Benefits to Look for in an Airline Credit Card

7. Business Credit Cards

How business cards work: Business credit cards are designed to meet the needs of businesses by offering business-specific features. These cards typically come with higher credit limits, employee cards and expense management tools. They often include rewards categories that align with common business purchases, such as online advertising, office supplies and travel.

This type of credit card is best for:

- Small business owners looking to manage and track business expenses

- Business owners who want to streamline employee spending

Frequently Asked Questions

The Bottom Line

Choosing a credit card can be tough, even after you've narrowed down the type of credit card you want. Just take your time, compare the perks and offers you receive, and select the one that feels right for you at the time. You can always switch cards later if you decide you want different benefits.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya