What Are Subprime Credit Cards?

Quick Answer

If you have poor credit, subprime credit cards can help you access credit and rebuild your credit history when used responsibly. But they typically have high interest rates and fees that make them risky if you don’t have a plan for paying your bill.

Having a poor credit history doesn't automatically disqualify you from getting a credit card, but top-tier cards with generous rewards programs, low interest rates and other perks will probably be out of reach. You'll have a better chance of qualifying for a subprime credit card designed for people without a stellar credit history.

Subprime credit cards often have higher interest rates and fees that could worsen your financial situation if you don't have a plan for paying your bill each month. So it's important to understand how they work, the benefits and the risks before getting one. Here's what you need to know.

What Is a Subprime Credit Score?

Subprime credit scores typically refer to a FICO® ScoreΘ of 300 to 669 or a VantageScore® credit score of 300 to 600. FICO® Scores of 300 to 669 fall in the "poor" and "fair" score ranges.

People with subprime scores often have high credit utilization or debt-to-income ratios, late payments, charge-offs, bankruptcies, foreclosures or other negative marks on their credit. They may also have a short credit history because it takes time to build a solid credit profile.

Having subprime credit scores makes it more difficult to qualify for credit and results in higher rates and less favorable terms.

Learn more:What Affects Your Credit Scores?

What Are Subprime Credit Cards?

Cards designed to help people build or rebuild their credit, such as those who have poor credit or lack a robust credit history, are often considered subprime credit cards. They work like other types of credit cards but typically have higher interest rates, low credit limits and additional fees because of the risk the issuer assumes. If you qualify, you can get a subprime credit card from many mainstream banks.

Tip: Card issuers aren't required to report to all three major credit bureaus—Experian, TransUnion and Equifax—so check that the card issuer reports to all bureaus before applying for a card since that's more beneficial to your credit scores.

Some subprime cards even offer rewards programs, but before you jump at the chance to earn cash back or other rewards, be sure to do the math. Compare the interest rates and fees the card charges with the potential benefits you might receive. It may make more sense to get a no-frills card with low or no fees while you rebuild your credit.

Are Subprime Credit Cards a Good Idea?

Subprime credit cards can give you access to credit and help you rebuild your credit history when used responsibly. However, there are a few things to know before getting one.

- Interest rate: Subprime credit cards typically have higher annual percentage rates (APRs) than cards for people with good or excellent credit.

- Low credit limit: Subprime cards typically have low credit limits, often $1,000 or less, which can make it difficult to keep your credit utilization low.

- Fees: The issuer may charge monthly or annual fees to keep your account active.

- Benefits: Many subprime credit cards don't offer rewards programs and other perks you may find with cards designed for people with stronger credit profiles.

Tip: As your credit scores improve, consider trading up for a different credit card that offers lower interest or better perks. Just remember that applying for credit typically reduces your credit scores by a few points, but the impact is temporary.

Learn more:Best Credit Cards for Building Credit

How to Get a Subprime Credit Card

You can get a subprime credit card by completing a few simple steps.

- Research providers. Several banks offer credit cards to people with subprime credit. Do your homework to find the one that's best for you. Be sure to compare rates, terms, fees and benefits.

- Get prequalified. Many issuers allow you to see whether you're likely to qualify before submitting a formal application. Prequalification uses a soft credit check, so your credit scores aren't affected.

- Choose the card you want. You may be able to select the card you want during the prequalification process without submitting a separate application. Accepting a credit card offer will generate a hard credit inquiry, which may reduce your credit scores by a few points.

- Use the card. Once your application is approved and you receive your credit card, you can use it to make purchases. Be sure to pay your bills on time and avoid getting too close to your credit limit.

Alternatives to Unsecured Subprime Credit Cards

If you're unable to qualify for an unsecured subprime credit card, here are some other options to consider.

- Secured credit cards: Secured cards are revolving lines of credit that work like unsecured credit cards, but they require a deposit. Because the card is secured by cash, it can be easier to qualify for than an unsecured card and may be a good option for people with subprime credit scores. Some secured cards offer credit limit increases or allow cardholders to "graduate" to an unsecured card after a certain number of on-time payments.

- Authorized user: Authorized users can make purchases with someone else's credit card but aren't responsible for paying the monthly bill. Some (but not all) credit card companies report authorized user account activity to the three consumer credit bureaus. This may help improve your credit if the primary account holder makes their payments on time and keeps their credit utilization low by staying well below the credit limit.

- Debit card: You typically won't build credit with a debit card, but using one to make purchases will help you avoid overspending.

How to Improve a Subprime Credit Score

Improving your credit scores takes time. Here are a few tips to help you get started.

- Pay all your bills on time. Your debt payment history is the single biggest factor influencing your credit scores. Paying on time helps improve your scores. Paying late or missing payments negatively affects your credit.

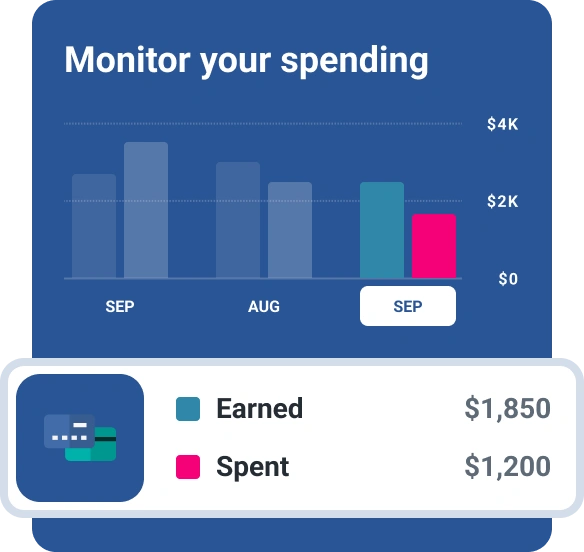

- Keep your card balances low. Your credit utilization, or the amount of credit you use compared to the amount you have available, is the second most important credit scoring factor. Low utilization rates generally have a favorable impact on your credit, while getting too close to your credit limits increases your utilization and can negatively affect your scores. Making more than one credit card payment each month can help keep your utilization low, especially if your card has a low credit limit.

- Apply for new credit sparingly. In general, the longer your credit history, the better. Opening new accounts decreases the average age of your credit history, and lenders may view applying for too much credit in a short time as a sign that you're struggling financially.

- Report rent payments. Landlords typically don't report rent payments to the credit bureaus. However, you can sign up for services like Experian Boost®ø that add rent and utility payments to your credit reports. If you pay on time, it may help improve your credit scores.

- Resolve credit reporting errors. Having late payments, charge-offs, bankruptcies and other derogatory marks on your credit reports negatively affects your credit, even if the information is inaccurate. You have the right to dispute information on your credit reports that you believe is inaccurate and have it removed. Just know that there's no way to remove accurate negative information from your credit reports; you'll have to wait for it to fall off naturally.

The Bottom Line

When used responsibly, subprime credit cards may help you access credit and build or rebuild your credit if you have some negative marks in your history or you're just starting out. But the high interest rates, increased fees and unfavorable terms don't make them an ideal long-term option. If you choose to get one, be sure to pay your bill on time and don't get too close to your credit limit; otherwise, you could hurt rather than help your credit.

Once your credit has improved, consider other options with lower interest rates, fewer fees and more favorable terms.

Don’t apply blindly

Apply for credit cards confidently with personalized offers based on your credit profile. Get started with your FICO® Score for free.

See your offersAbout the author

Jennifer Brozic is a freelance content marketing writer specializing in personal finance topics, including building credit, personal loans, auto loans, credit cards, mortgages, budgeting, insurance, retirement planning and more.

Read more from Jennifer